{{item.title}}

{{item.text}}

{{item.text}}

Michalis Louca

Director - Transfer Pricing and Value Chain Transformation, PwC Switzerland

In the circular letters dated 27 January and 28 January 2022, the SFTA published the safe harbour interest rates applicable to shareholder and intercompany loans, denominated in Swiss Francs and foreign currencies, applicable for 2022.

Swiss taxpayers can deviate from these interest rates so long as they are able to demonstrate that the interest rates that they apply are in line with the arm’s length principle – in practice, this means that the interest rates must be supported by a transfer pricing study.

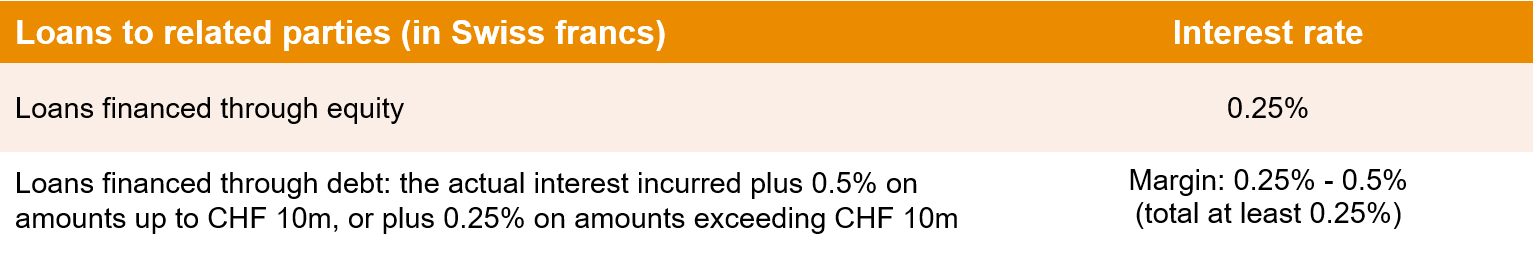

1. For loans denominated in Swiss Francs, made to shareholders and affiliated parties, the interest rates that a Swiss resident shall receive at minimum are as follows:

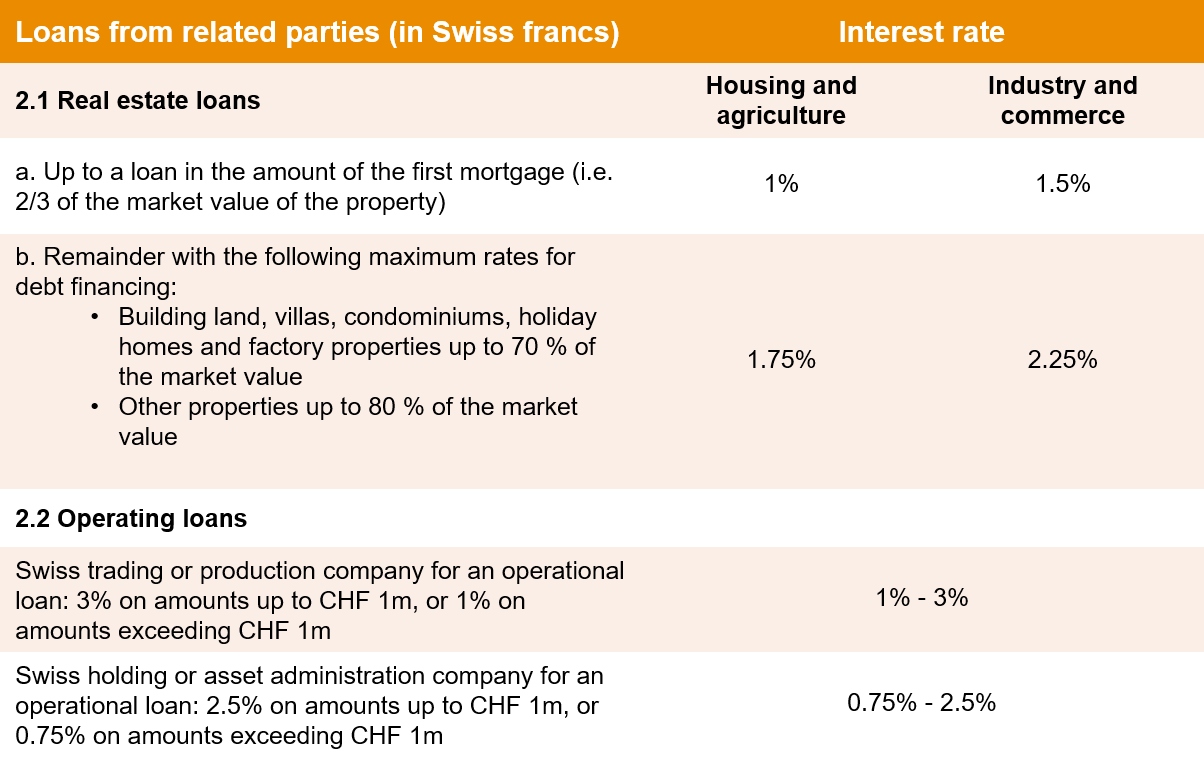

2. For loans denominated in Swiss Francs, received from shareholders and affiliated parties, the maximum interest rates payable by Swiss entities are as follows:

The table below shows the safe harbour interest rates applicable for 2021 and 2022.

For loans receivables of a Swiss company, these are the minimum rates that must be charged to a related party (note: if the CHF safe harbour rate is higher, then this higher rate has to be charged). If a loan is debt financed, then a minimum spread of 0.5% has to be applied.

These interest rates are basically also the maximum interest rates that a Swiss entity can pay to a related party. However, for loans payables of a Swiss company, the difference between the CHF minimum and maximum interest rates can be added i.e. for operating loans of a trading company a spread of 2.75% (for loans up to CHF 1m) respectively of 0.75% (for loans exceeding CHF 1m).

It is important to note that whilst interest rates listed above are safe harbours from a Swiss perspective, if a transaction is between a Swiss company and a foreign counter-party, the foreign counter-party will generally need to perform a transfer pricing study to demonstrate that the selected interest rates are at arm’s length.

Please contact us if you would like to discuss any aspect of transfer pricing for loans or other types of financial transaction such as guarantees, cash pooling, hedging or captive insurance.

#social#

David McDonald

Partner, Transfer Pricing & Value Chain Transformation Leader, PwC Switzerland

+41 75 413 19 10

Michalis Louca

Christoph Pauli

Agoston Lorincz

Senior Manager, Transfer Pricing and Value Chain Transformation, PwC Switzerland

+41 58 792 46 09

Etienne Michaud

Senior Manager, Transfer Pricing and Value Chain Transformation, PwC Switzerland

+41 58 792 96 70

Gilia Brault

Senior Manager, Transfer Pricing and Value Chain Transformation, PwC Switzerland

+41 58 792 9690