Cryptographic assets and related transactions: accounting considerations under IFRS

Cryptographic assets, including cryptocurrencies such as Bitcoin, continue to generate a significant amount of interest, given their rapid increases in value and expanded institutional adoption. As activity in cryptographic assets increases, it has attracted regulatory scrutiny across multiple jurisdictions.

At issue is how to recognise, measure and disclose activities associated with the issuances of, and the investment in, the various types of cryptographic assets. Since there are no accounting standards that specifically address cryptographic assets, one must look at the existing IFRS and apply a principles-based approach. In this publication, we highlight some of the accounting questions that are currently being debated and share our views on how IFRSs could be applied.

The issues that arise are diverse and highly dependent on specific facts and circumstances. While the examples and considerations illustrate generic principles, cryptographic asset transactions are rapidly evolving. As guidance and practices in this area evolve, this publication might be updated from time to time and expanded to capture further areas of interest. We therefore recommend that you consult your professional advisers or the authors of this publication for the latest developments.

1. Background

Cryptographic assets are transferable digital representations that are designed in a way that prohibits their copying or duplication. The technology that facilitates the transfer of cryptographic assets is referred to as a ‘blockchain’ or distributed ledger technology. Blockchain is a digital, decentralised ledger that keeps a record of all transactions that take place across a peer-to-peer network and that enables the encryption of information. Cryptographic assets and the underlying technology provide opportunities to digitise a variety of ‘real world’ objects. The benefits of digitisation (such as ease of access, transfer, etc) have resulted in cryptographic assets growing from an obscure curiosity to a technology that is proliferating into a variety of business uses.

There is no legal definition of cryptographic assets, as there is for securities in various jurisdictions; however, some cryptographic assets can legally be considered securities by local regulators. It is important to note that there are various subsets of cryptographic assets. Cryptographic assets are used for a variety of purposes, including as a means of exchange, as a medium to provide access to blockchain-based goods or services, and as a way to raise funding for an entity developing activities in this area.

One of the most commonly known subsets of cryptographic assets are cryptocurrencies, which are mainly used as a means of exchange and share some characteristics with traditional currencies. The most popular cryptocurrency is Bitcoin. However, the markets are evolving fast, and we will explore other types of cryptographic asset in this publication.

These transformative technologies have not gone unnoticed by the standard setters. The topic of digital currencies was identified as a potential new project for the IASB in 2015 through the Board’s Agenda Consultation process. However, the Board decided not to act immediately but to continue to monitor developments.

As part of that process, the Accounting Standards Advisory Forum (‘ASAF’), an IFRS Foundation advisory forum consisting of representatives from national and supra-national accounting standard setters, discussed digital currencies at a meeting in December 2016. The debate was focused on the classification of a cryptographic asset from the holder’s perspective. Conversations have continued in various accounting standards boards, but no formal guidance has been issued by the IASB at this point.

At the July 2018 Board meeting, the IASB reached an agreement to ask the IFRS Interpretations Committee (‘IFRS IC’) to consider guidance for the accounting of transactions involving cryptocurrencies, possibly in the form of an agenda decision on how an entity might walk through the existing IFRS requirements.

In June 2019, the IFRS IC published its agenda decision on ‘Holdings of Cryptocurrencies’, and it considered a subset of cryptographic assets with the following characteristics:

- a digital or virtual currency recorded on a distributed ledger that uses cryptography for security;

- not issued by a jurisdictional authority or other party; and

- does not give rise to a contract between the holder and another party.

The IFRS IC concluded that IAS 2, ‘Inventories’, applies to such assets where they are held for sale in the ordinary course of business. If IAS 2 is not applicable, an entity applies IAS 38, ‘Intangible Assets’, to holdings of cryptocurrencies.

There are many judgemental areas that will require further investigation as entities determine the applicable accounting treatment and as the technologies and markets continue to develop. For some topics, no uniform or definitive answers currently exist.

2. Frequently used terms

Some terms used in relation to cryptographic assets will also be used in this publication. This section explains these terms.

Coin/Token

A cryptographic asset might be described as either a ‘token’ or a ‘coin’. The difference is based on the asset’s functionality but, in practice, the terms can be used interchangeably, because no universally accepted definition of either exists. Currently, the term ‘coin’ generally refers to a cryptographic asset that has the express purpose of acting solely as a medium of exchange, while the term ‘token’ refers to an asset that gives the holder additional functionality or utility. The rights conveyed by a token are typically set out in a whitepaper or similar document by the issuing organisation.

Whitepaper

A whitepaper is a concept paper authored by the developers of a platform, to set out an idea and overall value proposition to prospective investors. The whitepaper commonly outlines the development roadmap and key milestones that the development team expects to meet.

Platform

The term ‘platform’ refers to software that provides a utility or services to users of the software. To facilitate the use of the software, users must own or use a particular coin or token.

Initial Coin Offering

Initial Coin Offerings or ‘ICOs’ have become a prevalent means for developers to sell blockchain tokens or coins to investors. When an ICO is undertaken, the issuer receives consideration in the form of cash or another cryptographic asset (most commonly, a cryptocurrency such as Bitcoin). In exchange, the developer might issue (or promise to issue) a digital token to the parties that provided contributions for the development of the digital token.

It should be noted that ICOs might be subject to local securities law, and significant regulatory considerations might apply.

Fiat currency

A fiat currency denotes paper money or coins of little or no intrinsic value in themselves and not convertible into gold or silver, but made legal tender by fiat (order) of the government (such as US Dollar or Euro).

3. Relevant characteristics for accounting purposes

For the purposes of determining which accounting standard applies and discussing the related accounting issues, it is useful to classify cryptographic assets into defined subsets based on their characteristics.

A single, generally accepted framework for the classification of these varied cryptographic assets does not currently exist. There is consequently no generally applied definition of a cryptographic asset. This reflects the broad variety of features and bespoke nature of the transactions in practice. However, based on our observations, there are some characteristics that can be used to classify cryptographic assets into similar types. We believe that similar types of cryptographic asset should be accounted for in a similar way.

The characteristics that we observe being most relevant for classifying cryptographic assets for accounting purposes are:

- the primary purpose of the cryptographic asset; and

- how the cryptographic asset derives its inherent value.

Although a range of other characteristics exist, we view these as not being fundamental to determining a common accounting treatment.

Based on the characteristics detailed above, we have defined four specific subsets of cryptographic assets, as set out in the following table:

| Subset | Purpose | Inherent Value |

| Cryptocurrency |

Cryptocurrencies are digital tokens or coins based on blockchain technology, such as Bitcoin. They currently operate independently of a central bank and are intended to function as a medium of exchange. | None – derives its value based on supply and demand. |

| Asset-backed token | An asset-backed token, such as a stablecoin described in tab 6, is a digital token based on blockchain technology that signifies and derives its value from something that does not exist on the blockchain but instead is a representation of ownership of a physical asset (for example, natural resources such as gold or oil). | Derives its value based on the underlying asset. |

| Utility token | Utility tokens are digital tokens based on blockchain technology that provide users with access to a product or service, and they derive their value from that right. Utility tokens give holders no ownership in a company’s platform or assets and, although they might be traded between holders, they are not primarily used as a medium of exchange. | Value is derived from the demand for the issuer’s service or product. |

| Security token | Security tokens are digital tokens based on blockchain technology that are similar in nature to traditional securities. They can provide an economic stake in a legal entity: sometimes a right to receive cash or another financial asset, which might be discretionary or mandatory; sometimes the ability to vote in company decisions and/or a residual interest in the entity. | Value is derived from the success of the entity, since the holder of the token shares in future profits or receives cash or another financial asset. |

It should also be noted that some cryptographic assets might exhibit elements of two or more of the identified subclasses. These result in hybrid cryptographic assets that will have to be assessed further. This document focuses on cryptographic assets that carry simple features, instead of hybrid tokens.

PwC Observations

Before determining the accounting treatment of a transaction from the issuer’s or owner’s perspective, it is important to understand the purpose and utility of the cryptographic asset. There is diversity of rights and obligations associated with cryptographic assets. Reading the whitepaper can provide insights into the terms/characteristics of the cryptographic asset that might result in differences in the accounting model applied.

Index

1. General observations

2. Cryptocurrencies held for own account

2.1. Applicable standard

2.2. Measurement considerations

3. Cryptographic assets other than cryptocurrencies held for own account

3.1. Applicable standard

3.2. Application to categories of crypto tokens

4. Cryptographic assets held on behalf of third parties

4.1. Practical observations and resulting challenges

4.2. Factors to consider when determining the accounting treatment

1. General observations

IFRS does not include specific guidance on the accounting for cryptographic assets and there is no clear industry practice, so the accounting for cryptographic assets could fall into a variety of different standards. Consideration should also be given to the entity's purpose for holding the cryptographic assets to determine the accounting model. We explore below the accounting standards and other considerations that might be relevant to the subsets of cryptographic assets.

2. Cryptocurrencies held for own account

2.1. Applicable standard

A few standards come to mind when considering the accounting for cryptocurrencies held by an entity for its own account.

Cash or a currency

IFRS contains no explicit definition of the terms ‘cash’ or ‘currency’. There might be an argument that, for accounting purposes, the words ‘cash’ and ‘currency’ are interchangeable. IAS 32, ‘Financial Instruments: Presentation’, makes a connection between currency and cash, and IAS 21, ‘The Effects of Changes in Foreign Exchange Rates’, makes a connection between cash, currency and monetary items.

Judgement is therefore required to determine whether cryptocurrencies can be considered cash or a currency.

Cryptocurrencies do not have some of the common properties of cash and currency, especially:

- cryptocurrencies are not legal tender and mostly are not issued or backed by any government or state; and

- cryptocurrencies are currently not capable of setting prices for goods and services directly. In other words, cryptocurrencies might be accepted to settle some transactions, but they are not directly related to the setting of prices for goods or services in an economy.

The assessment should consider the facts and circumstances for each cryptocurrency. At the time of writing (June 2021), we are seeing central banks launch pilot projects as they explore the use of Central Bank Digital Currencies (CBDCs). CBDCs are explored further in section 6.

Financial asset – other than cash

Holding a unit of a cryptocurrency typically does not give the holder a contractual right to receive cash or another financial asset, nor does the cryptocurrency come into existence as a result of a contractual relationship. Moreover, cryptocurrencies generally do not provide the holder with a residual interest in the assets of an entity after deducting all of its liabilities. As explored in section 6, stablecoins might meet the definition of a financial asset, but companies holding these units need to carefully assess the contractual terms of the cryptographic asset, since not all stablecoins are created equal.

Property, plant and equipment

Cryptocurrencies do not fall into the scope of IAS 16, ‘Property, Plant and Equipment’, because they are not tangible items.

Inventory

IAS 2 does not require inventories to be in a physical form, but inventory should consist of assets that are held for sale in the ordinary course of business. Inventory accounting might be appropriate if an entity holds cryptocurrencies for sale in the ordinary course of business. An entity that actively trades the cryptocurrencies, purchasing them with a view to their resale in the near future and generating a profit from fluctuations in the price or traders’ margin, might consider whether the guidance in IAS 2 for commodity broker-traders should be applied.

However, if the entity holds cryptocurrencies for investment purposes (that is, capital appreciation) over extended periods of time, it would likely not meet the definition of inventory.

PwC Observations

If it is determined, based on the entity’s business model, that inventory accounting is appropriate, inventories would typically be measured at the lower of cost and net realisable value. An entity that holds cryptocurrencies to sell them in the near future, generating a profit from fluctuations in prices or traders’ margin, might apply the commodity broker-trader exception in IAS 2. The term ‘commodity’ is not defined in IAS 2, but a broker-trader that concluded a cryptocurrency was a commodity would measure the inventory at fair value less cost to sell, with changes in fair value recognised in profit or loss.

Intangible asset

If a cryptocurrency does not meet the definition of any of the above categories, it will likely meet the definition of an intangible asset under IAS 38, ‘Intangible Assets’, because:

- it is a resource controlled by an entity (that is, the entity has the power to obtain the economic benefits that the asset will generate and to restrict the access of others to those benefits) as a result of past events and from which future economic benefits are expected to flow to the entity;

- it is identifiable, because it can be sold, exchanged or transferred individually;

- it is not cash or a monetary asset; and

- it has no physical form.

IAS 38 applies to all intangible assets except those excluded specifically from its scope (for example, inventories).

| Applicable standard | Initial measurement | Subsequent measurement | Movements in carrying amount |

Inventory (IAS 2)

|

Cost | Lower of cost and net realisable value | Movements above cost

Movements below cost

|

Inventory (IAS 2)

|

Cost | Fair value less costs to sell | Profit and loss |

Intangible assets (IAS 38)

|

Cost | Fair value less any accumulated amortisation and impairment (in most cases, no amortisation is expected for cryptocurrencies) | Movements above cost

Movements below cost

|

Intangible assets (IAS 38)

|

Cost | Cost less any accumulated amortisation and impairment (in most cases, no amortisation is expected for cryptocurrencies) | Movements above cost

Movements below cost

|

PwC Observations

The range of possible classifications, as well as their associated measurement, indicates the importance of understanding the nature and characteristics of the cryptocurrency, as well as the entity’s business model/purpose for holding the asset. This increases the importance of implementing specific accounting policies and ensuring their consistent application to similar transactions, as well as appropriate disclosures. Where an entity can evidence the existence of clearly distinguished portfolios of similar assets held for different purposes, different treatments might apply within an entity.

3. Cryptographic assets other than cryptocurrencies held for own account

3.1. Applicable standard

A similar thought process will apply when considering the accounting for cryptographic assets other than cryptocurrencies. Those cryptographic assets include security tokens, asset-backed tokens and utility tokens (together referred to as ‘crypto tokens’) held by an entity for own account.

Cash or a currency

Crypto tokens are issued not as a general-purpose medium of exchange, but to provide holders with other rights, including rights to goods or services or certain underlying physical assets.

Judgement is required to determine whether crypto tokens can be considered cash or a currency. However, since crypto tokens generally lack the properties of cash (described in section 2.1 above), they are unlikely to be considered cash or a currency under IFRS.

Financial asset – other than cash

Certain crypto tokens give the holder a right to cash or a financial asset. This could be based on future performance of a platform, a residual interest in net assets, or the value of an underlying asset. However, further consideration is needed to verify whether such rights and obligations are legally enforceable, since financial assets can only arise from a legally enforceable contractual relationship.

Unless crypto tokens provide the holder with a right to cash or another financial asset, they will not meet the definition of a financial asset. As explored under tab 6, some stablecoins might meet the definition of a financial asset, but companies holding these units need to carefully assess the contractual terms of the cryptographic asset, since not all stablecoins are created equal.

For the classification and measurement of crypto tokens that meet the definition of a financial asset, entities should follow the guidance in IFRS 9, ‘Financial Instruments’.

Property, plant and equipment

Cryptographic assets do not fall into the scope of IAS 16, because they are not tangible items.

Inventory

IAS 2 does not require inventories to be in a physical form, but inventory should consist of assets that are held for sale in the ordinary course of business. Inventory accounting might be appropriate if an entity holds cryptographic assets for sale in the ordinary course of business. An entity that actively trades the cryptographic assets, purchasing them with a view to their resale in the near future and generating a profit from fluctuations in the price or traders’ margin, might consider whether the guidance in IAS 2 for commodity broker-traders should be applied.

However, if the entity holds crypto tokens for investment purposes (that is, capital appreciation) over extended periods of time, it would likely not meet the definition of inventory.

Measurement guidance for crypto tokens that meet the definition of inventory can be found in section 2. above.

Intangible asset

Depending on the rights associated with a crypto token, it could potentially also meet the definition of an intangible asset under IAS 38 if:

- it is a resource controlled by an entity (that is, the entity has the power to obtain the economic benefits that the asset will generate and to restrict the access of others to those benefits) as a result of past events and from which future economic benefits are expected to flow to the entity;

- it is identifiable, because it can be sold, exchanged or transferred individually;

- it is not cash or a monetary asset; and

- it has no physical form.

IAS 38 applies to all intangible assets except those excluded specifically from its scope (for example, inventories).

Measurement guidance for crypto tokens that meet the definition of an intangible asset can be found in section 2. above.

Prepayment

Crypto tokens might provide the holder with a right to future goods or services. These tokens are a prepayment for future goods or services. A prepayment for future goods or services might meet the definition of an intangible asset.

Where the prepayment does not meet the definition of an intangible asset, the accounting will be similar to the accounting for other prepaid assets.

Measurement guidance for crypto tokens that meet the definition of an intangible asset can be found in section 2. above.

Underlying asset

In some situations, crypto tokens provide the holder with an interest in an underlying asset. The underlying assets might be commodities (such as gold or oil), intangible assets (such as a licence or a patent), artwork or real estate. While some asset-backed tokens represent a real claim on the asset itself, others have no ability to redeem the actual underlying.

Where the crypto token represents a contractual right to receive cash equivalent to the value of the underlying asset, it might meet the definition of a financial asset. If the crypto token represents a right to the asset itself, it might be accounted for in a manner similar to the underlying asset.

Crypto tokens that are accounted for in a manner similar to the underlying asset will be measured following the relevant accounting standard for the underlying asset.

3.2. Application to categories of crypto tokens

When applying the thought process set out above to the categories of crypto tokens described in the introduction, general observations can be summarised as follows:

(1) Crypto tokens with the characteristics of asset-backed tokens

Asset-backed tokens might give the holder a right to an underlying asset. These tokens could be used to transfer the ownership of underlying assets without physically moving them. It is a means to transact the underlying asset at minimal cost. As a result, the accounting will likely be driven by the nature of the underlying asset and the relevant accounting standard.

(2) Crypto tokens with the characteristics of utility tokens

Utility tokens usually give the holder a right to future goods or services. These tokens are a prepayment for goods or services. A prepayment for goods or services might meet the definition of an intangible asset and IAS 38 could be applied. Where it does not meet the definition of an intangible asset, it is accounted for similar to other prepaid assets.

(3) Crypto tokens with the characteristics of security tokens

Security tokens might give the holder a right to cash, based on the platform’s future profits or a residual interest in the net assets. Such rights might be discretionary or mandatory, and they might be accompanied by the ability to vote to impact decisions relating to the underlying platform. A contractual right to cash or another financial asset might exist in these circumstances, in which case these security tokens meet the definition of a financial asset subject to IFRS 9.

(4) Crypto tokens with hybrid characteristics

Crypto tokens exhibiting elements of two or more subclasses require further analysis, and judgement is required to determine the applicable accounting treatment. Factors to consider will include the interaction of contractual clauses, and their substance and relevance in the context of the overall characteristics of the token.

4. Cryptographic assets held on behalf of third parties

4.1. Practical observations and resulting challenges

Cryptographic assets might also be held by an entity on behalf of its customers. Some examples are:

- An entity that operates a trading platform that enables its customers to exchange different cryptographic assets, or to exchange fiat currency for a cryptographic asset.

- An entity (such as a bank or similar financial services entity) that offers custodian services for its customers’ cryptographic assets. In this case, customers lodge cryptographic assets with the entity for safe keeping.

Arrangements for holding such cryptographic assets vary. In most cases, there will be some indication (such as a contract, or a statement in a whitepaper) that the cryptographic asset is held on behalf of customers, and that sets out what customers need to do to access or use the cryptographic asset. The other features of the arrangement might vary, including (but not limited to) the following:

- The ability of the entity to ‘borrow’ the cryptographic assets to use for its own purposes. Even if such a right is not explicitly contained in the arrangement with the customers, it might be implicit, depending on the degree of segregation of the customers’ assets (see below).

- The degree of segregation of cryptographic assets held on behalf of customers from cryptographic assets ‘owned’ by the entity.

- The claims of customers in the event that the entity is liquidated. They might vary or be unclear. Customers might have the status of unsecured creditors, with no preferential claim on the cryptographic assets held by the entity on their behalf.

- The security of the assets. Cryptographic assets held on behalf of customers might be held in either a ‘hot wallet’ (connected to the internet), a ‘cold wallet’ (not connected to the internet, and harder to access) or a ‘warm wallet’ (offline, but easier to connect to than a cold wallet, often through the use of hardware). The customer or the entity might hold, and might be able to use, the private key to the wallet.

- The degree to which the exchange/the entity/the customer is able to identify specific misappropriated cryptographic assets through the blockchain technology.

- Whether cryptographic assets held on behalf of others are held in an account/wallet of the entity or in an account/wallet at a third party.

- The relevant law or regulations for cryptographic assets held on behalf of others; or, in some cases, whether there are specific laws and regulations governing such cryptographic assets.

- The extent to which the rights and obligations of the parties are clear or contractually enforceable (for example, if contained in a whitepaper). In many cases, external legal opinions might help to establish these. However, laws and regulations governing cryptographic assets are still developing, and so legal opinions might not prove conclusive.

The key accounting question is whether or not such holdings of cryptographic assets on behalf of customers should be recorded on or off the entity’s balance sheet under IFRS.

4.2. Factors to consider when determining the accounting treatment

There is no IFRS that directly provides guidance on whether an entity’s holding of cryptographic assets on behalf of others should be presented on its balance sheet. We believe that such entities should consider the general guidance in IAS 8, ‘Accounting Policies, Changes in Accounting Estimates and Errors’, in developing an accounting policy for such assets.

This requires consideration of existing IFRS dealing with similar and related issues and the definitions in the Conceptual Framework (the ‘Framework’).

The Framework defines ‘asset’ and ‘liability’ as follows:

- ‘An asset is a present economic resource controlled by the entity as a result of past events. An economic resource is a right that has the potential to produce economic benefits.’

- ‘A liability is a present obligation of the entity to transfer an economic resource as a result of past events.’

In determining whether an asset and liability should be recognised on the balance sheet of the entity holding the cryptographic asset on behalf of customers, an entity considers:

- Whether it has the right (explicit or implicit) to ‘borrow’ the cryptographic assets to use for its own purposes. If the entity has such a right, it would seem that the definition of an asset set out above is met.

- The rights of customers to cryptographic assets held on their behalf if the entity is liquidated. In particular, if customers would have the status of unsecured creditors with no preferential claim on the cryptographic assets held by the entity on their behalf, this is a strong indicator that the cryptographic assets and the corresponding liability should be recognised on the balance sheet, because the Framework definition of a liability would seem to be met.

In practice, the level of segregation of the customers’ assets from the entity’s assets is critical in determining which assets should be recognised on balance sheet (own assets and customer’s assets that are not segregated) and which assets should be off balance sheet (assets that are segregated and that the entity holds as a custodian). Factors to consider include:

- Whether the rights and obligations of the entity and its customers are set out in a contract or whitepaper (if any); whether the rights and obligations are contractually enforceable; and whether external legal opinions are available as evidence. Enforceability is assessed in the context of specific laws and regulations addressing cryptographic assets, to the extent that such laws and regulations exist, and in the context of other laws and regulations where they do not.

- Whether there is a reconciliation between the cryptographic assets held by the entity on behalf of the customers and the individual holdings of each customer, as reflected in their account statement. Similarly, whether there is a reconciliation between the transactions in cryptographic assets carried out in the market and the orders executed on behalf of the individual customers, to assess whether each transaction could be attributed to the relevant customer. Also, how frequently such reconciliation is performed.

- Traceability to a dedicated blockchain address (not all transactions can be individually traced to a dedicated blockchain address). If the cryptographic asset is traceable to a dedicated blockchain address of the customer, this is more likely to indicate segregation.

- Whether the cryptographic asset is held in an account/wallet of the entity or at a third party, and whether the third party keeps a record of cryptographic assets held on behalf of customers. If the cryptographic asset is held in an account/wallet at a third party, this is more likely to indicate segregation.

- Whether the entity holds customers’ cryptographic assets in hot or cold wallets. An entity might allow customers to hold some amounts in a hot wallet for frequent trading, and some other amounts from the same customer in a cold wallet for safe-keeping. Whether the customer or the entity holds and is able to use the private key to the wallet might also be relevant. If the cryptographic asset is held in cold wallets, and the private key is held and can only be used by the customer, this is more likely to indicate segregation.

Given the above and the lack of an IFRS that specifically deals with this issue, assessing whether cryptographic assets held on behalf of the customers should be on or off balance sheet is a matter of judgement, and it might vary depending on the facts and circumstances listed above. As a result, there is not a ‘one size fits all’ answer.

Index

1. Practical market observations

2. Accounting for token pre-sale agreements

3. Accounting for ICOs by the issuer

4. Accounting for a purchase of goods or services by the ICO entity in exchange for ICO tokens issued

4.1. General considerations

4.2. Own cryptographic assets exchanged for third party services

4.3. Own ICO tokens exchanged for employee services

1. Practical market observations

An Initial Coin Offering (‘ICO’) is a form of fundraising that harnesses the power of cryptographic assets and blockchain-based trading. Similar to a crowdfunding campaign, an ICO allocates tokens instead of shares to investors/subscribers. These ICO tokens typically do not represent an ownership interest in the entity, but they often provide access to a platform (if and when developed) and can often be traded on a crypto exchange. The population of ICO tokens in an ICO is generally set at a fixed amount.

Each ICO is bespoke and will have unique terms and conditions. It is critical for issuers to review the whitepaper or underlying documents accompanying the ICO token issuance, and to understand what exactly is being offered to investors/subscribers. In situations where rights and obligations arising from a whitepaper or their legal enforceability are unclear, legal advice might be needed, to determine the relevant terms.

ICOs might be considered to be securities by a securities regulator, but it is important to note that there is no uniform global view. As a result, issuers should monitor regulatory developments closely and consider the impact that any changes might have on financial reporting.

2. Accounting for token pre-sale agreements

Entities looking to raise funds via an ICO sometimes make use of a ‘Simple Agreement for Future Tokens’ (‘SAFT’) to attract seed investors and lock in funding from interested parties in private sales prior to a public sale. A SAFT is an early-stage investment, pre-ICO, where the investor provides upfront funding to the issuer in exchange for a promise to receive a variable number of tokens on a successful ICO. The number of tokens to be received by the SAFT investor usually depends on the ICO token price on issuance. As an incentive for investing in the pre-ICO entity, the SAFT issuer will typically settle the SAFT using an ICO token price that is discounted by a predefined amount (for example, a 10% discount to the ICO token price at issuance). Thus, on a successful ICO, the SAFT investor will receive a number of tokens equal to the value of what was originally invested, plus a return equal to the specified discount on the ICO token.

Terms of a SAFT can vary, impacting the determination of the accounting treatment. Factors to consider include (but are not limited to) the characteristics/features that the tokens will have, and the rights to which the future holders will be entitled.

An illustrative example

One common form of SAFT is a SAFT on utility tokens that entitles the investor to a discounted price for tokens compared to other investors at the time of an ICO. Typically, the SAFT terminates if the ICO does not happen on or by a stated date, at which time the entity is required to return to the investor the amount originally invested (or a portion thereof). The success of an ICO is not within the control of the entity – for example, the ICO is abandoned if the minimum fundraising goal (sometimes referred to as a ‘soft cap’) is not achieved. A SAFT holder does not have the right to redeem its SAFT prior to the stated date.

If the utility tokens underlying the SAFT clearly entitle the holder to future goods and services, those tokens would not be considered a financial instrument. It follows that, from the perspective of the issuer, a SAFT to deliver a utility token might be viewed as not within the scope of IFRS 9, because it is usually not a contract “to buy or sell a non-financial item that can be settled net in cash or another financial instrument, or by exchanging financial instruments, as if the contracts were financial instruments”. [IFRS 9 para 2.4]. In such a case, the SAFT might be viewed as a customer’s prepayment for future goods and services under IFRS 15, ‘Revenue from Contracts with Customers’.

However, on the basis that the occurrence of a successful ICO is beyond the control of the entity, and the characteristics of the tokens to be issued might be unclear, some might view the SAFT as containing a financial obligation, because it represents a contractual obligation to deliver cash if the ICO does not occur by the stated date. In such a case, the SAFT might be viewed as a financial liability of the issuer in accordance with IAS 32 at initial recognition. There might also be other embedded features which require further assessment, such as embedded derivatives based on the specific terms of the arrangement.

PwC Observations

Facts and circumstances will need to be carefully evaluated in determining which view appropriately reflects the overall substance and economics from the issuer’s perspective.

3. Accounting for ICOs by the issuer

When an ICO is undertaken, the issuing entity receives consideration. The form of the consideration varies (for example, cash or another cryptographic asset) and, for accounting purposes, it is key to understand the economics and characteristics of the transaction.

It is possible that an ICO could create a joint arrangement requiring further analysis based on IFRS 11, ‘Joint Arrangements’. The fact that the subscribers provide the majority of the funding might suggest that the arrangement is a collaboration between the ICO entity and the subscriber. However, the subscribers are typically passive, which suggests that the arrangement might not provide the parties with joint control. Some issuers might grant, to subscribers, veto rights over the future direction of the project; these are typically protective in nature and, in most cases, they will not create joint control.

Where consideration for the ICO is not in the form of cash but another cryptographic asset, the transaction might be an exchange of similar goods or services. An exchange of similar goods might mean that no accounting is needed. However, we believe that it is unlikely that an ICO will be an exchange of ‘similar goods or services’, because no two cryptographic assets are generally alike.

Assuming that there is an exchange transaction and that the arrangement does not create joint control, the consideration received by the ICO entity is recorded as the debit side of the journal entry. Depending on the form of the consideration, this might involve the thought process explained under Tab 2.

However, the key challenge for issuing entities is determining the accounting for the ICO token issued (that is, the credit side of the journal entry). This will depend on the nature of the ICO token issued, as well as the guidance of the applicable accounting standard.

The following figure provides a possible analysis framework of accounting models to consider when determining the nature of, and accounting for, the issued ICO token. Consideration of the contract terms is needed, to understand the obligations of the issuer:

Financial liability

An issuer of an ICO token should assess whether a token meets the definition of a financial liability. Specifically, an entity would consider the definition in IAS 32, which states that a financial liability is:

- a contractual obligation:

- to deliver cash or another financial asset to another entity; or

- to exchange financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the entity; or

- a certain contract that will or might be settled in the entity's own equity instruments, such as those that violate the principle stated in paragraph 11 of IAS 32 (commonly known as the ‘fixed-for-fixed’ principle).

If the ICO token is a financial liability, the accounting would follow the applicable guidance in IFRS 9.

Many ICO tokens will not meet the definition of a financial liability, but there are situations where the terms and conditions might provide for a refund of proceeds up to the point of achieving a particular milestone. There might be situations in which the contract creates a financial liability, at least up to the point at which the refund clause falls away.

Equity instrument

An equity instrument is any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities. [IAS 32 para 11]. Typically, ICO tokens do not provide the holders with such a residual interest; for example, they do not give the holders rights to residual profits, dividends, or entitlement to proceeds on winding up or liquidation. These ICO tokens might therefore lack the characteristics of an equity instrument. Careful consideration is needed to assess whether the rights to the cash flows only relate to a specific project or whether, in substance, they provide rights to residual cash flows of the ICO entity.

Revenue transaction/prepayment for future goods and services

The issuing entity should consider whether the ICO token issued is, in substance, a contract with a customer that should be accounted for under IFRS 15.

IFRS 15 would apply if (1) the recipient of the ICO token is a customer, (2) there is a ‘contract’ for accounting purposes, and (3) the performance obligations associated with the ICO token are not within the scope of other standards.

Appendix A to IFRS 15 defines a customer as “a party that has contracted with an entity to obtain goods or services that are an output of the entity’s ordinary activities in exchange for consideration”.

To determine whether a contract with a customer exists, an entity should consider whether the whitepaper, purchase agreement and/or other accompanying documents create ‘enforceable rights or obligations’. [IFRS 15 App A]. To be a contract with a customer for the purposes of IFRS 15, such rights should be legally enforceable. This assessment might be challenging where the documentation provided by the issuer is not well defined. Entities should further evaluate all of the criteria in paragraph 9 of IFRS 15, to determine if a contract with a customer exists.

PwC Observations

Whitepapers are not the same as a standard legal contract or other offering documents (such as a prospectus or offering memorandum). Entities should carefully examine the whitepaper or similar document, to make sure that there are, in fact, legally enforceable rights. Clauses that disclaim any legal obligation by the issuer require further investigation. In some situations, additional legal advice might be needed.

In many circumstances, issuers might use the consideration received in the ICO to develop a software platform. Hosting and maintaining the specific platform is often an integral part of the ICO’s future business model. The token could provide the holder with access to the platform, which might be operated as part of the entity’s ordinary activities.

This might result in the holders meeting the definition of ‘customers’, from the perspective of the ICO entity; accordingly, the proceeds from the ICO could be revenue of the issuing entity, which will likely be initially deferred.

Determining the performance obligations, how they are satisfied and the period over which to recognise revenue will be judgemental and will depend on the specific facts and circumstances of the ICO offering.

Consider other relevant guidance

Where none of the above considerations appear to be relevant, the hierarchy in IAS 8 should be considered in determining the appropriate accounting treatment. We believe that it is unlikely that issuers will receive consideration without taking on an obligation to the subscribers. Even if the arrangement does not give rise to a financial instrument or a promise to deliver goods or services to a customer, there is likely to be a legal or constructive obligation to the subscriber. This might result in the issuer recognising a provision in accordance with IAS 37.

4. Accounting for a purchase of goods or services by the ICO entity in exchange for ICO tokens issued

4.1. General considerations

Some issuers of ICO tokens might choose to keep some tokens generated through the ICO, to use as a means of payment for goods or services. Examples of the use of such ICO tokens include obtaining services in developing or operating the entity’s platform, or to remunerate/incentivise employees. This is explored further in the following sections.

When an ICO entity allocates a specified number of ICO tokens for the purpose of its own use, it should consider the accounting for the generation of the ICO tokens itself.

The generation of ICO tokens for own use does not generate proceeds for the ICO entity. The act of generating ICO tokens is not, in itself, an exchange transaction.

Generating ICO tokens is similar to a retail store printing vouchers for discounts on future purchases at the store and not distributing them to customers. Therefore, it seems appropriate that such an event would not be considered for accounting purposes. This situation changes once the vouchers are provided to third parties in exchange for consideration – or, in accounting terms, once an exchange transaction takes place.

An ICO entity would not usually account for the generation of tokens until an exchange transaction has occurred.

4.2. Own cryptographic assets exchanged for third party services

Sometimes, ICO tokens are provided to third parties for services, such as developing a platform. The observations summarised in this section cover situations in which the receiving party is determined to be a third party (and not an employee, as defined in IAS 19, ‘Employee Benefits’).

In order to determine the appropriate accounting treatment for an exchange transaction that takes place between an ICO entity and a third party, it is important to obtain a detailed understanding of the economic substance of the exchange.

Generally, the accounting will follow:

- the substance of what the ICO entity receives in return for cryptographic assets (debit side of the journal entry); and

- the characteristics of ICO tokens generated and delivered by the entity.

When determining the debit side of the journal entry, an entity would consider the nature of the goods or services received and whether there are costs that can be capitalised as an asset, or if the costs are to be recognised as an expense. For example, if the payment is to develop software, can the costs be capitalised as part of the intangible, based on the applicable IFRS guidance, or should they be expensed (for example, research and development guidance under IAS 38)?

The credit side of the entry is determined by the obligations that the entity incurred as a result of issuing the ICO tokens. This assessment determines the applicable standard, based on the promises associated with the ICO tokens. The thought process of the assessment will be aligned with the considerations described in section 3. above.

For example, where the ICO tokens provide an entitlement promise to deliver future goods or services to a customer (such as a discount on future services provided by the ICO entity), the credit side of the journal entry should be determined based on IFRS 15. In this case, the revenue from providing the ICO tokens should be measured at the fair value of the goods and services received by the ICO entity.

4.3. Own ICO tokens exchanged for employee services

Some ICO entities might reward their employees in the form of a specific number of tokens generated through the ICO. IAS 19 or IFRS 2, ‘Share-based Payment’, might need to be considered.

When assessing the accounting treatment of such arrangements, an entity considers the characteristics of the ICO tokens generated.

Unless the ICO tokens meet the definition of an equity instrument of the ICO entity (that is, a contract that has a residual interest in the assets of the ICO entity after deducting all of its liabilities), the arrangements would not meet the definition of a share-based payment arrangement under IFRS 2. Instead, they would fall within the scope of IAS 19 as a non-cash employee benefit.

IAS 19 will then determine the recognition, as well as the measurement, of the employee benefit, as shown in the following example:

An illustrative example

An ICO entity rewards named employees in the form of a specific number of utility tokens generated (and currently held) by the ICO entity. Based on the nature and characteristics of the utility tokens, the entity concludes that they are, in substance, a contract with a customer that should be accounted for under IFRS 15, with the employee being the customer in this situation. The reward is ‘paid’ shortly after the end of the financial year in which the ICO was successfully executed to the employees who:

- contribute to the success of the ICO; and

- stay in their jobs until the end of the financial year in which the ICO was successfully executed.

Recognition:

The ICO entity determines that the substance of the arrangement is an exchange of employee services for goods and services to be delivered by the entity. This is accounted for as a short-term employee benefit [IAS 19 paras 11, 19–23] and non-cash consideration for goods and services. [IFRS 15 paras 66–69].

The arrangement includes a condition that the employees should remain in their jobs at the ICO issuer during the vesting period. The ICO entity should recognise a liability and short-term employee benefit expense over the vesting period. The liability will be reclassified as deferred revenue when the employees obtain the right to access the utility tokens on their digital accounts.

This treatment is also consistent with the definition of a contract liability in IFRS 15, which states that a contract liability arises when the entity has received the consideration. In this case, this is when the employee services have been provided.

Measurement:

The ICO entity recognises the undiscounted amount that it expects to pay in exchange for the services provided by the employees as a liability and an expense. [IAS 19 para 11]. The ICO entity could measure the amount that it expects to pay by using the fair value of the utility tokens to be delivered to the employees, or by using the estimated cost of the goods or services that it expects to deliver in the future.

Journal entries:

a) As service provided over vesting period

- Dr Employee costs

- Cr Short-term employee benefit liability

b) When utility tokens issued from ICO

- Dr Short-term employee benefit liability

- Cr Deferred revenue

PwC Observations

The circumstances of each transaction will need to be carefully evaluated in determining which view appropriately reflects the overall substance and economics, from the issuer’s perspective especially, regarding the measurement of the benefits provided.

Index

1. The fair value hierarchy of IFRS 13

2. Suggested approach to determine the valuation of a cryptographic asset (‘CA’)

3. Determining an active market

4. Reliability of data

5. Trading pairs

6. Valuation in the absence of an active market

6.1. Valuation techniques and inputs

6.2. Calibration of valuation techniques

| inventory held by a broker-trader applying fair value less costs to sell accounting | expense for third party services paid for in cryptographic assets |

| cryptographic assets classified as intangible assets in cases where the revaluation model is used | expense for employee services paid for in cryptographic assets |

| revenue from the perspective of an ICO issuer | cryptographic assets acquired in a business combination |

| disclosing the fair value for cryptographic assets held on behalf of others | cryptographic assets held by an investment fund (either measured at fair value or for which fair value is disclosed) |

IFRS 13, ‘Fair Value Measurement’, defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date”, and it sets out a framework for determining fair values under IFRS.

Fair values are divided into a three-level fair value hierarchy, based on the lowest level of significant inputs used in valuation models, as follows:

- Level 1: quoted prices in active markets for identical assets or liabilities that the entity can access at the measurement date;

- Level 2: observable inputs other than level 1 inputs; and

- Level 3: unobservable inputs.

Generally, IFRS 13 gives precedence to observable inputs over unobservable inputs. If a valuation is not based on level 1 inputs at the reporting date (for example, because there is not an active market at the date or time of reporting), the value will need to be determined using a valuation model. The objective in such valuations should be to estimate what the exit price of the entity's position at the valuation date would be.

It should be noted that the hierarchy level of a cryptographic asset might evolve over time. For example, it is possible that a cryptographic asset that was previously valued using level 3 inputs might become traded in an active market, or vice versa.

IFRS 13 contains a number of disclosure requirements, depending on the level of the measurement hierarchy that a fair value measurement falls into, as well as the measurement basis used in the financial statements.

Given that markets for cryptographic assets are rapidly evolving, determining the fair value of cryptographic assets can be complex. IFRS 13 notes that, in making disclosures about fair value, the following factors should be considered:

- the level of detail necessary to satisfy the disclosure requirements;

- how much emphasis to place on each of the various requirements;

- how much aggregation or disaggregation to undertake; and

- whether users of financial statements need additional information to evaluate the quantitative information disclosed.

If the specific disclosures required by the standard are insufficient to meet the objective of helping users to assess the fair values, IFRS 13 requires additional information to be disclosed to meet that objective.

Many cryptographic assets show a high volatility of prices, and markets might remain open 24/7. So the time at which a reporting entity values the cryptographic asset might be important. For example, is the valuation time 11:59 PM at the end of the reporting period, or the close of business on that day? How is the valuation time determined in groups with subsidiaries in different time zones? This might represent a significant accounting policy, in which case it would also have to be disclosed in the notes to the financial statements.

3. Determining an active market

The first step in considering the fair value of a cryptographic asset is to determine if an active market exists for that cryptographic asset at the measurement date (in other words, whether a level 1 valuation can be performed).

Appendix A to IFRS 13 defines an active market as one “in which transactions for the asset or liability take place with sufficient frequency and volume to provide pricing information on an ongoing basis”.

A benchmark for evaluating the depth of a market could include active trading days within a given time period. The average daily turnover ratio, which is calculated by dividing the average daily trading volume by the total amount of cryptographic assets outstanding, is a metric for volume that could also be considered.

IFRS 13 does not define specific thresholds that need to be exceeded with regard to frequency (such as active trading days) and volume (such as turnover ratio) to determine if an active market exists. This means that the conclusion requires professional judgement.

Many large traditional shares have a turnover rate of less than 1% every day. Those shares would likely still be considered to be traded in an active market if there are sufficient active trading days within a given period.

Data available from CoinMarketCap (‘CMC’) for May 2021, for the five cryptographic assets with the highest market capitalisation, suggested average daily turnover ratios between 4% and 302%, with active trading every day. Looking purely at that quantitative information, it would likely be possible to conclude that active markets exist for these cryptographic assets.

However, further analysis of the underlying data suggests that some other qualitative factors might need to be considered:

- reliability of data in general (see section 4.4 below); and

- trading pairs (see section 4.5 below).

In some cases, there might be several markets for a particular cryptographic asset that meet the definition of an active market, and each of those markets might have different prices at the measurement date. In these situations, IFRS 13 requires the entity to determine the principal market for the asset.

The principal market will be the market with the greatest volume and level of activity for the relevant cryptographic asset which the entity holding the cryptographic asset can access. While CMC includes data from numerous exchanges, many exchanges serve regional markets and might not be an option for a principal market for a specific entity. IFRS 13 also contains a tiebreaker, if there is not a clear principal market (that is, because there are several markets with approximately the same level of activity). In the case of a tie, IFRS 13 defaults to the most advantageous market within the group of active markets to which the entity has access with the highest activity levels.

Paragraph 17 of IFRS 13 states that “an entity need not undertake an exhaustive search of all possible markets to identify the principal market […], but it shall take into account all information that is reasonably available. In the absence of evidence to the contrary, the market in which the entity would normally enter into a transaction to sell the asset […] is presumed to be the principal market […]”.

Once a principal market is identified, it is still necessary to investigate the pricing mechanisms used by the market to ensure that the pricing is based on orderly transactions in accordance with paragraphs 15 and B37–B44 of IFRS 13.

An entity might purchase cryptographic assets outside an exchange, in a private placement (for example, purchase from a liquidity provider). In that case, the purchase price is an entry price, and so it is not the relevant valuation basis for measurement of the cryptographic assets. The fair value of assets held is based on an exit price in accordance with paragraphs 9 and B2 of IFRS 13.

4. Reliability of data

In a presentation from a market participant to the SEC, trading data from one of the principal market sources was analysed, and it was suggested that, after comparing trading data from a prominent provider among the different crypto- and ‘traditional’ exchanges and performing other analysis over available data, there were indicators of various exchanges reporting inflated trading data.

This In depth does not comment on that report, but the report does highlight that, when obtaining trading data used for an assessment of frequency and volume, it is crucial to consider the source of the data. Data from regulated exchanges is generally considered more reliable than from an unregulated exchange, but it is necessary to consider the regulation criteria and if there is any surveillance over the trading data.

5. Trading pairs

A level 1 fair value input is defined in Appendix A to IFRS 13 as “Quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date”. A cryptographic asset is often exchanged for another cryptographic asset (‘crypto to crypto’), instead of being exchanged into a traditional currency (‘fiat’) (‘crypto to fiat’). These crypto to crypto exchanges are usually included in the trading prices and volumes of a given cryptographic asset published by data provider websites. The trading prices used in these instances seem to be results from an implicit conversion of the cryptographic asset into fiat, at a rate under discretion of the respective exchange or the publisher of the data.

In our view, an active market for a certain cryptographic asset exists only when crypto to fiat exchanges published by reliable sources exist. Crypto to crypto exchanges should not be considered when determining if there is an active market.

In practice, there are exchanges that do not offer the possibility for crypto to fiat trades at all. In this instance, an entity might exchange a cryptographic asset for another cryptographic asset, and then exchange the second cryptographic asset into fiat at another exchange. This means that it is possible for a market to exist for a cryptographic asset in which there is frequency and volume of trades, but that this market is not an active market under IFRS 13.

While generally, under IFRS 13, the market predominantly used by the entity to sell a cryptographic asset should be considered the principal market, a market that does not exchange crypto to fiat cannot be the principal market, because it is not an active market under IFRS 13.

For example, if an entity would like to determine if active markets exist for Bitcoin, it would consider all exit trades (Bitcoin/fiat) from exchanges to which it has access. The entity could then consider the active trading days and average turnover ratio, and conclude on the sufficiency of frequency and volume in accordance with IFRS 13, to determine whether the exchange was the principal market.

An illustrative example

Assume that two cryptographic assets, asset A and asset B, exist. Assets A and B are frequently converted into each other, based on a market where there are observable exchange ratios. Assets A and B are not considered foreign currencies within the scope of IAS 21.

Asset A is readily convertible to cash in an active market, but there is no active market where asset B can be converted to cash. In valuing asset B, would the transactions converting asset B to asset A on the active market be observable transactions that qualify for level 1 fair value measurements?

There is not an active market, and hence not a level 1 fair value in the entity’s functional currency (fiat), for asset B. This is because there is no active market where asset B can be directly converted to cash. Moreover, converting asset B to cash, via conversion to asset A, will generally incur costs or a spread that will be a non-level 1 input, and it will take time, during which the fair values of the assets might change. Since measurement in the fair value hierarchy requires the lowest level of significant inputs to the ‘entire measurement’ [IFRS 13 para 73], the ‘entire measurement’ in this case cannot be a level 1 fair value measurement.

Although the definition of an active market does not refer to fiat currency, the presumption is that, in order to qualify as a level 1 fair value measurement, the transaction should be measured in a fiat currency. Such fiat currency might be a foreign currency translated under IAS 21 to the reporting entity’s functional currency. However, for financial reporting purposes, the valuation needs to be established in some unit that qualifies as a foreign or functional currency under IAS 21.

Any cryptographic assets that are not directly convertible into fiat at an active market do not fulfil the criteria of a fair value level 1 asset, as defined by paragraphs 76–78 of IFRS 13, because there will always be some additional implied fee or spread to exchange into fiat.

Where this implied fee or spread is observable (for example, because the cryptographic asset held is convertible into fiat through another cryptographic asset, which trades into fiat in an active market), the fair value of the cryptographic asset held will likely qualify as a level 2 asset in the fair value hierarchy.

Cryptographic assets that cannot be readily converted to fiat will likely qualify as a level 3 asset.

Two other issues that arise in determining if there is an active market are:

- In some cases, there might be significant price fluctuations between markets. These could result in a difference between the price in the principal (or most advantageous) market and the actual price received, and hence in day one gains or losses, when using a fair value model. The existence of such price differences would not, of itself, be an indicator that there is no active market.

- Some cryptographic assets aim to be backed by a fiat currency – for example, for one cryptographic token to represent the value of US$1. However, because these cryptographic assets are not considered a foreign or functional currency in the definition of IAS 21, they are treated no different to other cryptographic assets with regard to determining if an active market exists.

6. Valuation in the absence of an active market

6.1. Valuation techniques and inputs

Many cryptographic assets will not have an active market as described by IFRS 13, and so they will need to be valued using a valuation technique.

An appropriate valuation technique is one that estimates an orderly transaction price to sell the asset or to transfer a liability at the measurement date under current market conditions.

In some cases, multiple valuation approaches should be used. The appropriate valuation technique should consider how a market participant would determine the fair value of the cryptographic asset being measured.

In many cases, the market approach (para B5 of IFRS 13) will be the most appropriate technique for a cryptographic asset, because this would be used by a market participant. However, there might be particular facts and circumstances where an entity could demonstrate that a market participant would use a different approach. The cost approach (para B8 of IFRS 13) or the income approach (para B10 of IFRS 13) is likely to be rare in practice.

In determining an appropriate valuation technique, IFRS 13 indicates that the technique should be appropriate in the circumstances, and it should maximise the use of relevant observable inputs and minimise the use of unobservable inputs.

For a cryptographic asset, observable inputs might include information obtained on bilateral transactions outside an active market, certain quotes from brokers, and other information, given that many markets are still unregulated.

Where broker quotes are used, these should be carefully evaluated. Broker quotes can be derived from models rather than being based on observable market transactions. At this time (June 2021), it does not yet appear that broker quotes are being widely used in this sector.

In general, a valuation model should be applied consistently from period to period. The market for cryptographic assets is evolving rapidly, and so valuation techniques used by market participants are also likely to evolve. IFRS 13 permits an entity to change valuation techniques (or change weightings amongst multiple valuation techniques) where the change results in a measurement that is equally, or more, representative of fair value, in the circumstances. Factors such as the following might result in changing valuation techniques:

- new markets develop;

- new information becomes available;

- information previously used is no longer available;

- valuation techniques improve; or

- market conditions change.

An illustrative example

A cryptographic asset not traded in an active market is purchased in an arm’s length transaction, without other elements, for CU100 at the beginning of the day on 1 June.

At the end of 1 June, the entity uses a valuation technique and determines that the value is CU104. Prior to considering the CU4 increase in fair value, the entity would firstly re-evaluate the appropriateness of the valuation technique/model used. Secondly, the entity would be required to determine whether the model was calibrated to the transaction price of CU100 paid at the beginning of 1 June, as set out in paragraph 64 of IFRS 13. That is, the valuation model would need to be run at the acquisition time, to determine whether the transaction price differed from CU100.

Now assume that the output of the valuation model (using unobservable inputs) is CU102 at the acquisition time, even though only CU100 was paid. In this case, the entity would likely consider that the difference between the valuation technique and the fair value at the beginning of the day amounted to CU102 – CU100 = CU2.

Therefore, at the measurement time (the end of the day, in this example) the output of the valuation technique would be adjusted for that difference, to arrive at a fair value of CU104 – CU2 = CU102.

The more time that passes between the initial transaction date and the measurement date, the less relevant the initial transaction price might become. However, in measuring the cryptographic asset, entities should ensure that their valuation method provides a sensible result in the light of IFRS 13’s calibration requirement.

It is important to note that not all appraisal reports obtained from third party valuation experts take into account these calibration requirements. When relying on a third-party appraisal, an entity would need to ensure that the methodology used by the appraiser is consistent with all aspects of IFRS 13, including its calibration requirements.

The transaction price paid by the entity might also be relevant to the valuation of other units of the same cryptographic asset held at the measurement date.

The accounting treatment of cryptographic assets and related transactions requires significant judgement and a thorough understanding of the underlying facts and circumstances, because there is no accounting standard specifically addressing the accounting for those types of asset. Therefore, there are no disclosure requirements specifically designed for cryptographic assets and related transactions.

However, that does not mean that no or limited disclosures are appropriate for cryptographic assets and related transactions. Apart from the fact that this is a judgemental area, the main reason for transparency around the relevant facts and circumstances is that cryptographic assets and related transactions are a topic of significant interest for all stakeholders (especially shareholders, analysts and regulators). This becomes even more important, given that those users might have different local expectations.

As a result, entities should ensure that their financial statements contain clear and robust disclosures. Those will include some of the applicable generic disclosures required by IFRS, depending on the accounting classification by the issuer/holder.

The following table summarises some of the more common topics for disclosure. However, this list is not exhaustive and will need to be tailored to develop disclosures that are specific to the entity and the relevant facts and circumstances:

| Topic | Examples |

| Involvement with cryptographic assets and related transactions, including purpose for transactions |

|

| Accounting policies, and judgements made in applying them (IAS 1 paras 117(b), 122) |

|

| Sources of estimation uncertainty (IAS 1 para 125) |

|

| Events after the reporting period (IAS 10) |

|

| Fair value of cryptographic assets (IFRS 13) |

|

| Risks and how they are managed (IFRS 7 – although not necessarily applicable – could be useful guidance) |

|

Since this is an evolving area of accounting, entities should closely monitor developments, so that they can align their disclosures with market expectations and requirements.

Index

1. What are stablecoins and CBDCs?

1.1. Stablecoins

1.2. Central Bank Digital Currencies

2. What type of cryptographic assets are stablecoins and CBDCs?

2.1. Stablecoins

2.2. CBDCs

3. Current status of accounting under IFRS

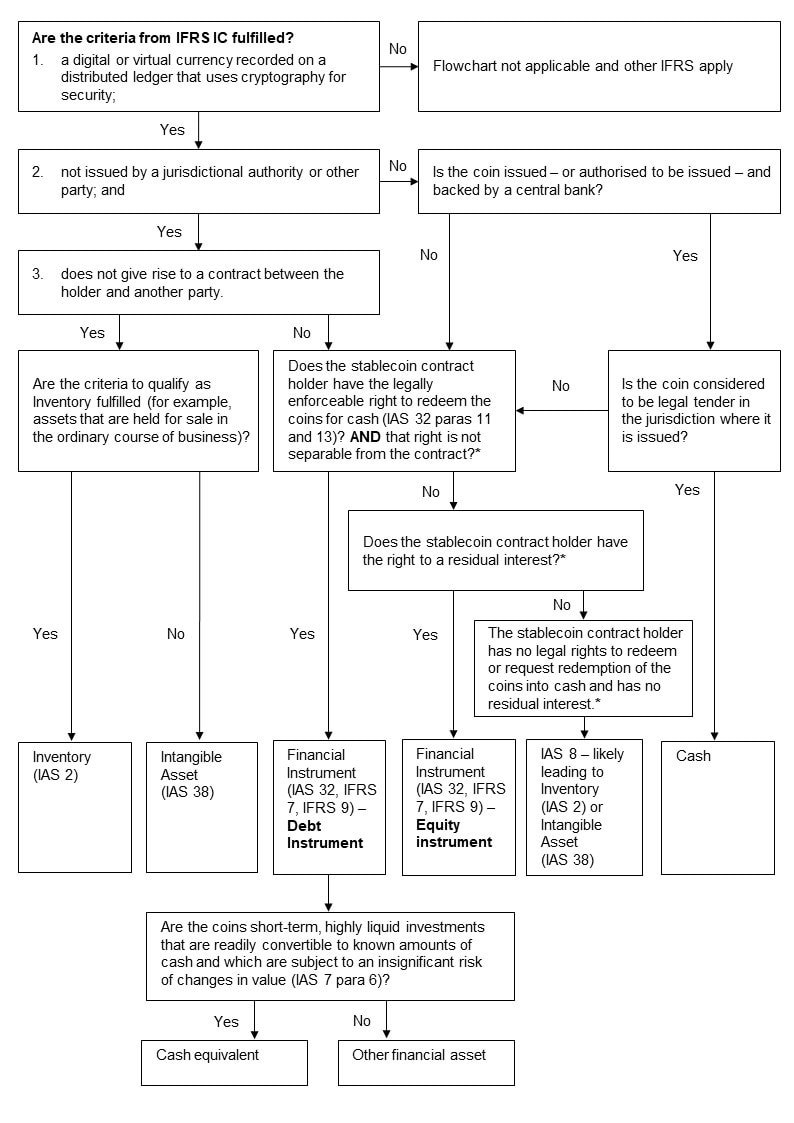

4. Decision tree

5. Common considerations

5.1. Does the Stablecoin holder have the legally enforceable right to redeem the Coins for cash (IAS 32 paras 11 and 13)?

5.2. Does the stablecoin holder have a legally enforceable right to a residual interest?

5.3. The stablecoin holder has no legal rights to redeem or request redemption of the coins into cash and has no residual interest

5.4. Definitions of cash and cash equivalents

6. Preliminary conclusion

1. What are stablecoins and CBDCs?

1.1. Stablecoins

Stablecoins are cryptographic assets that have the primary purpose of representing the value of an asset that is not generally subject to significant volatility, such as fiat currencies, gold or other commodities.

This is usually achieved by collateralising the asset whose value the stablecoin is aiming to peg against. For example, if a stablecoin is designed to represent the value of a fiat currency, such as one USD, it would ensure that one USD is securely stored with the issuing entity for each stablecoin in circulation. Theoretically, other than in the Decentralised Finance or ‘DeFi’ space, it is also possible to achieve this by collateralising assets other than that which the stablecoin is pegging against, including other cryptographic assets (although this is less commonly seen in practice). Finally, the desired effect can even be achieved without collateralisation at all, in which case the stable value is maintained by an algorithm that controls the supply and demand of the coins, to eliminate volatility.

One key reason for the existence of stablecoins is that they allow holders to readily reduce exposure to cryptographic assets with a high volatility by relatively quickly and cheaply exchanging these volatile assets into stablecoins. If a holder were to sell such volatile cryptographic assets to purchase the underlying asset of a stablecoin, they would likely incur significantly higher transaction costs and it would likely take significantly longer for the transaction to be completed. This is because most exchanges either do not allow for the trade of certain cryptographic assets into non-cryptographic assets, such as fiat currencies, possibly resulting in multiple transactions, or they charge higher transaction fees on such transactions.

1.2. Central Bank Digital Currencies

A CBDC is considered to be a digital representation of sovereign currency that is issued – or authorised to be issued – by a central bank and represents a claim against the issuing central bank. These attributes are also the key differentiators between a CBDC and a stablecoin, which is issued by a privately held or controlled entity.

While still early in the development stage, based on the considerations of the Bank of International Settlements there are four different types of CBDC being contemplated:

a) Direct CBDC – a payment system, operated by the central bank, which offers retail services. A direct CBDC is a direct claim on the central bank. The central bank maintains the ledger of all transactions and executes retail payments.

b) Hybrid or two-tiered CBDC – an intermediate solution that runs on two engines. Intermediaries handle retail payments, but the CBDC is a direct claim on the central bank, which also keeps a central ledger of all transactions and operates a back-up technical infrastructure allowing it to restart the payment system if intermediaries fail.

c) Intermediated CBDC – an architecture similar to the hybrid CBDC, but in which the central bank maintains only a wholesale ledger, rather than a central ledger of all retail transactions. Again, the CBDC is a claim on the central bank, and private intermediaries execute payments.

d) Indirect or synthetic CBDC – a payment system operated by intermediaries that resemble narrow payment banks. Consumers have claims on these intermediaries, which operate all retail payments. These intermediaries need to fully back all liabilities to retail clients with claims on the central bank.

2. What type of cryptographic assets are stablecoins and CBDCs?

2.1. Stablecoins

For the purposes of determining which accounting standard applies and discussing the related accounting issues, it is useful to classify cryptographic assets into defined subsets based on their characteristics.

A single, generally accepted framework for the classification of different cryptographic assets does not currently exist. There is consequently no generally applied definition of a cryptographic asset. This reflects the broad variety of features and bespoke nature of the transactions in practice. However, based on our observations, there are some characteristics that can be used to classify cryptographic assets into similar types.

The characteristics that we observe being most relevant for classifying cryptographic assets for accounting purposes are:

- the primary purpose of the cryptographic asset; and

- how the cryptographic asset derives its inherent value.