Streamlined financial reporting is the right idea at the right time. With concerns of non-compliance prompting companies to include more and more information, readers are finding it harder and harder to find what they need and get a clear picture of companies’ performance. Here we look at the principles of streamlined financial reporting and why, applied intelligently, they can help transform corporate storytelling into something more meaningful and rewarding for all concerned. In other words, how streamlining can help companies tell their story in a more compelling way.

Too much information! The urgent need for streamlined financial reporting

In recent years the financial reports produced by companies across the spectrum have been mushrooming in both size and complexity, both online and in print. In an attempt to meet the increasingly stringent demands placed by reporting standards and regulators, entities are putting absolutely everything into their reports that might be relevant for compliance.

But a major consequence of including more information is that financial reports lack structure, and readers often find it hard to get to the relevant information. To make matters worse, there’s frequently no clear thread or common style of presentation linking the financial section to the rest of the annual report – never mind to the other external communications the company puts out. Rather than being aligned with and providing strong evidence in support of the messages the company is trying to articulate (for example in its equity story), annual reports and financial statements have become increasingly diffuse and disconnected.

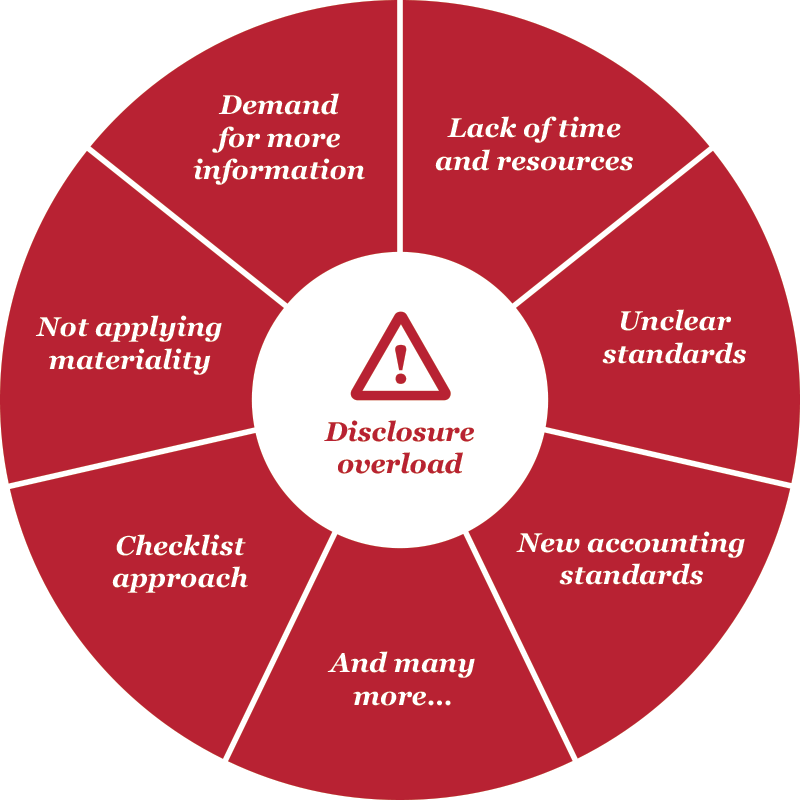

A direct result of this checklist mentality – where financial reporting and compliance rules are more or less the sole driver of what’s disclosed – is that the length of the average financial report published by large companies has increased by around 50% in the last ten years. Figure 1 summarises the main factors leading to this disclosure overload.

The trend is exacerbated by the growing complexity of business reality. On the back of digital technology we’re also seeing entirely new forms of communication. The upshot is a great deal of uncertainty and frustration, not just among the recipients of financial reports, but also among the executives and directors of the companies that publish them. But now the tide is changing: a growing number of companies are saying enough is enough, and have started looking for ways of addressing the challenges.

Less is more: the principles of streamlined financial reporting

The logical response to these developments is streamlining. The idea is to address the information needs of readers by giving the report a clearer structure and focusing on the relevant information. Streamlined financial reporting revolves around a few commonsense principles:

- Create a framework and focus on the needs of your audience: You can streamline your report to structure the available information according to how relevant and important it is rather than simply giving investors more information. Your financial report should be geared to your readers. You have to find out what information they expect to get, tell them a clear story, and avoid the temptation of treating streamlining as a ‘one-size-fits-all’ solution.

- Consider materiality: Rather than including all disclosures that could potentially be required by the standards, focus on those that are material to understanding your company’s performance over the course of the year and draw readers’ attention to the important figures and developments. A streamlined report rejects the checklist mentality, focusing instead on information that is key to understanding the company’s performance.

- Use clear language: Use plain explanations and avoid jargon.

- Highlight important information: Emphasise the most critical information by making it more prominent. For example, you can highlight calls of judgement graphically to draw readers’ attention to their relevance.

- Better design: Use colour, headings, graphs and charts to help readers navigate the report and improve readability. Simple tables and graphics will make your report easier to read and understand.

Isn’t there a risk of non-compliance if we reduce the information we’re disclosing?

The good news is that the regulators recognise the problem and are firmly on the side of companies that declutter their financial reports intelligently. The IASB (International Accounting Standards Board) has acknowledged the need. In the foreword to an October 2017 brochure, “Better Communication in Financial Reporting”, IASB chairman Hans Hoogervorst states the case unambiguously: “Ineffective communication of financial information can lead to investors overlooking relevant information or failing to identify relationships between pieces of information in different parts of a company’s financial statements… Conversely, effective communication of information in financial statements can contribute to better investment decisions and a lower cost of capital for companies.”

When embarking on streamlining it’s crucial to ensure that the focus is on improving disclosure, not reducing disclosure for the sake of reduction. Hans Hoogervorst’s emphasis on communication is important: intelligent streamlining is about formulating, structuring and presenting a clear story that actually communicates more, not less, about the company and its financial situation. A good storyteller always has their listener or reader front of mind. The fact that your company will have a different story and a different readership from other companies means that you have to think carefully about how to present it. Get this right and you not only give your investors the information they need, but you build your reputation as an organisation that takes its responsibilities towards its stakeholders seriously.

Where did the idea of streamlined financial reporting originate?

Streamlined reporting already has a proven track record. The pioneering work was done in Australia, where major companies such as Wesfarmers and Stockland have dramatically pared back their reporting (reducing the length by up to 40% despite increasingly stringent regulatory requirements), structuring the information much more tightly and coherently and – above all – gearing the report and the language it’s written in to readers and their priorities. Many of these pioneers have also made much more effective use of innovative design features such as pop-up boxes with simple explanations of complex accounting issues to make it easier for shareholders to understand the company’s financial situation.

Leading companies in Australia, many of them supported in their efforts by PwC, are using all this as a springboard to change additional elements of their reporting, with the ultimate aim of integrated reporting.

How is streamlined reporting being received? Is it something for us?

The success of companies in Australia hasn’t escaped Europe’s notice, and large listed groups in Germany and Switzerland (including Georg Fischer and Swisscom) have already embarked on an overhaul of their financial reporting, and many more are showing an interest in doing so. The IASB has recently initiated projects reflecting the need to modernise, and includes the principles of clearer communication in its Disclosure Initiative. For example, IAS 1 has been amended to address the relevance, materiality and structure of financial statements. Last but not least, there is also full buy-in from SIX Swiss Exchange, which has acknowledged the benefits of clearer disclosure and the potential of streamlining financial reports to achieve this.

Some of the benefits cited by companies that have embarked on streamlining are as follows:

- Streamlining is a proven collaborative and innovative approach that addresses a topic many companies wrestle with by tackling it top down (from CFO level) while involving all key stakeholders and fostering the working together across functions (external reporting, investor relations, etc.).

- It brings alignment within all the functions of the company dealing with financial communications for a stronger and more consistent message to the market, from drivers of the business to actual performance.

- Streamlining makes reporting more focused and transparent to investors and stakeholders, leading to increased visits to the website and more downloads of information, ultimately cementing trust in management and the organisation (which is now seen as an industry trend-setter) and resulting in a better share price. This isn’t just our opinion at PwC: in the course of our work we’ve repeatedly heard from investors that meaningful communication and presentation have a positive impact on the cost of capital and perceptions of the company.

- Streamlined reporting is a great motivator for finance teams − who can be proud of their output – and a great incentive for key employees to stay with the organisation.

This can all potentially translate into a key factor differentiating an organisation from its peers. Added to this, for many companies the streamlining process is the first easy step in the future of finance, a starting point for shaping the future of the finance function by reshaping the ultimate deliverables.

PwC in Switzerland is building on the network’s experience overseas and has launched a number of projects with listed companies of various sizes in different industries, building on the firm’s experience with managing many similar projects. The concept has been very well received by executives and directors in this country. They too realise that in a world where information is being generated at an exponential rate, it’s important for companies to continue innovating to make sure their information finds its mark. Because if you’re not able to tell your story in a way that resonates with your shareholders, then someone else might do it for you.

Summary

- With companies concerned about non-compliance and putting more and more effort and information in their financial reports, readers are finding it harder to get what they need

- By streamlining financial statements – including less information but selecting and structuring it in a crispier way around clear messages – companies can make their reporting more meaningful and reinforce stakeholders trust

- The principles of streamlined financial reporting are intuitive: create a framework, focus on your audience, use plain language, highlight important information, consider materiality, and better design the report for ease of use

- Streamlining pays off: big-name companies in various continents are already getting very positive feedback from their stakeholders – including the regulators – by telling their story in a more compelling way