The Federal Customs Authority in Switzerland is currently undergoing a huge transformation. One big element of the DaziT programme is the renewal of the IT landscape for the customs processes. The IT systems NCTS and e-dec will be replaced by Passar within the next four years.

What does the DaziT programme consist of?

The transformation programme DaziT (from the Rhaeto-Romanic word “dazi” for customs and T for transformation as well as IT) is a holistic modernisation and digitisation programme of the Federal Customs Authority (FCA). It started in 2018 and will run until the end of 2026 with a total budget of CHF 400 million. With DaziT the duty and import tax collection as well as the goods declaration process will be simplified, harmonised and fully digitised to allow efficient processes for the cross-border trade transactions.

But DaziT is not only a digitisation and IT project. The whole FCA as an organisation is also changing fundamentally. The current FCA will become the Federal Office for Customs and Border Security (FOCBS) with a lean and agile organisation, new job profiles and automated tasks (e.g. profiling, enhanced data analytics etc.) to strengthen the security, control and enforcement aspects.

How does the transition of the IT landscape take place?

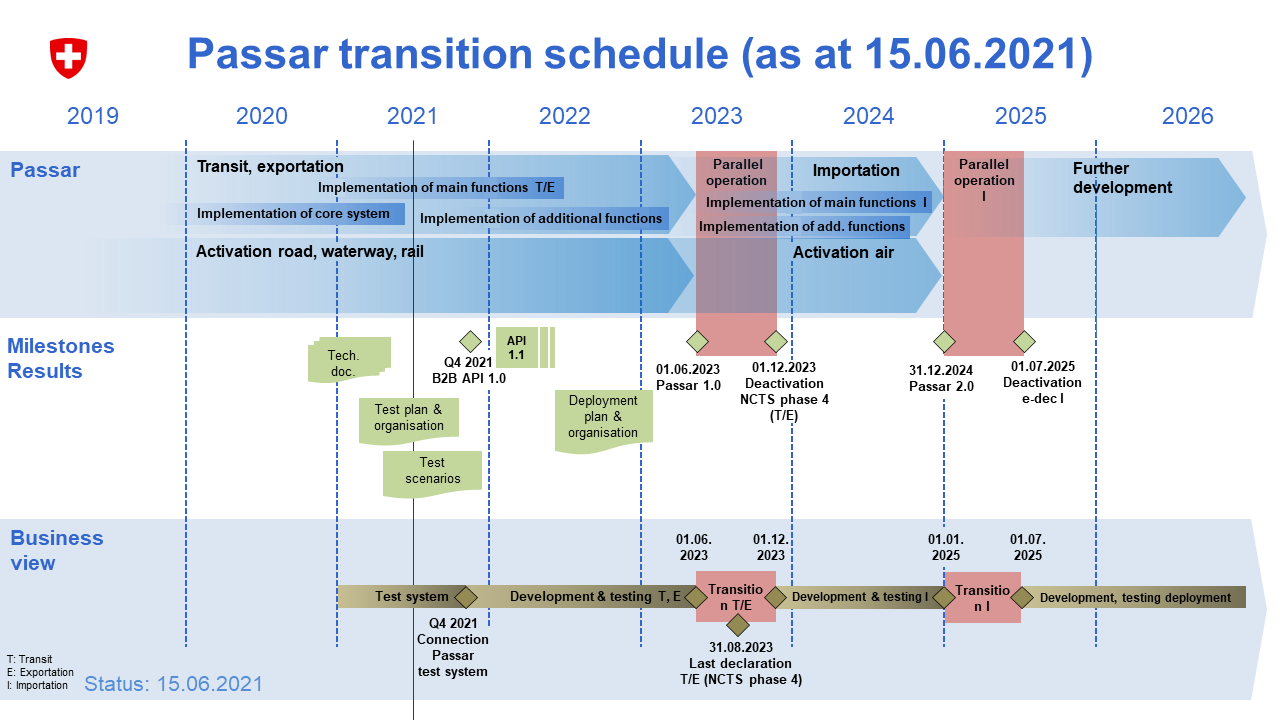

The technical backbone of DaziT is the renewal of the whole IT landscape. The transition from the current NCTS and e-dec systems to the new uniform goods traffic system called “Passar” (from the Rhaeto-Romanic word for border crossing) will take place in three phases.

First the transit and export process will be moved from NCTS and e-dec Export to Passar 1.0 by 1 June 2023. In a second step the import process will be transitioned from e-dec Import to Passar 2.0 by 31 December 2024 with a parallel operation for six months, concluding in the deactivation of the old e-dec Import system by 1 July 2025. With Passar 3.0 all the special provision for goods and functions will then be available on Passar.

The schedule takes into account the technical aspects, the internationally defined deadlines (i.e. NCTS migration, ICS2 etc.) as well as the revision of the Swiss Customs Act. The transition will be designed in consultation with the business community and the external third-party software developers are involved in the testing and implementation of the Passar phases. The technical information can be found on the website of the FCA.

What does this mean for your business and how can we help?

Companies oftentimes face challenges with implementation of process and IT system related changes. The cross-border interactions with multiple external parties, such as suppliers, freight forwarders and customs brokers add another layer of complexity. Companies should review their internal customs and trade processes to be able to face the upcoming changes in the Swiss customs handling.

PwC supports businesses with developing standard operating procedures, building up a responsibility matrix, testing broker and logistics provider collaboration, making all information necessary for the broker to file the declarations (or enhance the self-filing), and adjusting ERP or global trade management systems to support the change.

Furthermore, PwC has developed a tool “Trade Activator” that can visualize the cross-border business of your company based upon customs (or broker) data in multiple jurisdictions, including Switzerland. We help you visualize and subsequently analyze your cross-border trade in order to detect optimization possibilities and to mitigate risks.

Contact us

Simeon L. Probst

Partner, Customs & International Trade, PwC Switzerland

Tel: +41 58 792 53 51

Partner, Customs & International Trade, PwC Germany

Tel: +49 151 14261677