ESMA recently published its final guidelines on naming ESG (environmental, social and governance) funds. Here’s a closer look at how asset managers might have to review their naming policies to comply.

On 14 May 2024, the European Securities and Markets Authority (ESMA) published its final guidelines on naming ESG (environmental, social and governance) funds. Among other things, they specify circumstances where the name of an AIF or UCITS is unclear, unfair or misleading. As expected, the regime is more stringent for funds using sustainability-related terms. But the requirements for impact- and transition-related funds have also been adjusted. Do asset managers have to review their naming policies to comply with the new rules?

Why the changes?

Let’s first take a brief look at the background. In recent years (especially between 2020 and 2022), investor demand for investment funds that incorporate ESG factors has been growing sharply. Since then, the use of sustainability-related terms in fund names in Europe has significantly increased. This has led to concerns that misleading claims, including claims that are part of the names of funds, may give rise to the risk of greenwashing. Against this backdrop, in November 2022 ESMA consulted on guidelines for investment funds using ESG or sustainability-related terms in their names.

On the basis of feedback received during the consultation, ESMA has now published its final guidelines in a number of areas to address the risk of greenwashing stemming from the recently reviewed broader EU fund legislative framework under the AIFMD and the UCITS Directive.

What’s the scope of the guidelines?

The final guidelines apply to the following:

- UCITS management companies, including any UCITS which has not designated a UCITS management company

- Alternative Investment Fund Managers, including internally managed AIFs

- EuVECA, EuSEF and ELTIF

- MMF managers

- Competent authorities

What’s the timeline for applying the guidelines?

The guidelines will be translated into the official EU languages and published on the ESMA website. Publication of the translations will trigger a two-month period during which competent authorities must notify ESMA as to whether they comply or intend to do so. The guidelines will apply from three months after the publication of the translations, subject to some transitional provisions for managers of funds existing before the date of application.

A transitional period of 6 months is foreseen for existing funds, consistent with the proposal made in the consultation paper. Considering the application timeline outlined above, this will give managers of existing funds a minimum of 9 months in total to comply following the publication of the translations.

What does all this mean for the asset management industry?

Asset managers will have to consider the new guidelines throughout the entire life cycle of their funds.

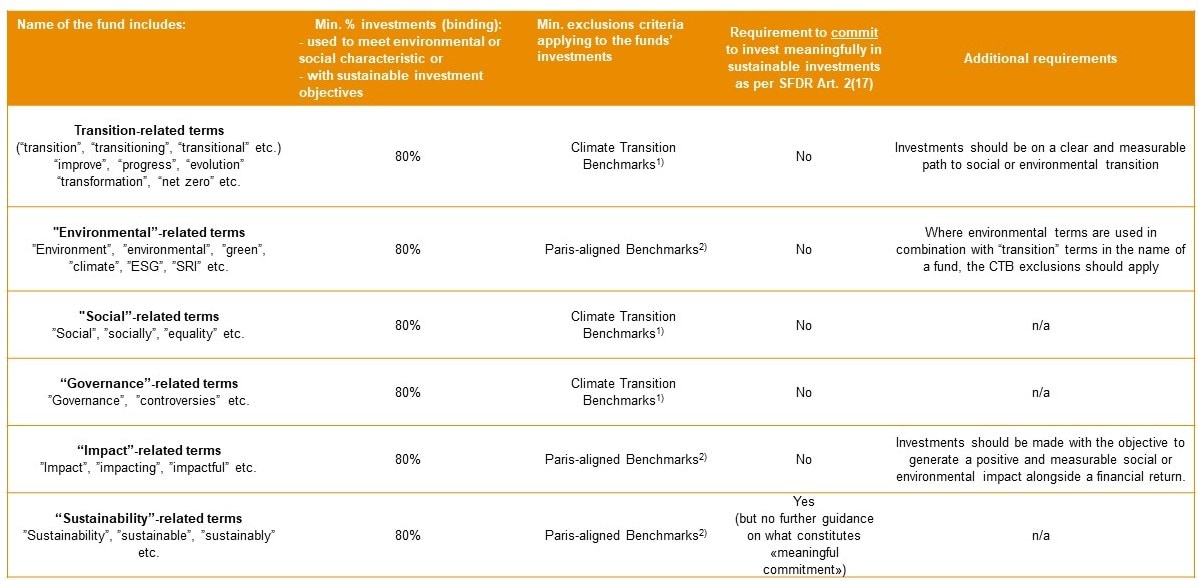

In particular, they will need to conduct extensive reviews of existing funds to ensure compliance with a range of criteria governing the use of transition-, “environmental”-, “social”-, “governance”-, “impact”-, and “sustainability”-related terms. This will include ensuring that a minimum percentage of investments meet the requirements of the environmental or social characteristic or have sustainable investment objectives.

Asset managers will also have to make sure that their funds’ investments are subject to specific minimum exclusion criteria in accordance with certain climate transition and Paris-aligned benchmarks.

Depending on the category of term, there may also be a requirement to commit to invest meaningfully in sustainable investments as per SFDR Art. 2(17).

This table gives an overview of the naming criteria:

1) As per CDR EU2020/1818, the following companies should be excluded: companies involved in activities related to controversial weapons, tobacco cultivation and production, as well as companies found in violation of the UNGC principles or the OECD Guidelines for Multinational Enterprises

2) As per CDR EU2020/1818, the following companies should be excluded, in addition to the aforementioned Climate Transition Benchmark criteria: companies deriving some revenues from the exploration, extraction, distribution or refining of fossil fuels or electricity, the thresholds of amount of revenues being based on the type of energy.

It’s important to note that where terms are combined, the provisions of the guidelines are to be applied cumulatively. To ensure that transition strategies are not unduly impacted, ESMA has specified that where environmental terms are used in combination with “transition” terms in the name of a fund, the CTB exclusions should apply. It should also be borne in mind that because they impact fund managers’ offerings, the final guidelines may also affect investors’ sustainability preferences.

What needs to be done?

Despite the transitional period and timeline for applying the guidelines, asset managers are advised to start analysing their existing portfolios as early as possible to identify potential gaps and take the necessary action.

Here are the key actions we recommend:

- Review the names of your existing fund offering against the investment strategy

- Include strategic considerations if necessary

- Where the investment strategy of an existing fund deviates from the aforementioned criteria, you may need to adjust the investments.

- You may need to adjust the wording of fund marketing materials and make periodic disclosures.

- Strengthen your internal anti-greenwashing framework and guidelines

- Include the new guidelines in your product approval and product review process

- Enhance your internal risk control framework where necessary

- Adjust fund disclosures and marketing materials where necessary

If this sounds daunting, our experts and PwC will be glad to assist.

New European guidelines mean that asset managers will have to review the names of their ESG-related funds and adapt them accordingly (or adjust their investment portfolios to comply). Despite a transitional period, there’s no time to lose. If you need advice or assistance, feel free to contact us.

Contact us

Partner, Sustainable Capital and Sustainability & Strategic Regulatory Leader, PwC Switzerland

+41 58 792 45 23

Sofia Jaccard