Climate change favours natural disasters, which threaten society and companies. The insurance industry, as well as providing cover for these risks and their financial consequences, must also contribute to sustainable finance as a long-term investor.

Need for a new understanding of sustainability

EU Sustainable Finance Action Plan

In March 2018 the European Commission launched an action plan on financing sustainable growth. The plan is intended to encourage the sustainable (and thus also environmentally friendly) design of financial flows and to promote sustainable investment. For the EU, this is not only about environmental protection, but also about protecting its economic interests and strengthening its financial sector.

In the context of the three dimensions of sustainability – environmental, social and governance (ESG) – the following developments are of relevance for the insurance industry:

- E for Environmental

Climate change and the resulting weather-related catastrophes are among the biggest risks for the insurance industry. Payments for weather-related losses have quadrupled over the last four decades. Climate catastrophes are the third biggest risk for non-life insurance and the second biggest risk for reinsurance.

- S for Social

The ageing global population means the cost of healthcare within national budgets is continuing to grow. Governments are passing on a share of that cost to the insurance industry. In addition, the demand on social security (occupational disability, unemployment) is also growing. And, moreover, new technologies are facilitating access to and distribution of insurance products.

- G for Governance

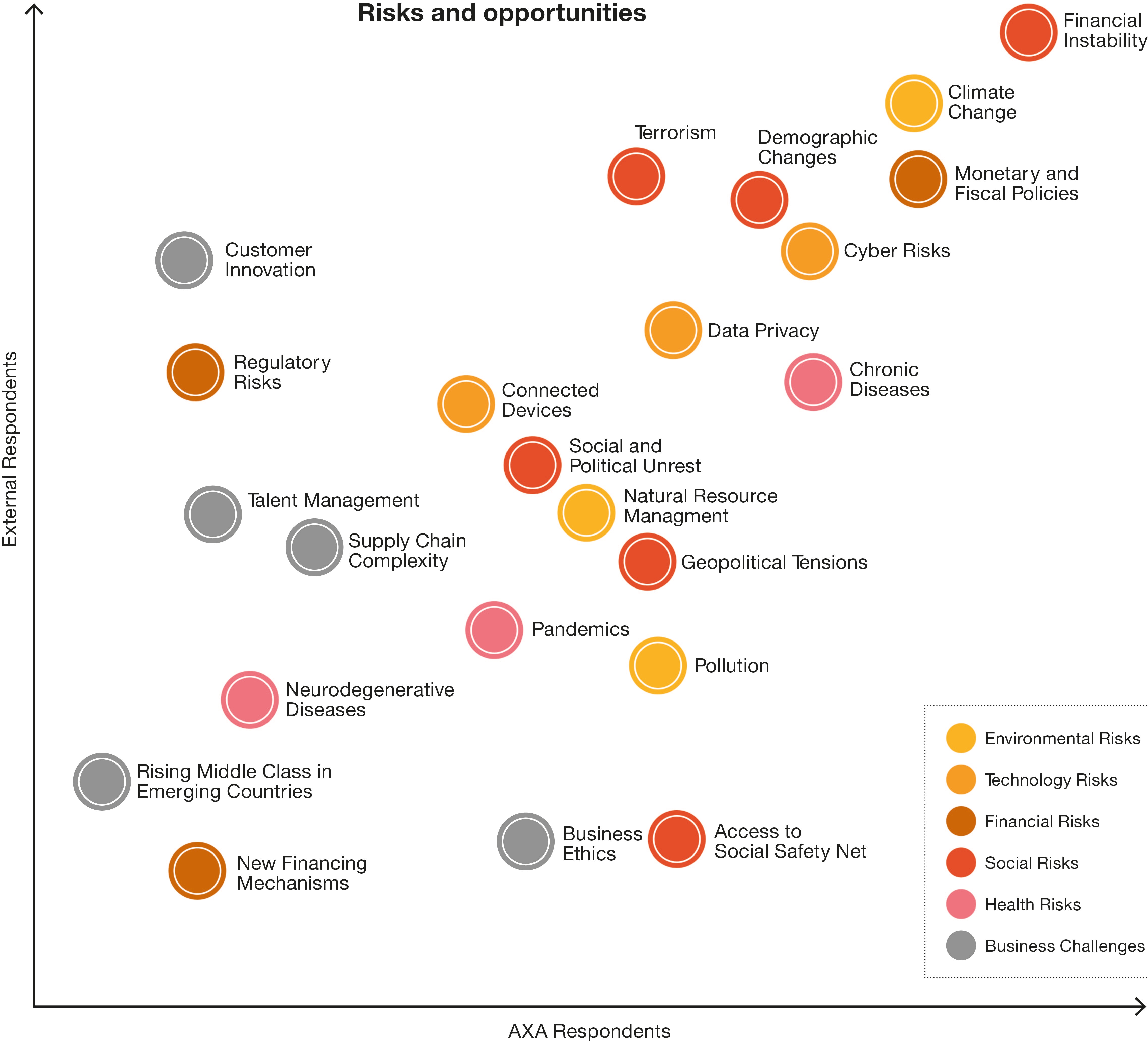

Legal proceedings against companies that contribute to climate change could soon be the biggest threat for insurers.1 More and more leading insurers are taking long-term sustainability trends and factors into account in their risk assessments and claims management, for example by drawing up a materiality matrix. This identifies and prioritises the most important sustainability topics with consequences for society (see Figure 1). Combined with integrated reporting, it contains information that is more comprehensive, networked and forward-looking than other business analyses.

Figure 1: AXA’s materiality matrix2

As one of society’s key risk bearers, the insurance industry should maintain continuous dialogue with its stakeholders. In this way it improves its understanding of the key risks and ESG issues and is able to prioritise. On this basis, the industry can design new solutions and adapt processes to promote sustainable development.

Insurers as investors and risk managers

Green investments not made easy

More and more insurance companies are committing to integrating ESG criteria into their investment processes. However, they run up against certain hurdles3 when designing green investments such as, but not limited to: limited market capacity; a lack of clear classifications, standards and methodologies for assessing green investments; a lack of adequate pricing mechanisms for CO2; and linkages to the financial industry’s risk appetite.

The crux of risk assessment

By modelling and assessing risks, insurers can calculate the technical reserves for expected losses as well as the buffer for unexpected losses. This makes risk assessment an element of the insurance company's competitiveness. Climate change and its consequences lead to:

- an increase in losses and greater variation in losses as a result of more frequent and serious events,

- higher risk capital requirements for insurers and reinsurers,

- a challenge in terms of affordability of natural disaster cover for risk regions and

- increasing difficulty in closing gaps in catastrophe cover.

New paths, new hurdles

Insurance companies are increasingly supporting research projects and establishing incubators in an effort to develop innovative preventative measures and improve their risk models. They are also investing in product design. For example, offering a premium reduction if a policyholder implements preventative measures. Product development raises additional challenges:

- Limited access to risk information and therefore difficulty in setting prices

- Political, regulatory and legislative issues

- Lack of awareness of insurance

- Weaknesses in domestic insurance markets

- Limited uptake of catastrophe cover

- Regulatory hurdles to accessing global reinsurance

- Scalability and sustainability of insurance programmes

Time for action

The insurance industry needs to take action: on the one hand, to improve the quality and make it easier to compare sustainable finance products and services and, on the other hand, to hedge the consequences of catastrophes through comprehensive risk management and to develop preventative measures. To do this, climate-related financial information is needed. Here, action4 is needed in several areas:

- Disclosure of climate-related financial information has improved since 2016, but is still insufficient for investors.

- More clarity is needed on the potential financial impact of climate-related issues on companies. The link between climate change and commerce can only be made if quantified information is available. Without this information, an investor cannot make an informed investment decision, nor can a risk manager calculate the relevant risks.

- Of companies using scenarios, the majority do not disclose information on the resilience of their corporate strategies.

- Addressing climate-related issues requires cooperation as well as the involvement of more functions than only those responsible for sustainability and corporate responsibility. The topic belongs on the agenda of risk management, finance and executive management.

Global task

On a geopolitical level, the insurance industry is a key player when it comes to developing the risk distribution and transfer solutions that are needed to improve global resilience against climate risks. The United Nations, World Bank and the insurance industry established the Insurance Development Forum (IDF) for precisely such projects. Its goal is to translate the insurance industry’s risk knowledge into national laws on risk reduction and to improve access to the insurance system for population groups most in need of protection.

By sharing risk information and expertise in the fields of risk management, innovative insurance solutions and digital distribution, the insurance industry is already making a contribution to improving financial and socio-economic resilience to extreme events. Most, though not yet all, insurers have recognised this potential.

Conclusion

Global competition among financial centres around ESG factors is now also penetrating the insurance industry. Efficient processes, legal compliance, information on risk modelling and innovative solutions are becoming increasingly important, as are new risk transfer strategies, particularly for developing and emerging countries.

Together with governments and organisations, the insurance industry must find ways to support sustainable development using its risk management, underwriting and investment functions. Society's resilience to climate risks can only be strengthened if public and private institutions work together.

Insurers need to recognise climate change as a topic of central importance in their company. They also need to improve their internal scenario analyses and stress tests. Environmental and socio-economic data are part of this. Because only if those data are available is it possible to formulate clear climate action plans and take corresponding investment decisions.

1 According to supervisory authorities at the Bank of England

2 See https://group.axa.com/en/page/materialityanalysis

3 See The Geneva Association (2018)

4 See the Task Force on Climate-Related Financial Disclosures (TCFD)

Text "#social#