In the constantly evolving pharma landscape, personalised interactions are becoming essential. To deliver them effectively, pharma companies need to enrich and broaden their traditional segmentation approach.

In this series of blog posts, we’ll share our thoughts and perspectives on various aspects of customer engagement. This first blog in our series will concentrate on customer segmentation. Effective segmentation is essential to gain a deep understanding of target audiences and fuel a more personalised approach to marketing strategy and engagement.

Why a new approach to customer segmentation?

The rapid evolution of pharma companies’ commercial landscape is changing how they need to engage with their stakeholders, especially with healthcare professionals (HCPs), patients and payers. Over recent years, Covid-19, the growing need for on-demand services and the rise of digital engagement preferences have all increased the importance of orchestrated digital engagement with personalised and tailored content delivered over the optimal channel mix.

All of the above factors increase the need for pharma organisations to rethink their traditional approach to engagement. Their goal? To adopt technology-led innovative solutions to create a more holistic understanding of HCPs and patients. With that understanding, pharma companies will be able to interact with stakeholders more effectively throughout their journeys, identifying specific pain points and addressing unmet needs.

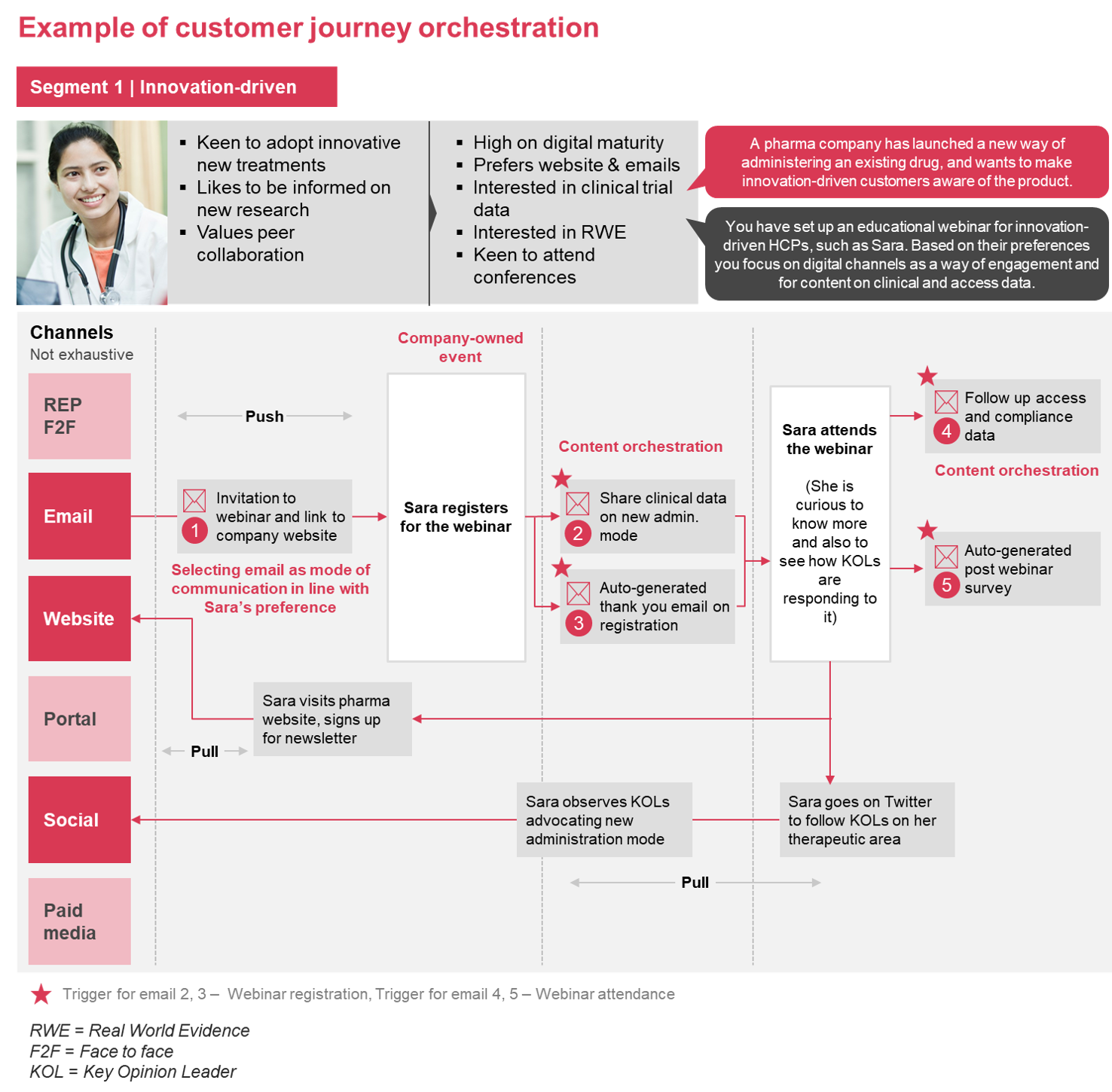

That’s where behavioural customer segmentation comes into play, laying the foundations for personalised customer engagement orchestrated across all relevant channels. In the rest of this article, we’ll focus on how behavioural segmentation can be applied to HCPs. However, the same approach – albeit with some modifications – will also apply to patients and payers.

Figure 1: The value of segmentation for pharma organisations and HCPs

A customer segmentation framework to build and maintain competitive advantage

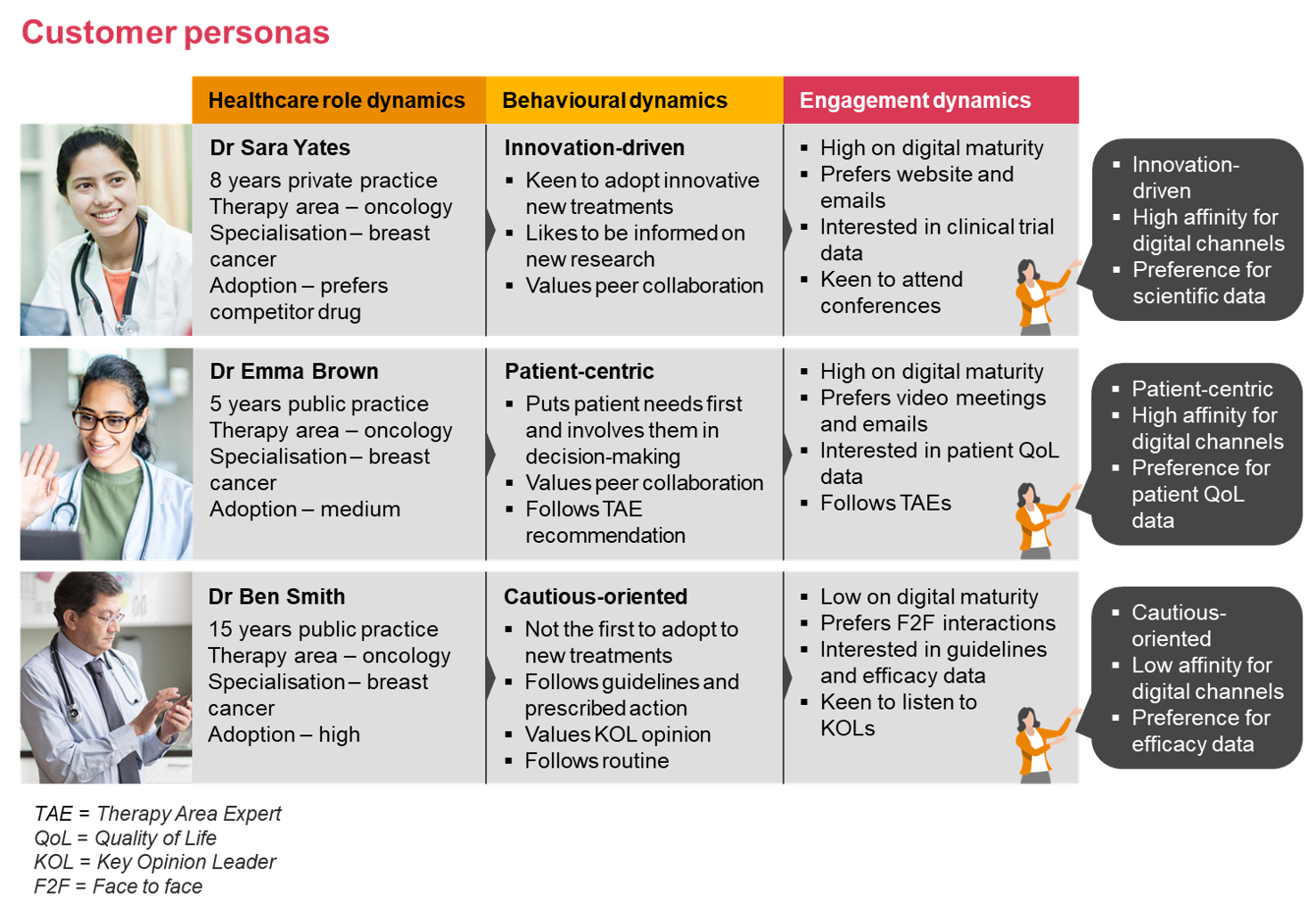

Conventionally, pharma companies have segmented customers according to their role in the healthcare ecosystem as well as their potential and/or actual adoption of products. Then, pharma companies would target specific customers for new drug launches and continue to engage with them throughout the product lifecycle. Most pharma companies, therefore, already have an adequate understanding of their existing customers from the perspective of ‘healthcare role dynamics’ (as we refer to it in Figure 2 below). This is specific to a particular therapeutic area.

However, this information alone is no longer sufficient to enhance a pharma company’s interactions with HCPs, patients and other healthcare stakeholders, and differentiate it from the competition.

That’s why our framework builds on existing pharma practice with two additional dimensions: behavioural and psychographic needs, and information/channel preferences.

Together, the three dimensions (healthcare role, behavioural and engagement) enable personalised customer interactions through tailored content and messaging. And because behaviour and engagement are therapeutic area agnostic, the model can be scaled across therapeutic/disease areas and improve collaboration between organisations’ global and local layers.

Figure 2: Three dimensions to build a comprehensive picture of the customer (here tailored for HCPs)

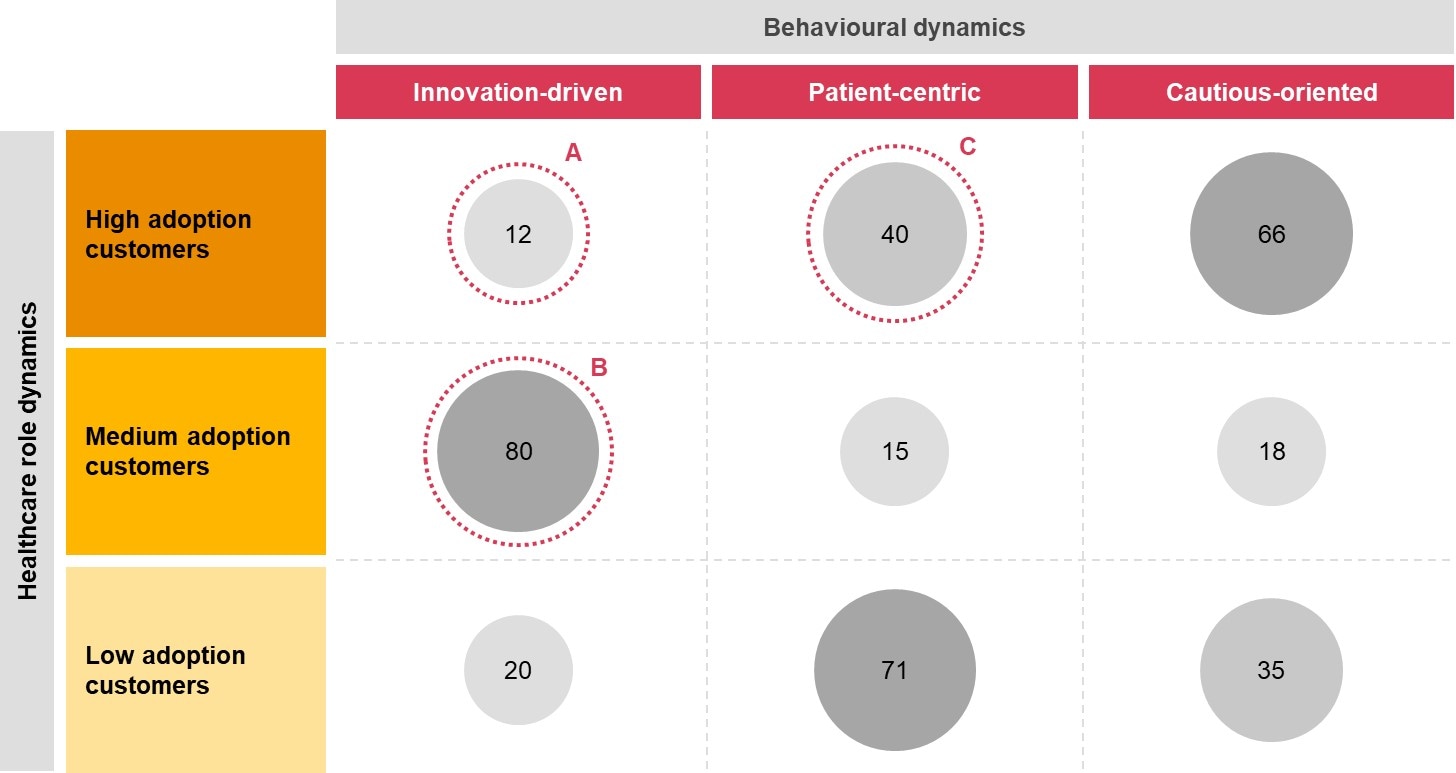

What does our customer segmentation look like in practice?

Segmentation connects global portfolio, commercial and/or brand teams defining the brand strategy with local teams that engage with customers both face-to-face and digitally. It helps global teams to define which HCP segments are a priority at each stage of a product launch, and local teams to identify which HCPs fall within each segment so they can implement personalised outreach.

Figure 3: Segmentation insights fuel end-to-end customer engagement

Please click on the tabs to see each step in more detail.

Key success factors for scaling customer segmentation organisation-wide

Pharma organisations looking to scale this segmentation framework across therapeutic areas and organisational levels for dynamic insights generation should consider five key success factors:

- Establish a standardised yet dynamic segmentation framework and process for data capturing

Early on, define the specific attributes that need to be captured under each segmentation framework dimension. This will enable comprehensive and homogenous data collection across countries and therapeutic areas. In addition, define clear business processes, rules and taxonomy for data capturing and utilisation within existing CRM systems.

- Prioritise primary market research to define therapeutic area, agnostic behavioural and engagement dynamics

From our market experience, behavioural characteristics and motivations are largely the same across therapeutic areas. Be diligent when defining these dimensions for the first time (e.g. build a questionnaire based on the most important criteria and drivers for you, use a robust sample size across geographies) and extrapolate them to make it therapeutic area agnostic.

- Activate a company-wide, technology-enabled database

Technology will provide you with the flexibility to scale based on your needs and to make informed decisions. By leveraging existing or new marketing tech solutions (e.g. CRM), you’ll be able to capture data in real time, and by aggregating your customer insights into visualisation dashboards you’ll be able to drive outcome-based planning and decision making.

- Develop capabilities for creating dynamic modular content

The value of introducing behavioural and engagement dynamics in traditional customer segmentation is to eventually produce personalised content and messaging that’s relevant to each HCP. So, to achieve maximum impact, pharma companies must invest in content creation tools and capabilities.

- Establish an effective segmentation organisation, with clear roles, responsibilities and governance

Effective segmentation will still depend on people and their level of collaboration. As such, defining the right roles, responsibilities and interfaces between cross-functional teams at global and country level will elevate your segmentation insights and their actionability.

Having outlined above the factors that are key for success, it is also important to highlight that most pharma organisations, when they’re onboarded on this journey, exhibit a lower level of maturity across these areas. It takes commitment, persistence and time for them to evolve.

Figure 8: Maturity levels across key success factors for scaling customer segmentation

How PwC helps with customer engagement and journey orchestration

PwC brings together teams with the knowledge and competencies to provide global pharma and MedTech companies with end-to-end support, helping them deliver more targeted and personalised customer interactions and harness data and analytics to enable data-led decision making.

As part of establishing a robust segmentation framework – the first step of the customer engagement journey – we focus on creating a common understanding of the approach for segmentation, activating and operationalising it, and connecting it with the omnichannel strategy.

Our global network of member firms allows us to localise every company’s strategy with deep market expertise. At PwC, we support our clients to develop and operationalise their segmentation framework, to create value for themselves and their customers.

Contact us

Lingli He

Burcu Yetkin

Theodore Milonas

Senior Manager, Customer Transformation, Pharma and Life Sciences, PwC Switzerland

+41 76 309 92 57

Setika Gupta

Senior Consultant, Customer Transformation, Pharma and Life Sciences, PwC Switzerland

+41 79 517 97 03