How blockchain technology could impact HR and the world of work

Blockchain’s potential to transform business is already manifesting itself in industries such as insurance. But what could the technology do for HR? We brought together some of the UK’s leading blockchain experts with HR leaders to explore its possible impacts.

Key findings

While disruption from blockchain is more commonly associated with areas like payments and capital markets, its effects on HR will be profound and pervasive.

Rather than focusing on the intricacies of the technology itself, HR functions should consider the benefits blockchain delivers – such as trustworthy verification of counterparties’ identity without the involvement of a third-party – and then identify problems and areas of inefficiency in their existing operations that could be addressed through blockchain.

The processes most appropriate for transformation through blockchain are likely to be those that are slow, cumbersome, labour-intensive and expensive due to the need for significant data collection and third-party verification.

Possible usages of blockchain

- Verifying and assessing the education, skills and performance of potential recruits – enabling those recruits to be allocated to the most appropriate roles.

- In turn, giving people a comprehensive, trustworthy blockchain-based record of their education, skills, training and workplace performance.

- Managing cross-border payments and employee mobility, including international expenses and tax liabilities, with the potential for organisations to create their own corporate currencies.

- Boosting productivity, such as by automating and reducing the burden of routine, data-heavy processes like VAT administration and payroll.

- Enhancing fraud prevention and cybersecurity in HR, including both employees and contractors.

"Blockchain could shake up the world of work. On one level it could revolutionise HR processes, but it could also transform workforces - the skills needed, secure value transfer and transparency to name a few."

Addressing HR pain-points

Start with the business rather than the technology, and seek out existing problems to address e.g. What are the business processes that HR goes through that are painful, and involve a lot of people, shared data, time and risk?

Four areas of greatest impact for blockchain include; cross-border payments and mobility; talent sourcing and management; productivity gains; and cyber security/fraud prevention.

1. Talent sourcing and management

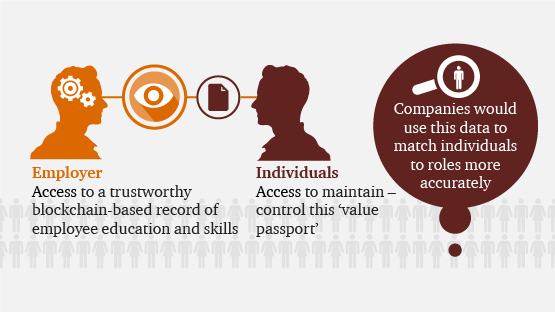

Blockchain could have a major potential on both sides of the employment relationship, from the ability for people to maintain – and control access to – a comprehensive, trustworthy blockchain-based record of their education, skills, training and workplace performance. By providing potential employers with access to this “value passport”, individuals would be able to turn their skills, training and experience into genuine value in the employment market.

By applying analytics to the data, companies would be able to match individuals to roles much more accurately and effectively.

2. Targeting productivity gains

The enhanced ability to match people’s skills and performance to jobs would provide an uplift to productivity across the UK, which currently lags behind many other OECD countries.

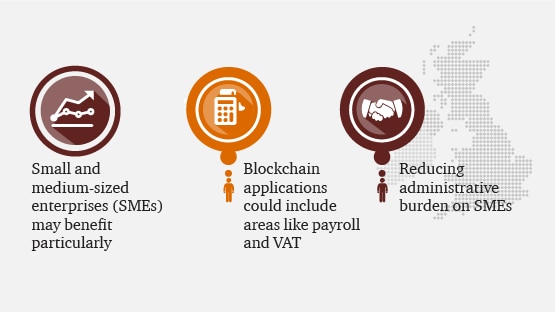

Small and medium-sized enterprises (SMEs) may benefit particularly. The burden of finding and recruiting the right talent is especially heavy for smaller businesses, and anything that can help them do this more effectively and efficiently will boost their productivity. Further high-potential targets for blockchain applications include areas like payroll and VAT, where reducing the administrative burden on SMEs could help them focus more on serving customers and growing their businesses.

3. Cross-border payments and mobility

Initial steps into blockchain for multinational businesses may include creating their own blockchain-based corporate currencies or “coins” that they can use to transfer value across their business globally and transact with their supply chains, free of the friction and costs of third-party reconciliation. Over time, central banks will also become involved, introducing their own blockchain-based means of exchange to support convertibility into “official” currencies.

4. Fraud prevention, cyber security and data protection

Given HR’s involvement in high-volume financial transactions and responsibility for a wealth of sensitive personal data, it’s a function where blockchain’s benefits in these areas are especially important. Blockchain’s use of consensus to establish facts helps to squeeze out fraud.

Cyber risks spring largely from an underlying lack of transparency in systems and data, the threat of cyberattacks is a further challenge that blockchain can help to address. Again, this may be of particular help to SMEs, many of whom who are underprepared for cyber threats.