On 26 July 2024, the Swiss Financial Market Supervisory Authority (FINMA) released its "FINMA Guidance 06/2024". Therein FINMA provides additional guidance for projects seeking to issue stablecoins and for banks providing default guarantees for issuers of stablecoins. FINMA’s latest guidance complements previous publications to this regards, namely its Supplement to the guidelines for enquiries regarding the regulatory framework for initial coin offerings (ICOs) from 2019.

The new guidance makes two major points. First, it defines minimum requirements for default guarantees of banks. Such guarantees are used by some issuers of stablecoins to be exempted from the banking license requirements. Second, FINMA argues that stablecoin issuers or an appropriately supervised financial intermediary must adequately verify the identity of all persons holding the stablecoin, due to a prohibition of anonymous transfers.

Amongst other reasons, FINMA deems these two aspects to be necessary due to international standards set by the Financial Action Task Force (FATF) and the Financial Stability Board (FSB). Whether financial market regulators in other jurisdictions will introduce similar approaches to further regulate the issuance of stablecoins remains to be seen.

Potential license requirements for issuers of stablecoins

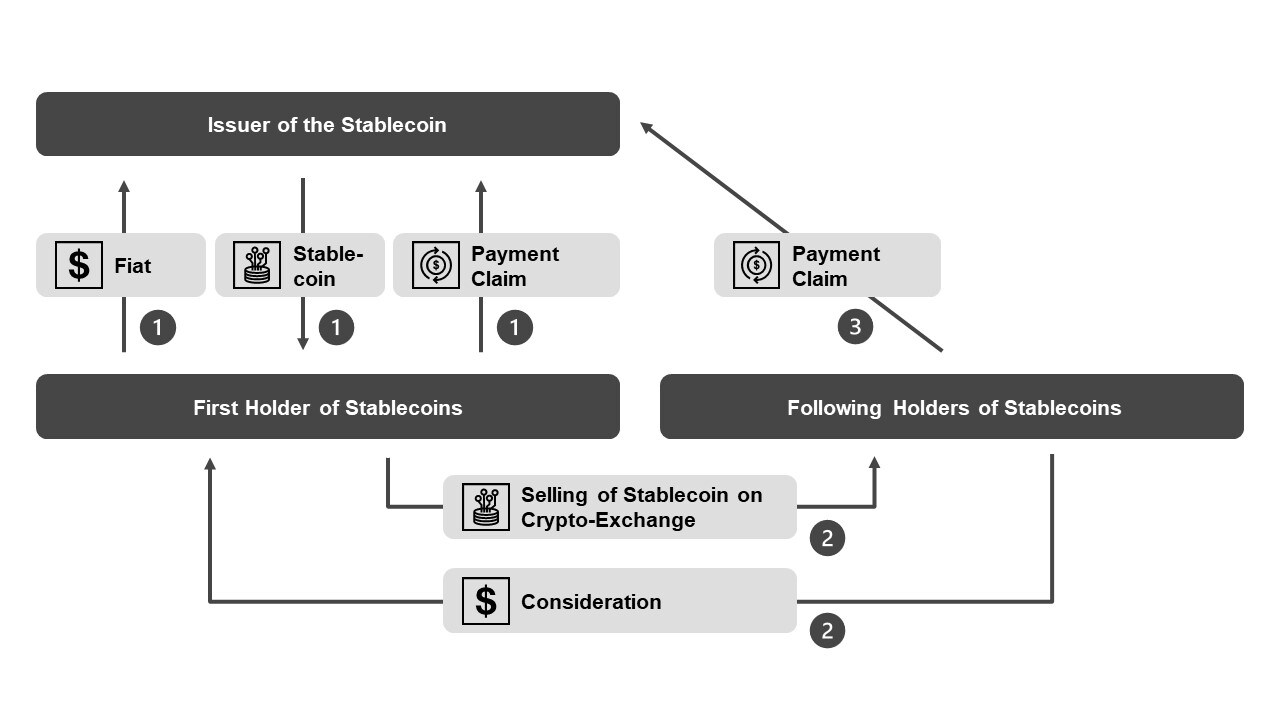

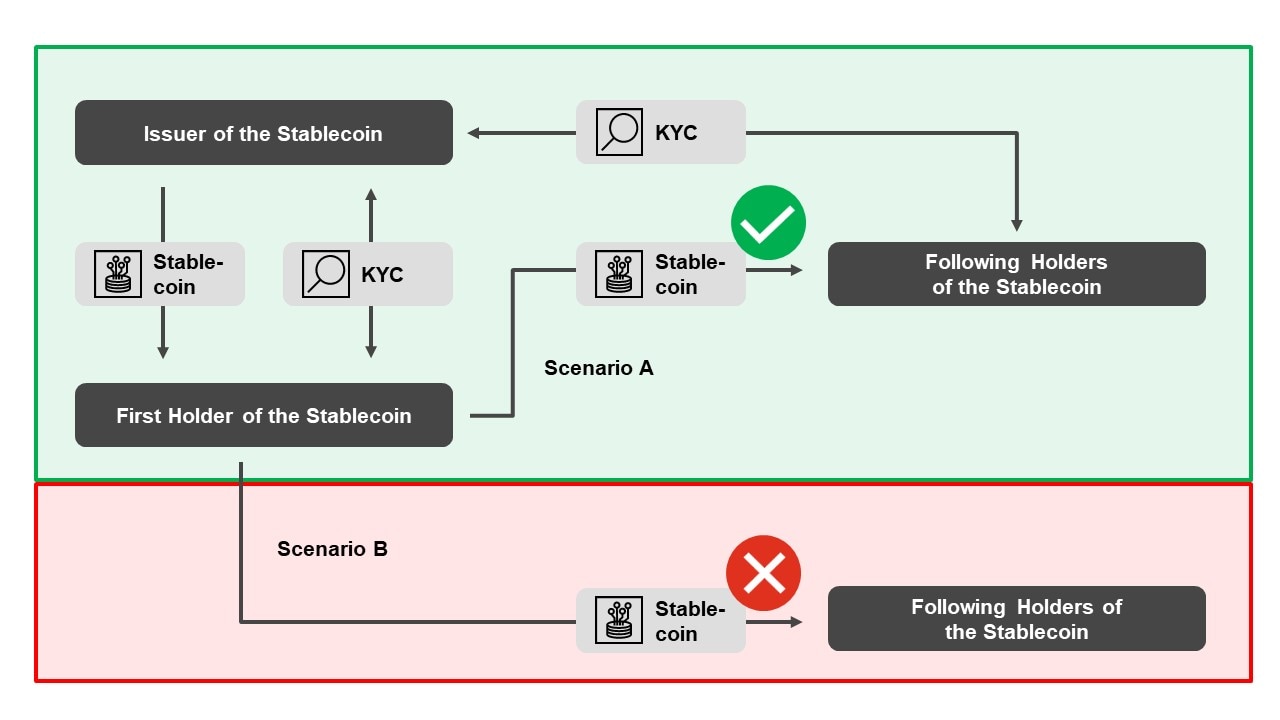

Stablecoins aim at offering a low-volatility payment option on the blockchain. The issuer of the stablecoin achieves this by introducing a stabilization mechanism that links the stablecoin to one or more underlying assets – usually fiat currencies. The holders of stablecoins often have a payment claim against the issuer. The payment claim against the issuer is typically transferred to following holders of the stablecoins by transferring the stablecoin:

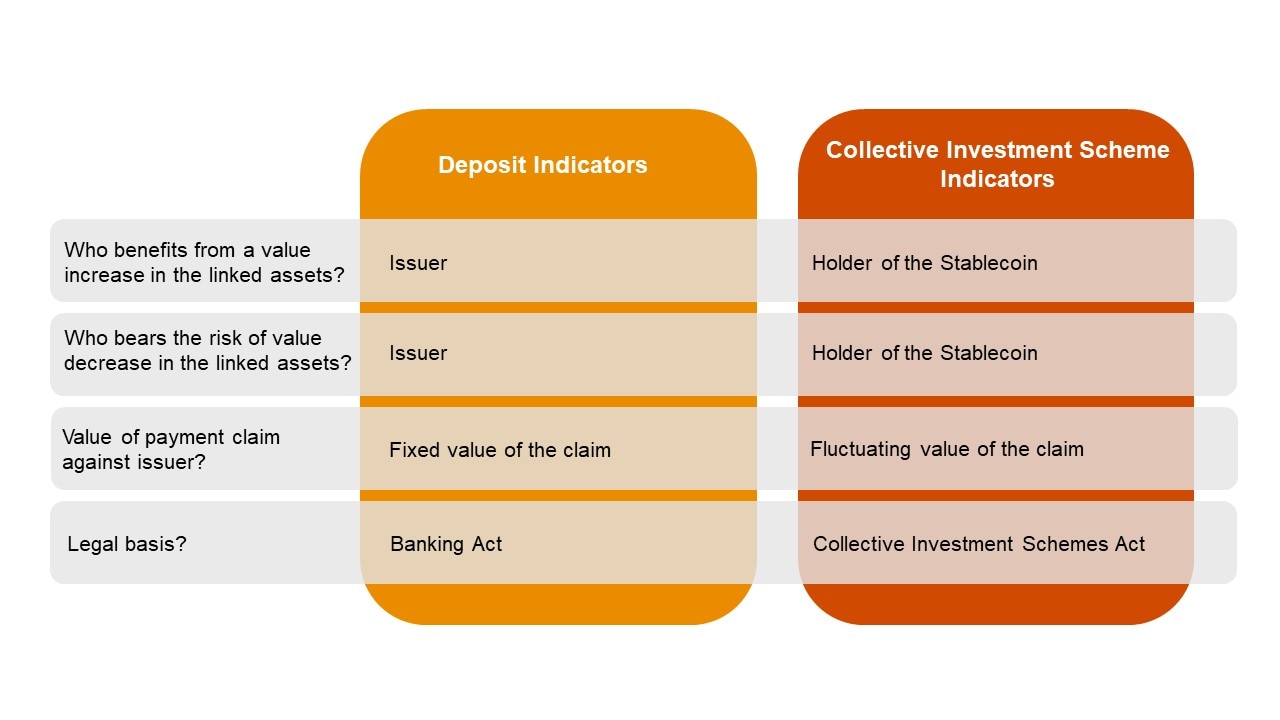

These payment claims often call for a classification as deposits under the banking law or as collective investment scheme. Thus, projects intending to issue stablecoins may trigger licensing requirements under the Banking Act or the Collective Investment Schemes Act. Key indicators for licensing requirements under either of both acts are:

Default guarantee as a reason for being exempted from the banking or FinTech license requirement

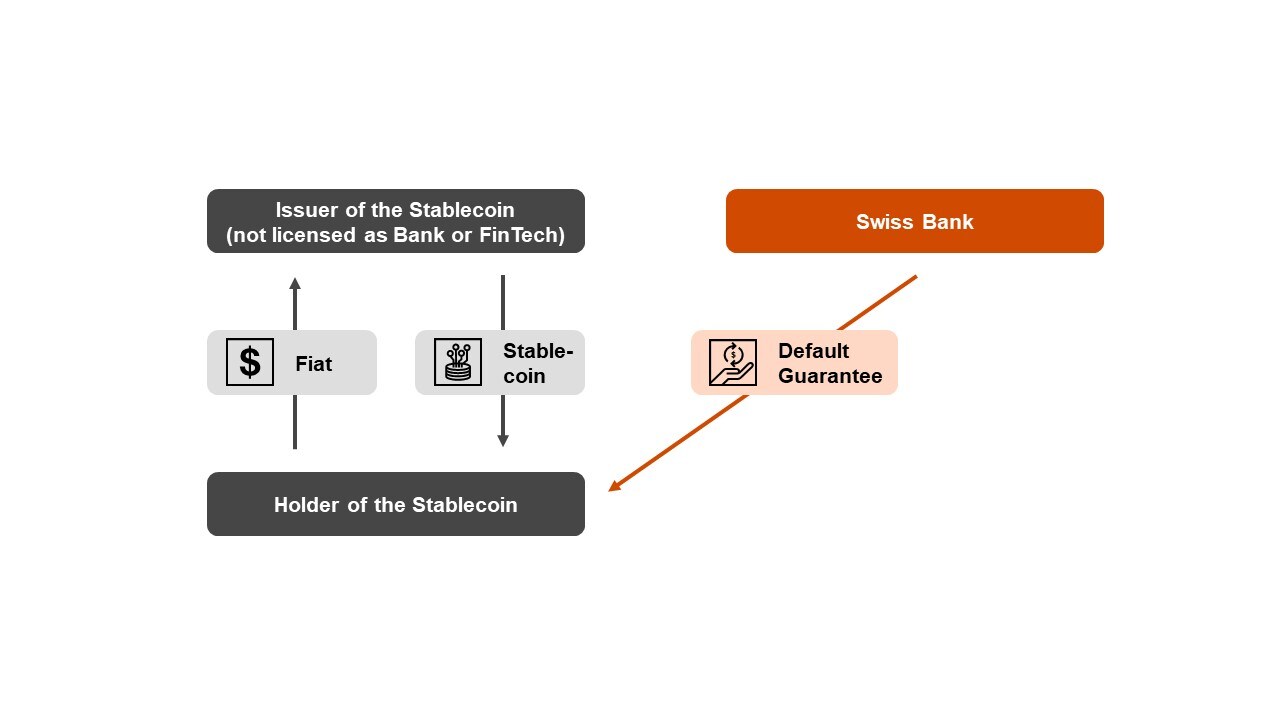

Issuers of stablecoins which represent claims similar to those of deposits may benefit from one of the exceptions from having to apply for banking- or a FinTech license. The most widely used exceptions is the default guarantee provided by a bank. If a bank guarantees the repayment of funds and interest (if any) to be paid, the activity of the stablecoin issuer does not trigger a licensing requirement under the Banking Act.

Minimum requirements for the default guarantee

FINMA demands that the default guarantee of the bank fulfills certain minimum requirements, otherwise the issuer of the stablecoins cannot rely on the exception from having to apply for license under the Banking Act. These requirements are:

To enable customers to swiftly call on the default guarantee, FINMA requires that the claim in question must be due at the time of insolvency – specifically, when bankruptcy proceedings against the stablecoin issuer are opened, not merely upon the issuance of a certificate of loss.

Regulatory requirements regarding Anti-Money Laundering

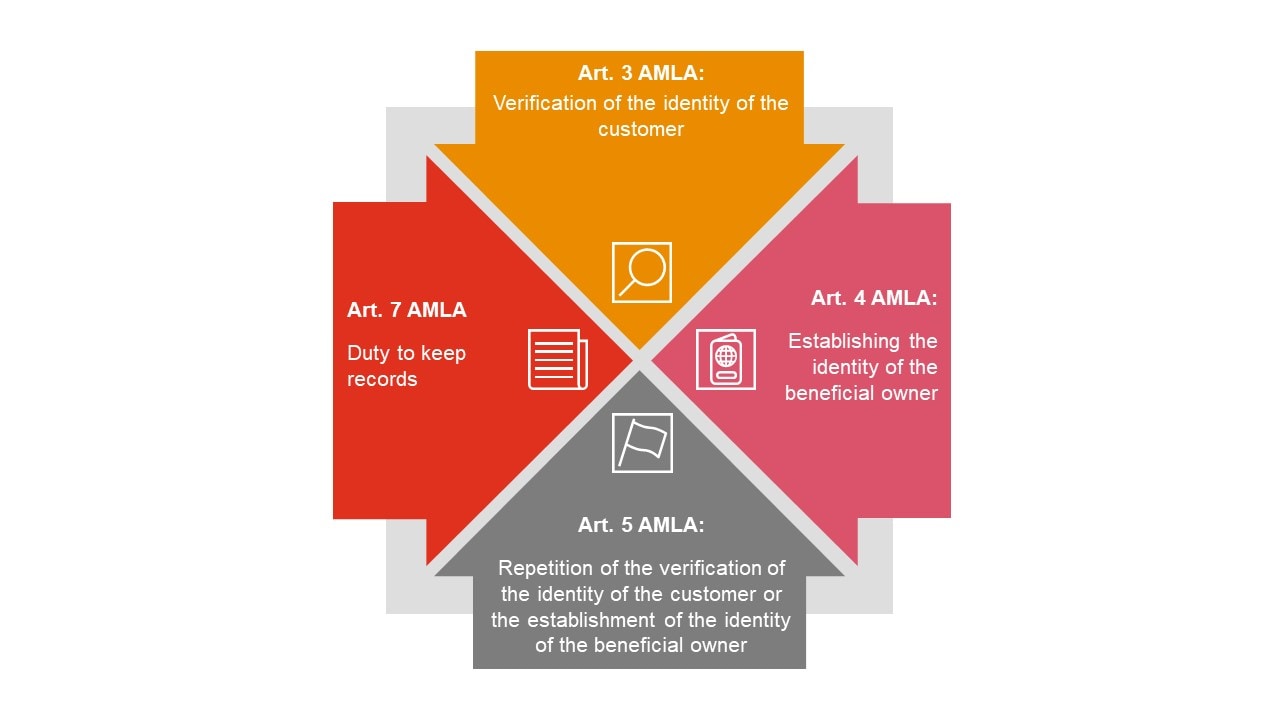

Irrespective of whether the issuer of stablecoins must apply for a license under the Banking Act, the Collective Investment Schemes Act, or neither of both, the Anti-Money Laundering Act almost always applies. Consequently, several obligations apply, including:

FINMA emphasizes that the identities of all stablecoin holders must be thoroughly verified to comply with the Anti-Money Laundering Act. This means stablecoins can only be transferred to individuals who have completed onboarding with the issuer (Scenario A). Anonymous transfers are prohibited (Scenario B).

Next steps

The new FINMA guidance 06/2024 takes effect immediately. In its report on amendments to the Banking Act dated 15 June 2018, the Federal Council highlighted the need to review the exemption rule for default guarantees in the Banking Ordinance. This topic is also addressed in the report "Digital Finance: Handlungsfelder 2022+." According to this report, the review, along with any necessary adjustments regarding the default guarantee, is expected to be completed by 2025.

Already now, issuers of stablecoins are well advised to assess the impact of the latest FINMA guidance on their contractual set-ups, operation, and business model.