FINMA Circular 2017/xx “Outsourcing” consultation paper

Key changes

- Outsourcing of critical services to banks in the same financial group is no longer permitted

- Intragroup outsourcing must meet the same requirements as external outsourcing

- Additional reporting requirements, including the inventory of outsourced services and concentration risks

- Data must be accessible in Switzerland in case of restructuring, resolution or liquidation

- New regulation combines banking and insurance companies, need to have the word available as we might update this section

General feedback on consultation paper

- Innovative technologies and solutions (e.g. cloud-based services) are not properly considered (Economiesuisse)

- Outsourcing abroad is too restrictive and requirements cannot be ensured as requested (Economiesuisse)

- Treatment of intragroup outsourcing results in high and unnecessary administrative work (SwissBanking)

- In general, Risk Resolution Planning (RRP) should not be treated in the circular (SwissBanking)

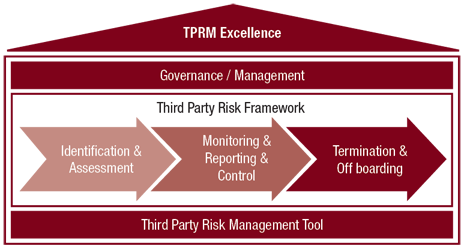

The general trend within financial services industry is to outsource services to external providers, resulting in higher efficiency, quality and lower costs.Therefore Third Party Risk Management receives more and more attention due to its benefits as well downsides and risks such as increasing reliance on products/ services, cyber security or not fulfilling regulatory requirements. Not appropriate third party risk management resulted in the past in high fines by the regulator, reputational damage or a loss of market share. Therefore there is a strong need for a robust TPRM framework, with a special focus on the following three key enablers: regulatory compliance, operational excellence and a digital solution.

Regulatory Compliance

Compliance with the various relevant regulations is a fundamental requirement. In addition, it is important to identify upcoming regulations to ensure timely implementation, such as FINMA Circular 2017/xx “Outsourcing” and FINMA Circular 2017/1 “Corporate governance” fundamental requirement. A TPRM solution, which only focusses on the risk and compliance area, tends to be complex, less efficient and expensive. Therefore, operational excellence is an essential element.

Operational Excellence

TPRM complexity is mainly based on:

- The high number of stakeholders involved (business, vendor management, compliance control groups) in different locations

- The wide variety of third parties and services which need to be assessed individually

A TPRM framework requires clear governance and processes around the third party’s life cycle. The trends are, in this respect, the centralisation and standardisation of assessment and operational tasks to reduce costs and gain efficiency in the centre ofncompetence (COC). The gains of operational excellence cannot be fully achieved without the support of a comprehensive technology based digital solution.

Digital Solution

Based on a recent PwC study, almost 50% of participants use simple manual office solutions, which results in highly disrupted processes. A TRPM digital solution should be managed within a single tool that offers an facilitates basic functionalities such as:

• Assessment of individual suppliers

• Monitoring of ongoing relationships

• Reporting on individual and portfolio levels

Therefore, an end-to-end solution is required to meet today’s requirements. Key requirements for a digital solution can be found below

How we can help you reach your targets

Our PwC team has already worked in this context during various engagements, and should therefore also be the right fit for your organisation. The areas where we may help can be adjusted according to your own particular needs.

Contact us

Operational Excellence & ESG Transformation Leader, PwC Switzerland

Tel: +41 58 792 26 50