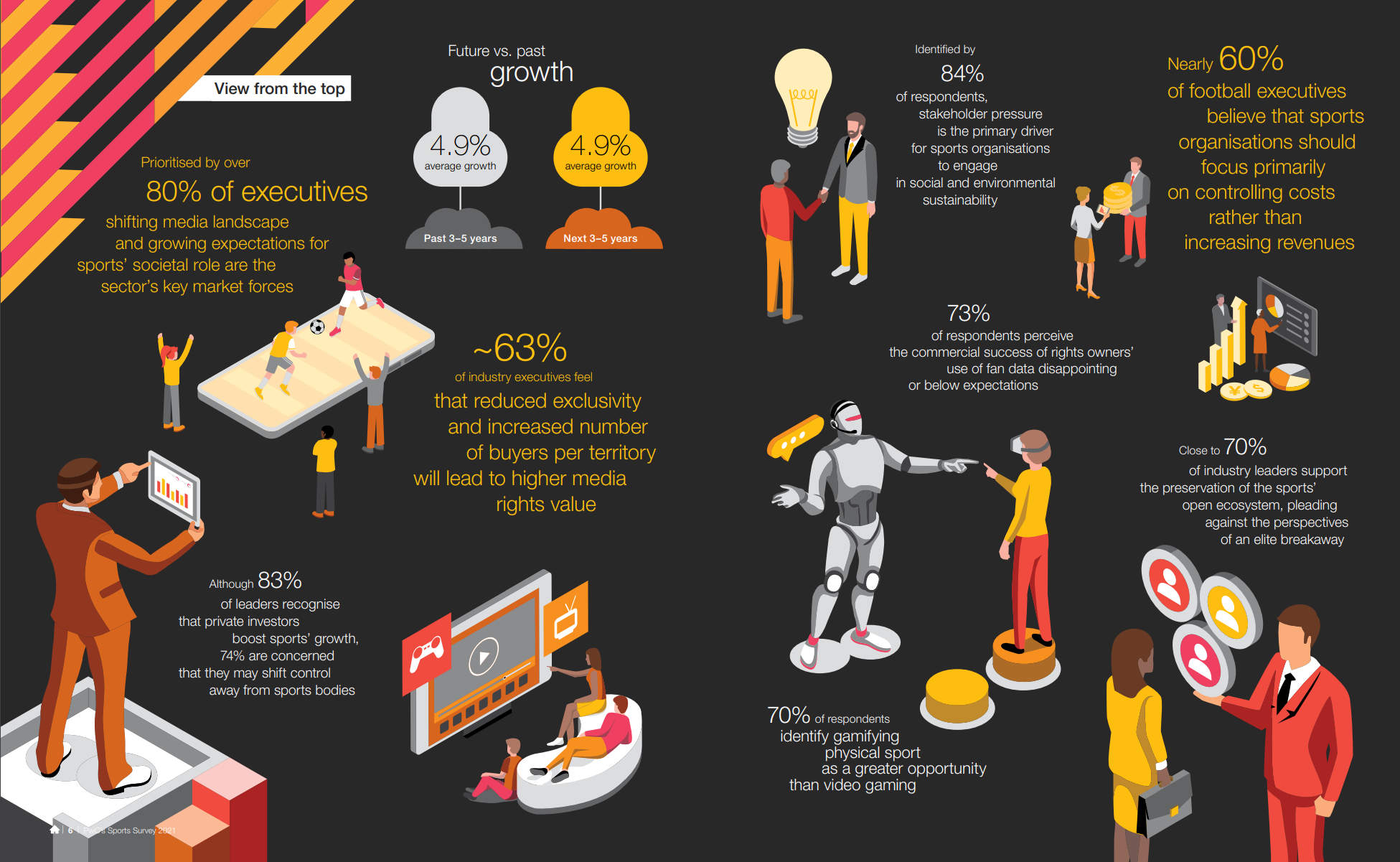

Taking the pulse of the sports industry each year, the sixth edition of the PwC Sports Survey addresses the arduous journey of sports organisations’ crisis recovery. Drawing on the views of nearly 800 sports industry leaders from around the world, the findings demonstrate that a host of internal and external forces continue to profoundly impact the sector as it seeks a more sustainable future.

This year’s edition covers the growths expectations and key market forces that are expected to transform the sports sector over the next three to five years. It then features three detailed chapters on societal and financial sustainability, major governance reforms of sports organisations as well as reshaping of commercial models. Ready to find out the key drivers to rebuild a better sports industry?

"Sports organisations must frontally embrace societal challenges, using their influential platform not only to promote human well-being and environmental protection, but more concretely, play an active role in developing a stronger society."

Explore the key trends shaping the sports industry in 2021

Sustainability: rebuilding for a durable future

Sports have long engaged in CSR activities to create positive impacts in their communities. But in recent months, we’ve seen a multitude of both internal and external factors heralding a powerful paradigm shift, where sports organisations’ societal role must take on an integral dimension, with social, environmental and financial sustainability fully integrated into the wider strategy.

A perfect storm is indeed forming, with athletes raising their voices and fans demanding a greater role in governance, pushing rights owners to strengthen their social fabric at an unprecedented level. In addition to sponsors’ quest for deeper purpose, the rise of professional investors in the sector, who increasingly consider sustainability criteria in order to guide their investments, also acts as a powerful driving force.

More than just ticking the box, it’s crucial that sports organisations walk the extra mile from being primarily an advocacy platform to becoming a true, actionable hub for sustainability. Using their unparalleled influence to do good in society, sports are indeed expected to exceed the ethical standards followed by most industries.

The dialogue on the social and environmental role of sports has intensified, with many athletes and stakeholders taking an open stand on issues beyond the field.

Transformation: rethinking the whole, coherently

Under intense pressure both internally and externally, sports organisations today have a vital need to transform in order to meet the challenges of the twenty first century. Those are too diverse and complex to rely on historical assets that can no longer be taken for granted, such as committed fans and institutional stakeholders, organic commercial appeal or exclusivity of sport governance at large.

Most industry reactions have yet been relatively aligned, whether in terms of innovation or diversification. Nevertheless, we believe that sports organisations should take a more tailored approach to their transformation roadmap. Endogenous factors such as an entity’s distinctive capabilities system are largely underestimated in favour of exogenous factors.

If consumption habits have long been debated in the sector, it’s also high time to talk about participation habits. Indeed, apart from mega-events and a few disciplines acting as true entertainment products, sports’ ultimate catalyst for interest and audience remains the familiarity with the physical practice which, if not nurtured and renewed, could cause serious damage throughout the ecosystem.

The variety of deals recently struck shows that sports are becoming increasingly assertive in leveraging private investors.

Commercial: embracing market liquidity

While major disruptive forces threatening the industry have so far had only a moderate impact on sports’ commercial operations, the effects of shifting fan behaviour, transforming media landscape and rising brand expectations are now materialising, forcing a long overdue shift from evolution to revolution.

Despite encouraging upsides, notably the streaming boom stimulating the sports rights market in specific territories, a general decline in linear viewership is likely to bring sports content closer to its retail value. Hence the importance of maximising the latter by thinking beyond pay-to-access to the whole spectrum of content-led, direct-to-fan monetisation.

With media companies carefully controlling sports content acquisition, brands pursuing granular marketing objectives and consumers demanding flexible, cost-effective access à la Spotify, all market dynamics are heading towards an unprecedented level of liquidity, implying lower value and higher volume of aggregated transactions.

Sports organisations must rethink their commercial models, gradually breaking away from rigid and exclusive packages to fully embrace the digital economy.

Download the survey

https://pages.pwc.ch/core-asset-page?asset_id=7014L0000004z7UQAQ&embed=true&lang=en

Our sports experts

Szergej Maszlov

Ioannis Meletiadis

Focus areas: strategy, planning, ticketing/hospitality, Zurich, PwC Switzerland

+41 58 792 14 62

Shin Szedlak

Katharina Honsberg

Claudio Prante

Stuart Woodcock

Patrick Balkanyi

Thibaut De Haller

Richard Thomas

Contact us

.jpg.pwcimage.370.208.jpg)