Benjamin Rutz

Director, Business Restructuring Services, PwC Switzerland

Claude Fuhrer

Partner, Deals Strategy & Operations Leader, PwC Switzerland

Operating environment

European automotive companies in particular are contending with growing production and supply chain problems, with high energy prices and raw material costs (especially for metals) hitting working capital and putting suppliers under pressure in the short term.

The good news is that production losses resulting from the global semiconductor shortage are easing from their peaks in 2021.

All this has impacted the supply chain. Even though original equipment manufacturers are still supporting many mid-market automotive suppliers and manufacturers, these companies ‒ especially those without a finger in the electric vehicle pie ‒ find themselves in growing distress.

May and June of 2022 saw year-on-year growth in monthly production in Europe for the first time in 11 months, primarily reflecting the substantial impact of the semiconductor shortage in 2021. Now the greatest downside risk is a potential shortage of natural gas.

Retailers are still putting in a good performance thanks to an acceleration in the second-hand market owing to long lead times for new vehicles, resulting in continued high prices. But with new car sales in Europe down 16.9% year-on-year, demand has softened. New vehicle registrations in the EU were at their lowest since 1996, pointing to a possible softening in OEM pricing.

Europe Passenger Vehicle Production: Scenarios for 2022 (in million units)

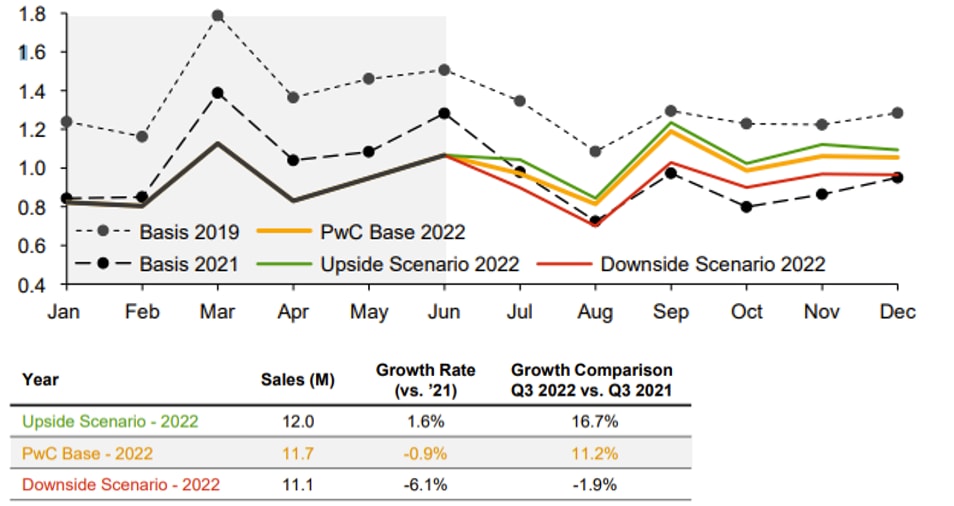

Europe Passenger Vehicle Sales: Scenarios for 2022 (in million units)

Source: PwC Autofacts Market Update, July 2022

Note - “Europe” includes EU, EFTA, UK

“Despite considerable headwinds slowing mergers and acquisitions in the automotive industry, the shift from internal combustion to electric vehicle drive technologies should give activity a boost as OEMs endeavour to keep up with e-mobility.”

Mergers and acquisitions

Against this backdrop it comes as little surprise that M&A activity declined in the first six months of 2022. On the other hand, there is significant demand among OEMs for technology enabling them to keep up with the shift from internal combustion to electric drive technology. We’re likely to see OEMs and suppliers optimising portfolios, disposing of assets outside their core businesses, and investing in new technologies.

Zooming in on Switzerland

The same factors impacting the automotive industry in general, and particularly suppliers, also affect automotive companies in Switzerland. Owing to their close ties with the industry in Germany, their development broadly follows that of the German OEMs, which have lately sold fewer cars at higher prices. One additional risk for Swiss suppliers is the appreciation of the Swiss franc, but this is limited, as often production facilities are located abroad (mostly near OEM sites). On the retail side, new car sales have declined, but the second-hand market is strong. If the elevated price levels of materials and energy persist, this would put Swiss suppliers at risk of distress.

#social#

Contact us

Claude Fuhrer

Partner, Global Health Industries Transformation Leader, PwC Switzerland

Tel: +41 58 792 14 23