{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

In the first half of 2024, the pharma and life sciences sector has attracted significant attention, not only as landmark deals in the GLP-1 space and beyond were announced and have subsequently fuelled the valuations of companies in this sector. Industry-wide issues such as regulation and the US elections, which are highly relevant to dealmakers, have received abundant media attention as well. In this blog post, I want to assess these global topics, review the key deals in Switzerland, and look ahead to what we can expect in the coming six months.

In the global healthcare and life sciences sector, the first half of 2024 was a period of high activity, both in terms of headlines and, to some extent, M&A deals. There were a few dominant topics that I would like to touch on before focusing on the Swiss market.

Global fundraising picked up in the first quarter. A recent study by investment bank Jefferies points to a surge in public equity financing in January and February 2024 that has not been seen since the first quarter of 2021 – the peak of the post-pandemic M&A frenzy. In fact, according to the study, funding levels reached $10bn in the first months of 2024 alone, compared to $11bn in Q1’21. For promising life science candidates, one way to raise funds is through initial public offerings (IPOs). Notable IPOs in the first quarter include CG Oncology, ArriVent Biopharma, Alto Neuroscience, and Fractyl Health, all of which raised more than $100m each. Such statistics point to a turnaround in activity and give hope, particularly to young biotechs that are far from reaching profitability.

The political environment influenced the sector too: The 2024 US elections, combined with the ongoing challenges and uncertainties associated with the Inflation Reduction Act (IRA), have driven M&A discussions. One view amongst industry experts is that the bill imposes a regulatory burden on the sector, thereby potentially hampering competitiveness and curtailing investor interest. The main criticism revolves around the issue of price controls and caps, which allegedly reduce commercial and innovative opportunities to the extent that R&D pipelines are reconsidered in terms of their commercial viability. The impact of high drug prices in the US compared to other markets is an important topic of public debate, regardless of political affiliations. Looking ahead, a change in US leadership could result in either minor refinements or major shifts in policy regarding drug prices and the IRA. Hence, the industry is eyeing the US presidential election in November to see how the regulatory landscape might evolve in the coming years.

In terms of numbers, deals in the health industries have declined again compared to the previous six months, and amounted to 1,958 globally for the first half of the year. This compares to 2,600 deals in the same period of 2023. While disappointing, the low figure may reflect investor caution in the face of expected interest rate cuts. Especially in the first quarter, public opinion was much more convinced of a gradual and drastic rate reduction than it is today.

Beyond the number of deals, we see extreme divergence between the share prices of companies in a certain field: Those involved in GLP-1 medication have rallied, hitting one all-time high after another. Investors are paying generous prices for assets involved in the development, manufacturing, and marketing of these products, the sheer size of the market driving expectations of future earnings growth.

Our chart below shows the extent of the price divergence: While big pharma players with little or no exposure to GLP-1-based drugs, such as Novartis and Pfizer, have mostly moved sideways, the prices of NOVO and LLY have exploded. In the case of Roche, the initial pressure on the share price in Q1’24 seems to have eased, partly due to positive phase 1 news from the GLP-1 franchise acquired as part of the 2023 Carmot transaction. Their shares have therefore recovered YTD.

The comparison with the two ETFs also included in the chart, XBI and IBB, underlines the general lack of momentum in the broader market in H1’24. While IBB’s constituents largely reflect large-cap US equities, XBI tracks mostly small- to mid-cap assets. With virtually no gains, the YTD performance for investors in these two listings is also rather sobering.

Select Health Industry Equities & ETFs Performance*

But what could this valuation environment mean for dealmakers in the M&A world? I see the current valuation environment as a chance: It appears that within the health industry sector, investors have rotated into sub-sectors with extreme growth prospects, boosting a relatively small number of equities. As a result, despite the apparent “rally of the few”, there are assets with relatively low valuations, stable balance sheets, and promising commercial prospects.

All in all, on a global scale, health industry M&A has received several impulses and stayed at the forefront of investors’ interest in the first half of 2024. Most importantly, events such as the upcoming US elections, a reduction of interest rates before the end of the year, and the catch-up pressure from non-GLP-1s have great potential to fuel demand for growth through strategic acquisitions in the second half of the year.

As always, I also want to look at what drives M&A in the Swiss health industry space:

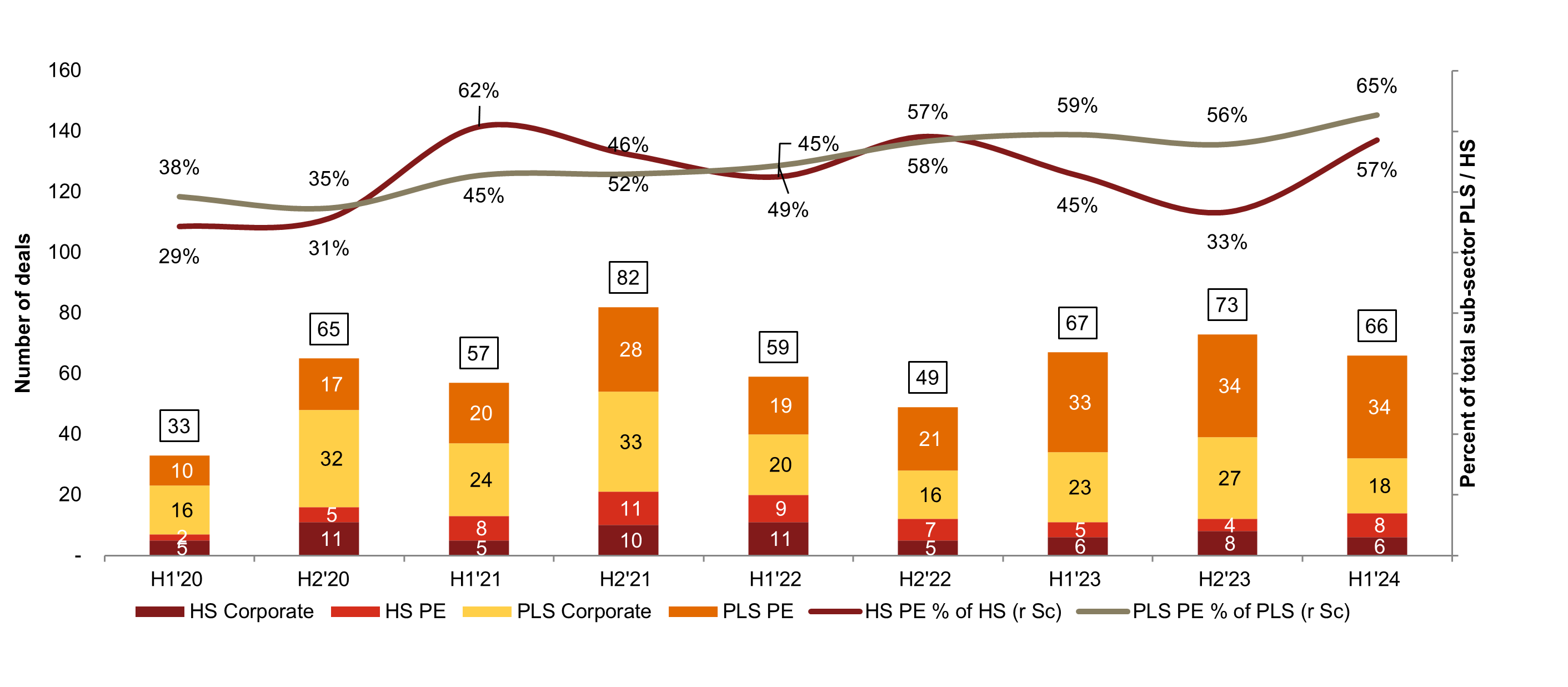

Despite the continued slowdown in global health industry M&A activity, the Swiss market concluded a total of 66 deals in the first half of 2024 in which either the buyer or seller was based in Switzerland. While this figure is down from 73 in H2’23, it must be highlighted and can be seen in the chart below that the H1’24 figure is on par with the same period in previous years. This is not the first time that we observe higher resilience in the Swiss M&A environment compared to the global stage. Compared to prior periods, the first six months saw a decline in total deal value, which is mainly due to the absence of ‘megadeals’ of more than $5bn such as Novartis’ spin-off of Sandoz and Roche’s acquisition of Telavant in 2022 and 2023.

Swiss Health Industry M&A Activity*

Looking at deal types, we see continued interest from private equity funds in both pharma and life sciences assets as well as health services, such as GPs, hospitals, and care homes. In fact, H1’24 recorded the highest share of PE deals since 2020.

Swiss Deals in Pharma Life Science & Health Services by Deal Type*

In terms of the most notable deals, Novartis has shown a strong appetite, deploying some of its $13bn in cash reserves reported on its balance sheet in December 2023. With the announcement of three strategic acquisitions, namely Mariana Oncology, IFM Due, and Calypso Biotech, the Basel-based life sciences giant decided to add to its radiopharma, biotech, and pharmaceuticals pipelines. Additionally, Lonza has announced capacity-driven acquisition plans by purchasing a major US manufacturing facility from Genentech, a subsidiary of Lonza’s Basel-based neighbour Roche.

| Buyer | Target | Deal value ($m) | Timing |

| Novartis AG | Mariana Oncology Inc | 1'750 | Q2 |

| Lonza Group AG | Genentech Inc-Biologics Manufacturing Facility,Vacaville,California | 1'200 | Q1 |

| Novartis AG | IFM Due Inc | 835 | Q1 |

| Dr Reddy's Laboratories SA | Northstar Switzerland | 634 | Q1 |

| Novartis AG | Calypso Biotech BV | 425 | Q1 |

| Sandoz Group AG | Coherus BioSciences Inc-CIMERLI Business | 170 | Q1 |

| Sonic Healthcare Ltd | Labormedizinisches Zentrum Dr Risch AG | 132 | Q1 |

In conclusion, the first half of 2024 has shown a stable deal count in Switzerland with several notable strategic acquisitions by big pharma. Dealmakers have again been creative in their choices. In fact, we see overarching acquisition themes which I have mentioned in my blog posts several times before: More than ever, life sciences transactions are about strategic pipeline additions aimed at sustaining high commercial potential on the one hand, and capacity-focused acquisitions on the other. And since it is hard to imagine these two topics going out of fashion, we should see more M&A activity between now and winter!

*Sources: LSEG, S&P Capital IQ and PwC analysis

Luca Borrelli