{{item.title}}

{{item.text}}

{{item.text}}

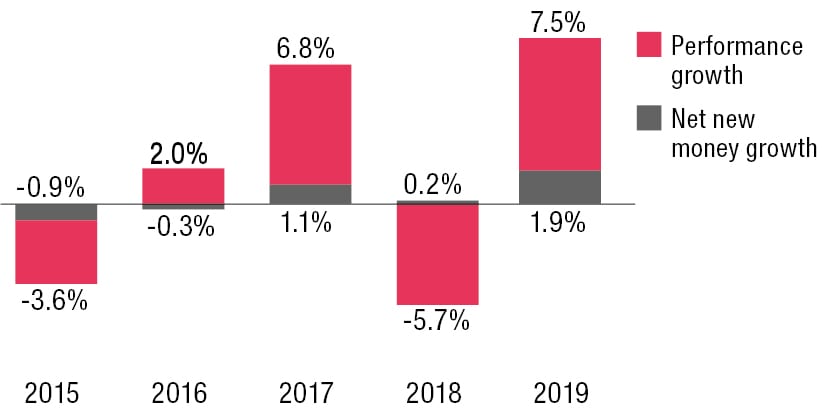

In 2019, global markets made a strong recovery from the previous year’s downturn and enabled Swiss private banks to achieve performance growth of 7.5%, which is the highest value in more than a decade.

During the tax dispute episode between 2009 and 2016, Swiss private banks suffered from net new money (NNM) outflows of around 2% of their AuM per year. After that, most Swiss private banks were able to settle their tax disputes and refocus on strategic and organic growth initiatives, leading to a turnaround to positive NNM growth starting in 2017. In 2019 Swiss private banks saw comparatively significant NNM growth of 1.9%, which is also the highest value in a decade.

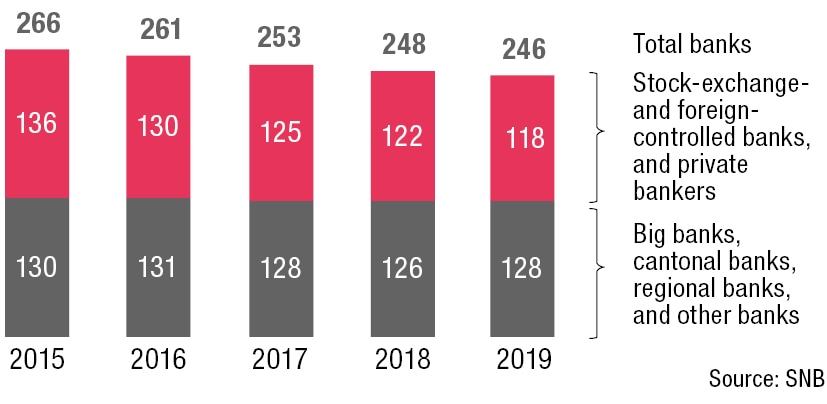

Over the last five years, the 13% decline in the total number of banks primarily operating in wealth management (stock-exchange- and foreign-controlled banks and private bankers) has been significantly more pronounced than the 8% decrease in the total number of Swiss banks. This can be attributed to the fact that many smaller private banks with less than CHF 2 billion of AuM do not reach their critical size to operate profitably and are thus sold. These types of bank have been the most prominent group on our transaction list for the last few years. Moreover, we observe that the number of transactions each year has tended to be lower since the tax disputes ended in 2017.

The year 2019 confirmed this trend as the private banking sector in Switzerland continued its consolidation, albeit at a slower speed. With three announced transactions, the number was not just lower than the average number of M&A deals of around 8 between 2002 and today, but also the lowest since we began our records in 2002.

In all three transactions the target was a small private bank having problems achieving the critical size to run in a profitable way or two smaller banks merging to increase the combined AuM volume.

We expect the consolidation process in the Swiss private banking industry to accelerate in upcoming years, mostly fueled by under-performing banks struggling to achieve sufficient profitability.

Swiss private banks have felt constant pressure on their margins over the last decade. After a drop in the median operating income margin to an all-time low of 85 bps in 2018, the positive developments in global stock markets in 2019 along with the associated performance fees and higher trading income gave an uplift to 89 bps, similar to the friendly market environment witnessed in 2017.

Due to the low interest environment with negative interest payments, the interest result made a much smaller contribution to total operating income compared with 2015. The operating expense margin increased only slightly, leading to a improvement in the operating profit margin from 12 bps in 2018 to 14 bps in 2019.

We do not expect a significant improvement in the operating profit margin going forward due to ongoing margin pressure and investment amounts to be spent in the context of the digitalisation of banking activities.

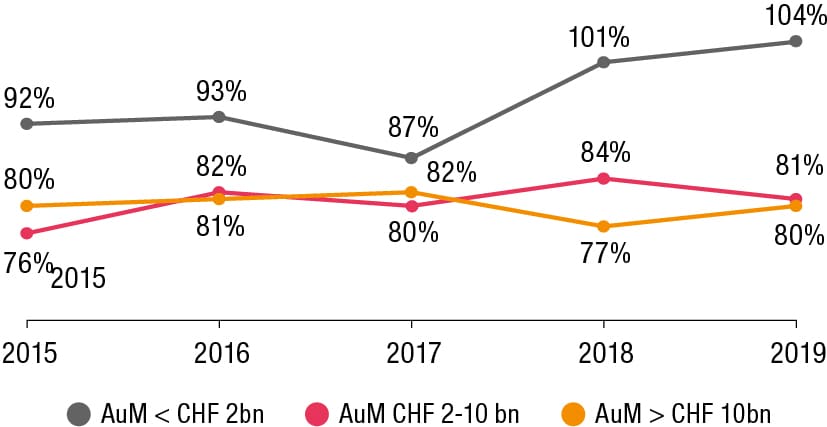

Over the last decade small private banks have consistently reported an increasing cost/income ratio (CIR). Their CIR exceeded 100% for the first time in 2018 and further increased in 2019. This shows that most small banks lack the sufficient economies of scale to be competitive. At the same time, mid-sized and large private banks have been able to stabilise their CIR at around 80% over recent years.

As seven of the 30 large banks in our sample report a CIR of below 70%, the efficiency of banks within that group varies significantly. The median CIR has slightly improved from 84.5% in 2018 to 83% in 2019 due to higher AuM and margin. Going forward we consider an average CIR of 80% to be a realistic number for the Swiss private banking industry.

https://pages.pwc.ch/core-contact-page?form_id=7014L0000000jlNQAQ&lang=en&embed=true