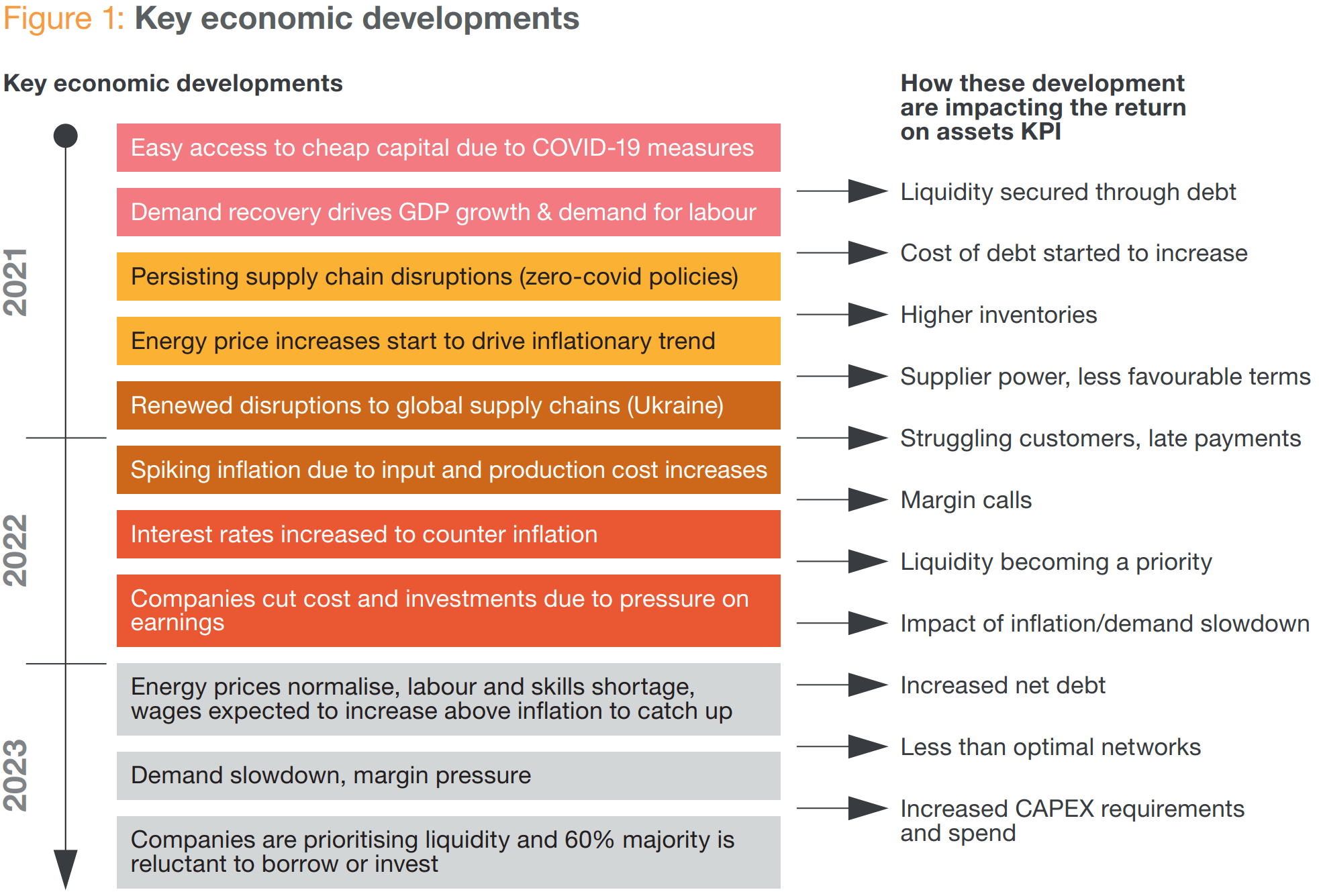

An evolving economic landscape

Today and throughout 2024, asset efficiency will remain a key metric for managers seeking to preserve shareholder value and strengthen the financial robustness of their businesses. The importance of this metric has been heightened by shrinking returns from the two other sources of returns on equity: profit and leverage. Specifically:

- profits are being eroded by falling demand, tighter market pricing, and rising input costs;

- at the same time, the effectiveness of leverage diminishes with rising interest rates and lending constraints.

Asset-light vs. asset-heavy

Asset intensity is deeply rooted in strategic decision-making. Asset-light strategies offer agility and adaptability in a volatile environment, and they allow for a more concentrated focus on core competencies. On the other hand, asset-heavy strategies grant more control, help in reducing supply chain risks, and provide scalability along with better economies of scale.

Moreover, operational management performance encompassing metrics like output per invested capital, overall equipment efficiency, or days inventory on hand, also play a significant role.

Whether companies that use fewer assets do better than others depends on the specific situation and dynamics of each industry, company, and market. But one thing is for sure: freeing up unproductive and excess assets from the balance sheet always creates value.

Fixed asset and working capital reduction drive enterprise value

For instance, consider a company with a 7% cost of capital and an expected 4% year-on-year growth. If this company reduces its working capital and fixed assets by CHF 100m while operating the same business, the benefits are twofold:

- a one-time liquidity surge of CHF 100m

- a cumulative shareholder value uptick of CHF 233m (or 2.33x) – factoring in both the CHF 100m from net debt reduction and CHF 133m in present value upside driven by avoided future assets requirements to support growth. If growth is 0%, the shareholder value created would be equal to the one-off liquidity benefit.

Harnessing ‘Return on Assets’ in difficult times

Top-tier companies capitalise on challenges, viewing them as growth catalysts. Every transformative phase demands strong leadership. While the recovery strategy should mirror the urgency and severity of challenges, leaders may, at times, opt for a stricter approach.

To combat conventional underperformance, a hybrid model combining quick wins with sustained, transformative strategies implemented at a normal pace is ideal. But during liquidity crunches or insolvency threats, swift action, cash conservation, and a dedicated turnaround team to oversee costs and cash flows become indispensable.

“The recovery approach chosen should reflect the urgency and severity of the situation, however, leaders might sometime choose to set a more severe tone.”

Alain FaresManaging Director, Value Creation LeadBoost your return on assets

The 10 principles for improving asset efficiency

1. Cash conservation and operational retrenchment

A ‘cash conservation office’ is traditionally used by distressed companies to prioritise cash and closely monitor expenditures, involving tactics such as withholding payments and freezing or slowing cash-draining operations. While effective at quickly instilling a cost and cash awareness and stabilising the business, it is a temporary fix as it can drain resources and demotivate employees.