Your expert for inquiries

Benjamin Rutz

Director, Business Restructuring Services

PwC Switzerland

Tel.: +41 58 792 21 60

E-Mail

Companies have too much tied-up capital – and for increasingly long periods

The Covid-19 crisis has left deep marks on working capital management. While the sales of companies in DACH and Benelux countries fell by an average of 16% in the second quarter of 2020 compared to the same quarter in the prior year, the level of tied-up capital fell by only 5% in this period. At the same time, the duration of capital tie-up rose by 8 days to 60 days.

“Now is the right time to focus on cash and working capital management. Anyone who fails to prioritize this topic will not only miss an opportunity to use cash as a value driver, they also risk the consequences of a negative cash flow.”

Overview of the study

Greater fall in sales than in tied-up capital

The pandemic is having significant impacts on sales, net working capital and capital tie-up durations. For instance, the sales of the companies analyzed fell by 16% between the second quarter of 2019 and the second quarter of 2020. However, the level of tied-up capital at these companies decreased by only around 5% in the same period – falling from €518 billion in the second quarter of 2019 to €494 billion in the second quarter of 2020. At the same time, the duration of tied-up capital rose significantly by 8 days (from 52 to 60 days).

Warehouses full: inventory period rises by 9 days

The Covid-19 crisis has also noticeably affected other key figures for working capital management. The strongest impact has been on days in inventory where the period between receipt and withdrawal of goods (days of inventory on-hand – DIO) rose by around 9 days, amounting to 81 days in the second quarter of 2020. This is because demand was below anticipated levels in many sectors. The result – high inventory levels.

Willingness to pay deteriorates among customers

Payment behavior has also worsened during the crisis. For instance, days sales outstanding (DSO), i.e. the period between the order date and receipt of payment, rose by 4 days to 53 days between the second quarter of 2019 and the second quarter of 2020. Analogously, days payables outstanding (DPO), i.e. the period between the invoice date and payment, rose by 5.5 days in this period, reaching an average of just below 74 days.

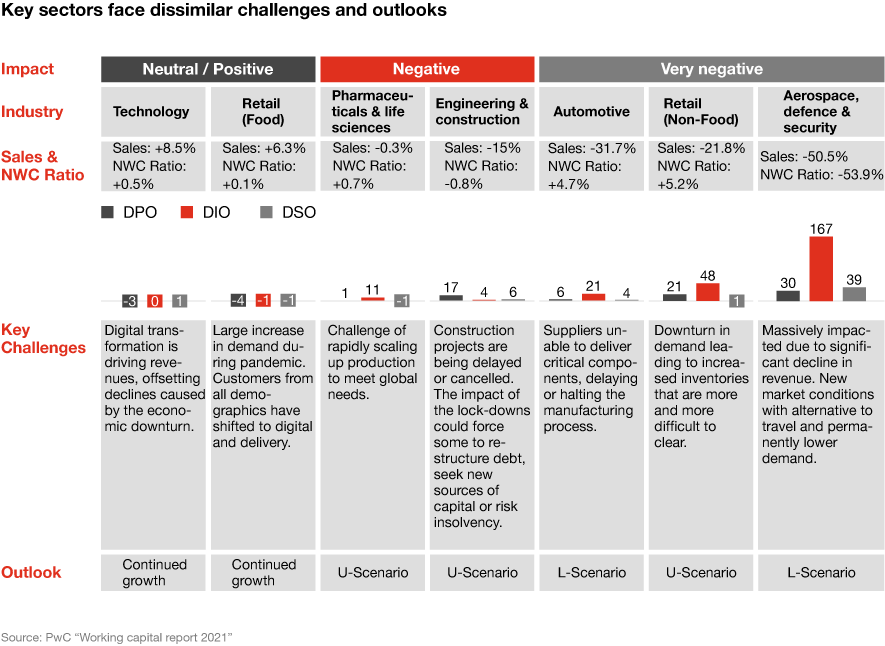

Major differences according to sector

The effects of the pandemic on the working capital management of companies vary strongly according to sector. In 16 of the 20 industries investigated, the cash conversion cycle deteriorated. Developments were particularly poor in the aerospace, defense and security sector as well as among airlines and airport operators. Other industries where sales developed positively, such as the media and entertainment sector or food industry, recorded only slight shifts in their net working capital.

Why cash and working capital management is so important now

Economic conditions will remain difficult for the foreseeable future. It is thus all the more important for companies to now focus on liquidity and optimize their working Capital management. There are five reasons to do this:

- Future disruptions, such as increased insolvency risk once government assistance stops, will place significant pressure on companies’ cash management and value chains.

- Working capital management is a key value driver because tied-up capital does not generate any income.

- The use of working capital is a free source of capital that can be used for acquisitions or the repayment of debts.

- Good working capital management allows for better oversight and control of a company's operational and financial performance.

- Improving working capital management increases company value.

Four levers for optimization

- Increasing resilience and agility in the supply chain

This entails, for example, the dynamic segmentation of supply chains, AI-assisted supply chain management or smart logistics flows. - Embracing digitalization and analytics

Digital enablers such as data analytics and process mining can assist in getting to grips with the complexity and fragmentation of supply chains and present an opportunity to release cash potential and bring about sustainable operational excellence. - Introducing financial supply chain management

Supply chain finance introduces an intermediary – e.g. a bank or FinTech – into the payment process between the purchaser and supplier. This makes it possible to improve capital management because the entire supply chain comes into focus. - Optimizing trade tax

Indirect taxes that are incurred in connection with customs and international trading account for a substantial part of cash flow, 12% on average. Companies should therefore view the effects of their tax obligations as a component of their risk management.

What PwC experts recommend

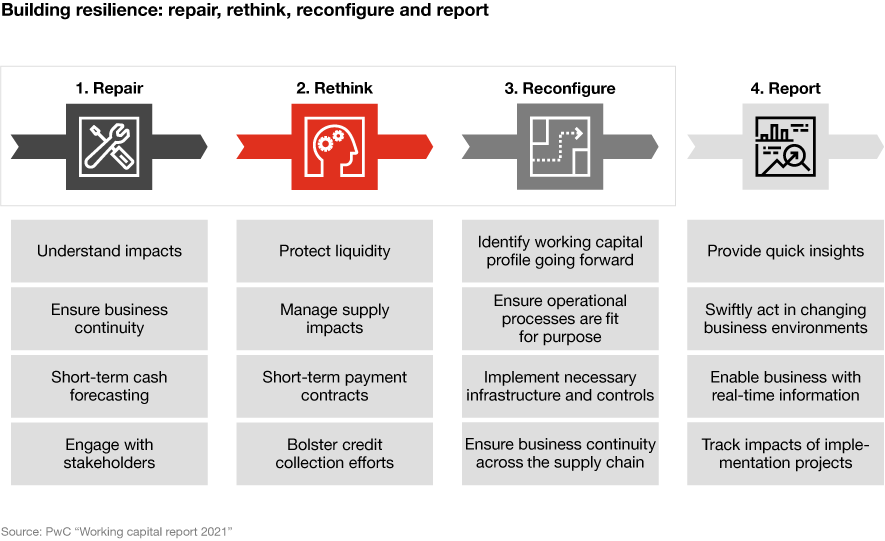

In order to optimize cash flow cycles in times of crisis, the experts at PwC recommend a four-step process:

- Repair

- Rethink

- Reconfigure

- Report

Repair

First of all, it is necessary to understand the impact of the crisis on net working capital and ensure the continuity of the business. Moreover, companies must prepare short-term cash forecasts and involve their stakeholders.

Rethink

The second step focuses on safeguarding liquidity and managing effects on supply chains. Short-term payment agreements come into focus here. Efforts to collect receivables are intensified.

Reconfigure

The third step is to design and uphold a working capital profile for the future with operational processes that are tailored to the company's individual requirements. This involves establishing the necessary infrastructure and controls and ensuring the continuity of supply chains.

Report

The fourth step centers around gaining insights quickly and taking action within a rapidly changing business environment. The focus here is on working with information in real time and keeping track of changes.

„Digital technologies assist in designing a more resilient form of WCM. They bring about increased transparency in supply chains and help in identifying dependencies quickly“.

Methodology

These are the results of a PwC study analyzing the working capital management of 658 companies from the DACH and Benelux regions.

Contact us

Director, Business Restructuring Services, PwC Switzerland

Tel: +41 58 792 21 60

Roland Schegg

Director, Leiter Consulting Familienunternehmen & KMU, PwC Switzerland

Tel: +41 79 215 29 31

Contact us

Director, Business Restructuring Services, PwC Switzerland

Tel: +41 58 792 21 60