Over CHF 6200 billion

this much money is managed in Switzerland.

4 to 6°C

current Swiss financial flows contribute towards global warming of 4 to 6°C.

Over 40 measures

implemented so that financial flows achieve net zero greenhouse gas emissions and contribute towards restoring biodiversity.

10 years

time for financial flows to be aligned with this goal.

At the end of June 2020, the Federal Council defined the objective of positioning Switzerland as a leading location for sustainable finance. “Leading the way to a green and resilient economy” outlines the strategy of the WWF and PwC, which shows how this can be achieved in practice. It focuses on Switzerland’s strengths and emphasises the positive environmental impact of financial flows.

Swiss financial flows are currently contributing to global warming to the tune of 4 to 6 degrees Celsius. Oil drilling, fracking and pipeline projects: Swiss financial institutions continue to fund, invest in and provide insurance for far too many activities that harm the climate and nature. By redirecting the money into sustainable activities, they can play an active role in shaping an economy that preserves the basis of our existence rather than threatens it. By 2050 at the latest, all financial flows should contribute to reducing greenhouse gas emissions to zero and restoring biological diversity. In order to achieve this, however, all new financial flows will have to be aligned to this target from as early as 2030 onwards. That means we have only ten years left.

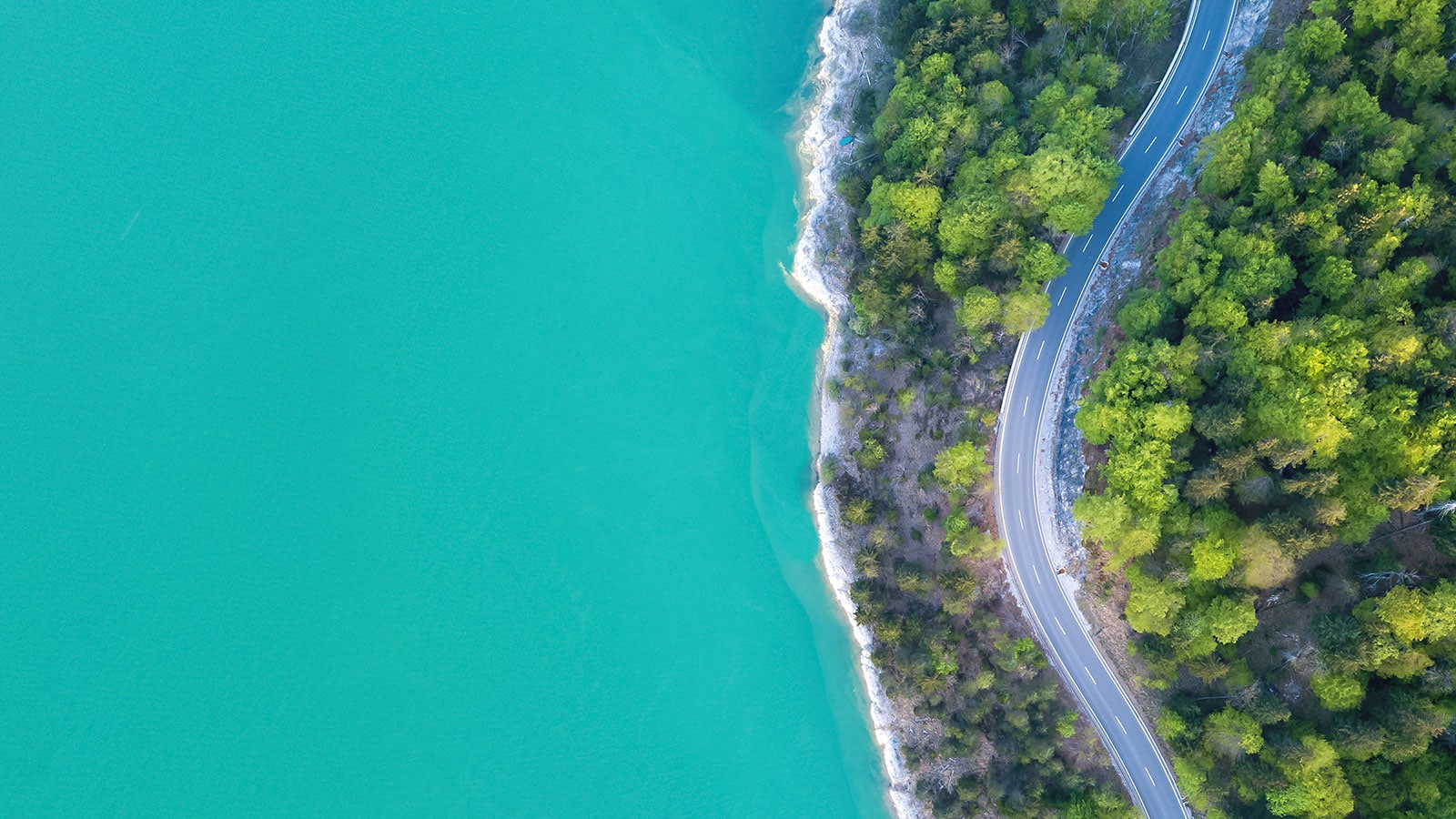

Figure 1: Leading the transition to a greener and more resilient economy

A concrete plan of action is needed

At the end of June 2020 the Federal Council defined the objective of positioning Switzerland as the leading location for sustainable finance. However, this declaration of intent will not be enough in the absence of practicable measures and an effective timetable. What is more, the focus on voluntary measures and self-regulation have barely had any effect so far. What we need is a concrete plan of action with an intelligent mix of voluntary measures, self-commitments and regulations. This is also reflected in the strategy for making Switzerland into a sustainable financial centre in the report “Leading the way to a green and resilient economy” by WWF and PwC. «With this quality strategy, we show decision-makers from Swiss politics and the financial industry what is needed for the Swiss financial centre to actually become a leading location for sustainability», adds Andreas Staubli, CEO of PwC Switzerland.

“With this quality strategy, we show decision-makers from Swiss politics and the financial industry what is needed for the Swiss financial centre to actually become a leading location for sustainability.”

Over 40 effective measures

The strategy contains over 40 concrete measures to be implemented within the next ten years. It is essential as a first step to align the strategies of Swiss financial institutions with the goals of the global agreement to combat climate change (Paris Agreement) and the Convention on Biological Diversity. A clear political framework and credible standards are also required in order to ensure the necessary transparency and legal certainty on the financial market. Furthermore, the real economy needs to work harder to facilitate the transition to a sustainable Swiss financial centre. This calls for the involvement of all players: not only financial institutions, but also politicians, supervisory authorities, companies, science and civil society.

The authors propose to place the short-term focus on the following leverage points, which in their view are the most impactful:

Leverage point 1

Turn Switzerland’s political commitment to net zero GHG emissions by 2050 into a legal obligation for financial actors and set a political goal for aligning financial flows with full biodiversity recovery.

Leverage point 2

Revise the fiduciary duty such that financial actors and regulators need to integrate the financial risks associated with climate change and biodiversity loss and are responsible for minimising the negative impacts of financial flows on climate and biodiversity.

Leverage point 3

Promote meaningful metrics for climate- and biodiversity-related financial risks and impacts and define clear standards determining what can be considered climate- and biodiversity-friendly and unfriendly.

Leverage point 4

Request real economy companies and financial actors to establish measurable strategies and targets for reducing GHG emissions and negative biodiversity impacts and to disclose their climate and biodiversity-related financial risks and impacts.

Leverage point 5

Rapidly align asset owners’ and banks’ investment, lending and underwriting portfolios with net zero GHG emissions and full biodiversity-recovery pathways and adjust capital requirements for banks and (re-)insurers accordingly.

Leverage point 6

Advocate for correctly pricing negative climate and biodiversity externalities and for adopting preferential tax policies for climate- and biodiversity-friendly activities, thus facilitating the transition to a green and resilient economy.

Switzerland has a lot of potential

There’s no better place than Switzerland to set this all in motion. With over 6,200 billion Swiss francs in assets under management each year, Switzerland carries a lot of responsibility. In addition, Switzerland has a long-standing tradition in sustainable finance, an innovative market, lean framework conditions and exceptional universities. Thomas Vellacott, CEO of WWF Switzerland adds: “The potential offered by Switzerland is immense, and economy and society will ultimately both benefit from an intact environment. Now is the time for politics, financial market players and all of us individually to come together and take action.”

“The potential offered by Switzerland is immense, and economy and society will ultimately both benefit from an intact environment. Now is the time for politics, financial market players and all of us individually to come together and take action.”

Download the report

Full version

Short version

Watch our live launch webinar from 1 September 2020

We successfully launched our new report "Leading the way to a green and resilient economy" with Thomas Vellacott (CEO WWF Switzerland) and Andreas Staubli (CEO PwC Switzerland) and our guest speaker Jörg Gasser (CEO SBA) at our digital launch event. Have you missed our live launch? You can find the recording below.

Replay now

Contact us

Partner, Sustainable Capital and Sustainability & Strategic Regulatory Leader, PwC Switzerland

Tel: +41 58 792 45 23