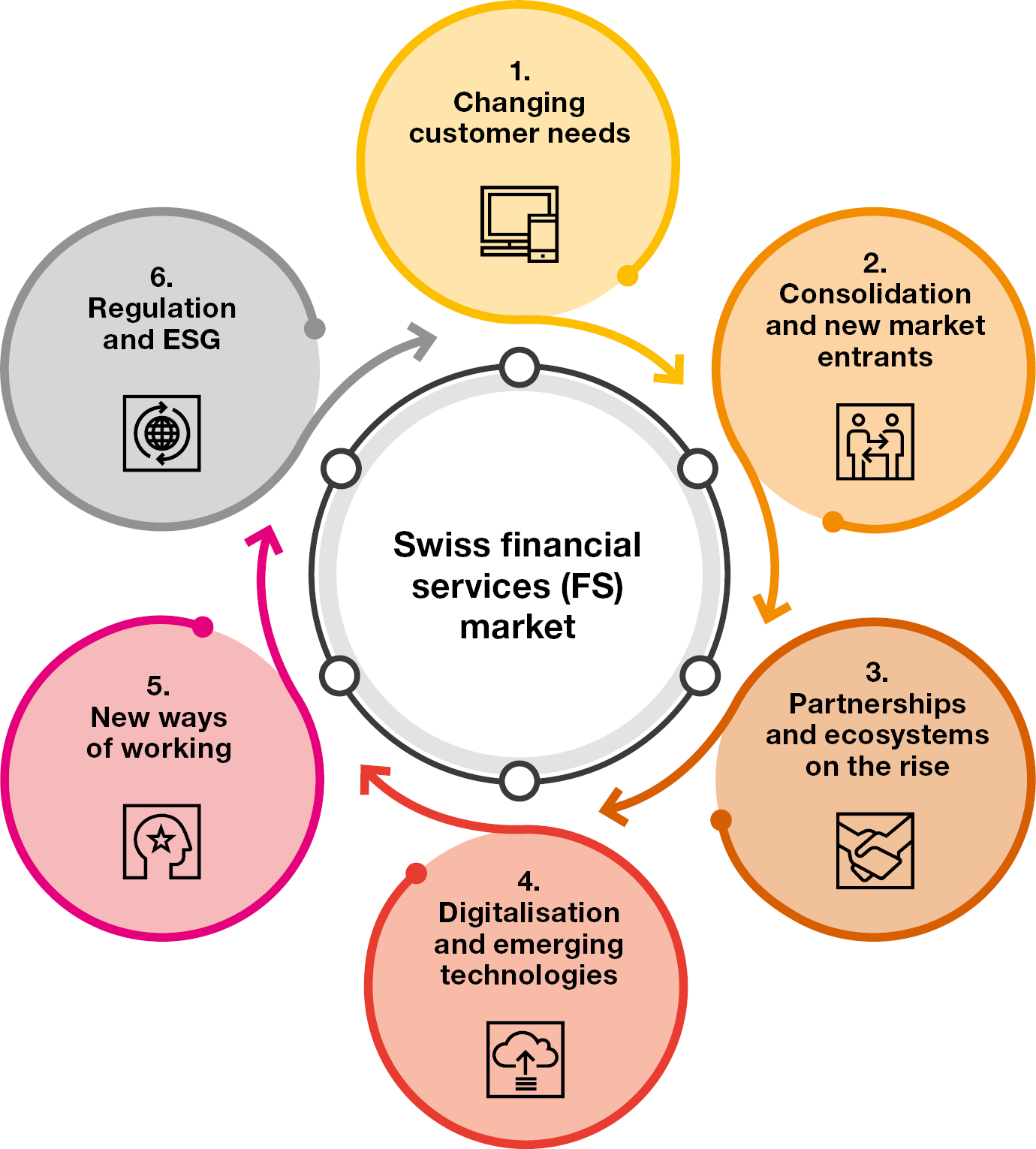

The six trends that shape the Swiss financial services (FS) market

The financial sector in Switzerland faces significant transformational forces and challenges. Traditional banks and insurance companies must undergo major changes to stay relevant and keep their market share. We’ve identified six trends that are shaping the Swiss financial services market – ranging from changing customer needs, new disruptive market entrants, ecosystems and emerging technologies to new ways of working, regulation and sustainability.

“By rethinking their business model and adopting new technologies, companies can transform change into opportunities.”

Alexander Schultz-WirthPartner FS Technology Consulting and Customer Centric Transformation, PwC Switzerland

A vision for Switzerland across six key areas

Customers are increasingly moving towards a digital lifestyle and expect businesses to follow suit. However, many traditional insurance or banking companies are still using processes with outdated technology that no longer make the grade. Executives have long talked about customer experience being a source of sustainable competitive advantage. As the walls that have protected incumbents are quickly crumbling, action is needed now.

The pressure on margins and ROI calls for larger market shares and leads to consolidation. Some incumbents with no or limited differentiation characteristics face a general lack of trust in their brand. Disruptive fintechs target specific customer segments and/or offer better, more user-friendly tools. Big tech’s strong ecosystem and tech capabilities are able to provide highly competitive offerings while also supporting incumbents in their service delivery.

Big players have realised that a collaborative response to the changed market environment can be a win-win situation for all parties involved. Partnerships between established corporations and start-ups, mainly in the fintech sector, create value for both parties. Incumbents gain speed (time to market), flexibility (costs and investment) and new talent. They may also benefit from the fintech companies’ customer segments, while the latter have access to additional revenue streams.

Today’s rapid digital transformation demands an even faster adaptation and implementation of emerging technologies. This entails an increase in both the efficiency of existing business models and the creation of new business models. Lightweight, cloud-first digital architectures are of utmost importance to provide better services. Insurance companies should use AI-based tools to evaluate risks, improve their client and authentication services, and boost cross-selling.

As ground-breaking as advanced digital tools can be, the greatest challenge for the digital transformation is the human being. Change triggers uncertainty and fear among many employees. The choice is not so much whether to change as an organisation, but about how to secure the future viability of the company. The basis for a successful transformation is the development of the digital mindset, which in turn is best achieved by engaging employees throughout the journey.

Regulation in the financial industry has sped up the digital transformation, and ESG issues are at the forefront. Regulatory developments remain a key driver of transformation. ESG has moved from niche to mainstream and has entered the mindset and the investment decisions of many stakeholders. Thereby, ESG products pose a challenge for established risk management systems and processes.

How can financial institutions bring about the necessary change?

The detailed recommendations can be found in our whitepaper How to capture opportunities in disruptive banking and insurance – a vision for Switzerland across six key areas.

Download the whitepaper

https://pages.pwc.ch/core-asset-page?asset_id=7014L0000002s3WQAQ&embed=true&lang=en

Contact us

Partner, Leader Customer Transformation, PwC Switzerland

Tel: +41 58 792 47 97