{{item.title}}

{{item.text}}

{{item.text}}

Rolf Röllin

Director - Corporate Tax, PwC Switzerland

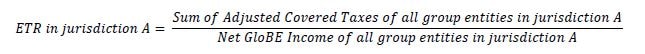

On 20 December 2021, the OECD/G20 Inclusive Framework (“IF”) finally published the long-awaited GloBE Model Rules (“MR”) governing the future of the most important aspects of Pillar 2. The rules shall serve as a template that jurisdictions can translate into domestic law. They provide a number of confirmations on several key parameters while the commentary on the MR is still required to answer certain detailed questions. Such Commentary shall be completed by the end of January 2022 and published thereafter. The complexity of the MR calls for coverage throughout a multitude of blogs: this blog marks the beginning of a series and sheds light on the overall architecture of the MR and certain selected key take-aways.

The MR provide helpful guidance on a variety of previously open technical aspects of the GloBE rules. Companies should analyze these new rules but also be cognizant of the fact that this will not be the end of the “story”. MNEs will need to closely follow further discussions/developments to continuously refine their approach towards BEPS 2.0 implementation and maintenance over the next months and years.

Given the quite ambitious time plan for implementation as outlined above, companies should start looking into addressing the incoming operational challenges (e.g. data collection, segmentation, tax accounting determinations and decisions, ERP system readiness) sooner rather than later. Specific attention points in this regard can ideally be properly identified in the coming months and then addressed throughout 2022. This will then also allow for audit readiness when it comes to the tax positions including GloBE in (early) 2023 and it will ensure a good basis for the development of a proper long-term strategy for a target approach to ongoing maintenance of BEPS 2.0 obligations and compliance.

Dominik Birrer

David McDonald

Partner, Leader Transfer Pricing and Value Chain Transformation, PwC Switzerland

+41 75 413 19 10

Markus Prinzen

Rolf Röllin

Jacob Parma

Christa Elsaesser

Etienne Michaud

Senior Manager, Transfer Pricing and Value Chain Transformation, PwC Switzerland

+41 58 792 96 70