{{item.title}}

{{item.text}}

{{item.title}}

{{item.text}}

Family offices have become a force to be reckoned with on the deals market, posing growing competition for institutional investors and private equity houses. Given the private nature of the business, until recently very little was known about capital flows from family offices and where these flows were destined. Now a new study from PwC gives unprecedented insight into where European family offices are most active, what sectors they favour, and what strategies and tactics they’re adopting in the deals space.

An important part of a family office’s remit is stewarding family wealth and assets, among other things by engaging in smart investments and transactions. In 2021, disclosed family office deals came to a staggering USD 227.6 billion globally – the first time in history that they’ve accounted for 10% of the entire deals market. What’s also interesting is that these transactions have included a number of multi-billion USD deals. Family offices are becoming significant players able to hold their own in a space otherwise dominated by institutional investors and private equity houses.

By its very nature, however, the business of family offices has not been very transparent, meaning that until now fairly little has been known about who’s investing in what from where, how family office deal activity is growing and evolving, and what sizes of deal, structures, locations, sectors and asset classes are involved. A new study changes this. Drawing on a proprietary database of 5,200 single family offices worldwide, almost 2,300 of which are based in Europe, PwC and Family Capital have managed to paint a much more detailed picture of the direct investments and real estate transactions within or originating from Europe undertaken between 2012 and 2021.

Perhaps the most striking insight is the sheer scale of family office deals activity and the rapidity with which it has increased over the last ten years. Both the volume and value of family office deals involving Europe – whether as the target location or origin of a transaction elsewhere – are now running at record levels. After a coronavirus-induced dip in transaction value and volume in 2020, activity has bounced back, driven primarily by direct investments in companies (which in the family office space frequently take place in the private markets). Real estate transactions have also recovered.

«In addition to their traditional interest in real estate, European family offices are becoming an increasingly powerful presence when it comes to direct private equity investment – and they’re finding more and more sophisticated ways of getting involved. Accounting for 10% of all deals, family offices are definitely a force to be reckoned with, and have a considerable influence on the market.»

Another fascinating finding of the study’s analysis of inbound, outbound and intra-European family office-backed deals is that European family offices are increasingly favouring investments in their home continent. As the graph shows, the proportion of family office-backed deals focusing on outbound opportunities fell to just 13%, compared with 41% in 2013. The European market is clearly getting more attractive for international investors. Why? For one thing, in an environment of global geopolitical uncertainty, European family offices are apparently feeling that staying at home is the safer option – not least because they’re more familiar with the culture and regulation of European business. The second factor is that while overseas sectors including US tech offered great investment prospects back in 2012 to 2014, Europe is now providing some even better opportunities.

The study also reveals that family offices are getting more ambitious and sophisticated in their dealmaking. So-called club deals, where a family office joins forces with other investors to share risks and be able to undertake bigger transactions, now account for one-third of all family office activity (compared with just 4% a decade ago). There has been an equally impressive increase in European mega-deals (worth USD 2.5 billion or more) involving family offices. Again we see that family offices are rapidly becoming a force to be reckoned with.

While real estate has been the most popular target for investment in the last decade in terms of deal numbers, in terms of value (USD 96.5 billion) the sector has been far outstripped by healthcare & biotech (USD 255.9 billion), retail & consumer goods (USD 143.9 billion) and automotive & industrial products (USD 142.5 billion).

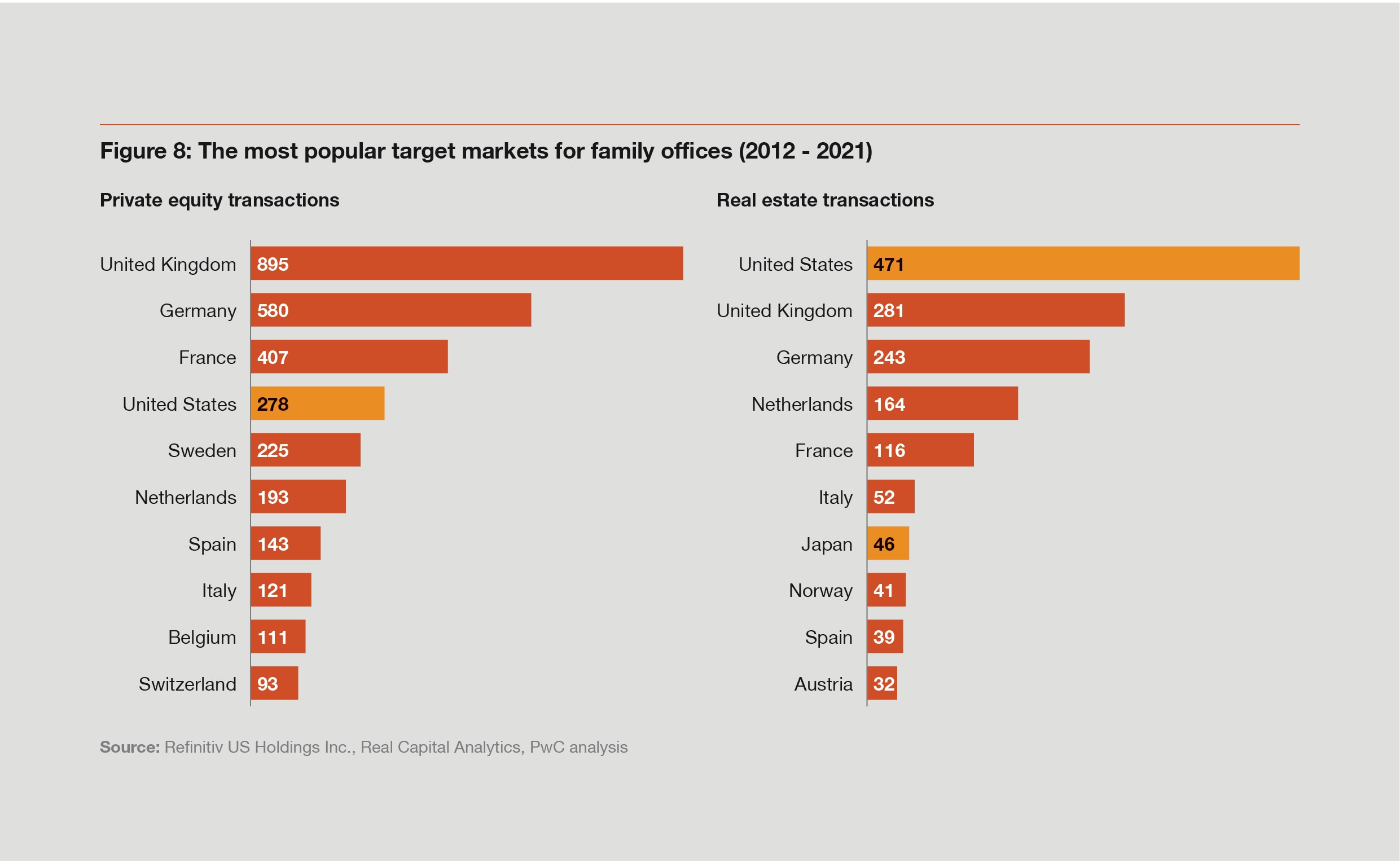

In terms of target markets, the UK and Germany lead the way as the most popular destinations for private equity transactions (see graph), but take second and third place respectively behind the US when it comes to real estate deals.

In recent years there has also been a significant increase in direct investments by family offices in Switzerland. In addition to the existence of exciting takeover targets, this has also required the professionalisation of family offices’ own structures (including the definition of exact search and investment criteria) and the recruitment and/or involvement of external M&A experts.

We have also noticed that medium-sized family businesses like to fall back on family offices and their long-term approach, both for external succession and for the implementation and financing of their own M&A activities.

We expect that this trend will continue and that family offices will be able to make more direct investments into medium-sized companies in the future. Especially family businesses and entrepreneurs who do not focus exclusively on price optimisation might prefer family offices to conventional private equity funds or trade buyers.

The study concludes that there’s potential for increased family office-backed activity on both the direct investment and real estate fronts. Property is looking particularly attractive in the current inflationary environment. Similarly, high inflation makes direct equity investments an appealing proposition for family offices seeking returns in line with their long-term value creation objectives. Club deals and co-investments, where family offices team up with private equity, are increasing the scope for direct investment – and thanks to their networks, family offices often have access to favourable deals on the private market that are beyond easy reach for other investors.

If you’d like to get deeper into the topic, check out the Family Office Deals Study or contact us to continue the conversation.

Check out the Family Office Deals Study website to find out what regions, countries and sectors European family offices are investing in – and learn about the increasingly sophisticated approaches they’re taking to deals.

#social#