Your expert for questions

Claude Fuhrer

Partner, Deals Strategy & Operations Leader, PwC Switzerland

Tel.: +41 58 792 14 23

E-Mail

Carve-outs as strategic instruments

Many industries and companies operate within market environments that are shaped by increasing complexity and uncertainty. There are several reasons for this – including regulatory requirements, political conflict, environmental factors and changing consumer behaviour, as well as technological transformations like digitisation. On top of this, sudden crises like the current Coronavirus pandemic further increase complexity.

Increasingly uncertain market environments offer particularly attractive opportunities for companies to achieve their various strategic goals by carving out certain business units. These goals might include strengthening the focus on the core business or increasing liquidity. However, new regulatory requirements or technological transformations in the respective industry can also make carve-outs a sensible option.

This exclusive PwC Deal study, which was created in cooperation with the market research company Kantar and the Technical University of Darmstadt, provides answers to questions like: How can we evaluate the success of a carve-out? What are the decisive factors in success? And what is the impact of taking early steps to create stand-alone structures and functions within the business unit that is being carved out?

“Investments in reducing complexity pay off. Creating stand-alone, fully functioning business units at an early stage can increase the success of carve-outs and leads to higher sales proceeds in most transactions."

An overview of the study

The first part of the study, “Optimism on uncertain grounds”, found out that business decision-makers in Austria, Germany and Switzerland take a surprisingly optimistic view of the current volatile market situation.

In the second part, “Mastering uncertainty and volatility”, the study focuses on the level of maturity and professionalisation within the companies surveyed. It places a strong focus on their respective approaches to strategic portfolio management and operational footprint management.

The third and final part of this series, “Unlocking value through carve-outs”, looks at the role of carve-outs as a strategic instrument – and considers how decision-makers can significantly increase the success of their carve-out activities.

An overview of the study results – Part 3

The third part of the study analysed three key aspects related to carve-outs:

- Assessing the level of entanglement of the target business.

- The duration and scope of Transitional Service Agreements (TSAs).

- Stand-alone solutions for transformations.

These aspects play a decisive role in the success of carve-outs. To evaluate them from the perspective of the selling company, our study considers:

- The targeted sale price (with the aim of maximising the price).

- The speed of the sale process (with the aim of maximising the speed).

- The cost of the transaction for the seller (with the aim of minimising the cost).

Find out what answers we received from the business decision-makers surveyed.

Unlocking value through carve-outs

- Assessing operational complexity

- Transitional Service Agreements (TSAs)

- Independent operating structures

Assessing operational complexity

Failure to recognise entanglements at an early stage can decrease the success of a carve-out

The complexity of the operational entanglements between the business unit that is being sold and the business units that will remain within the company is a key factor in deciding the success of a carve-out. These entanglements might include integrated value chains or centralised back-office services.

Generally, lower levels of entanglement lead to a higher sale price. Organising the business unit that is going to be sold as a stand-alone business – that functions as a completely independent unit – is one approach that can reduce the complexity of these entanglements and increase the sale price.

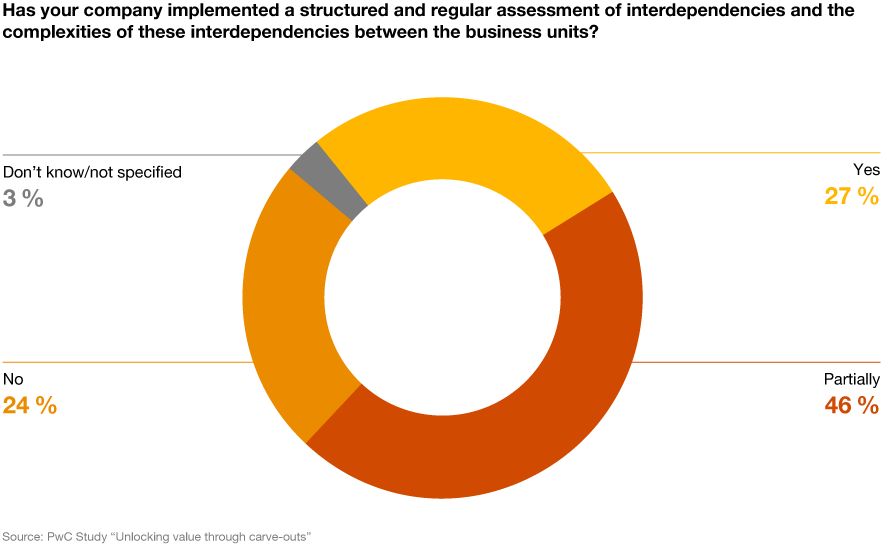

To do this, it is important that companies regularly assess the interdependencies between the various individual business units in a structured manner. However, just 24 % of the decision-makers surveyed stated that they do this to a comprehensive extent. 42 % said that they conduct complexity assessments to a partial extent, while 22 % do not conduct these assessments at all.

The study shows that failure to recognise operational entanglements at an early stage has a negative impact on the targeted sale price, the speed and the cost of the carve-out process – as well as the overall success of the transaction.

“Entanglements – especially in the value chain – are the key drivers for time and cost of a carve-out. Lack of transparency on these often leads to less value being generated from the carve-out.”

Transitional Service Agreements (TSAs)

A TSA duration that is too long or too short has a negative impact on the sale price

The duration of the Transitional Service Agreement (TSA) is another success factor in carve-outs. A TSA might cover topics such as accounting or IT infrastructure. These agreements contribute to ensuring uninterrupted business operations.

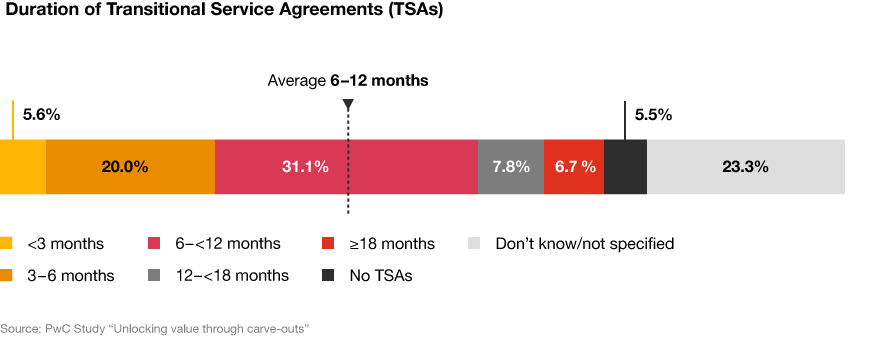

31.1 % of the decision-makers surveyed mentioned a TSA duration of 6 to 12 months, while 20 % mentioned a duration of 3 to 6 months and 23.3 % did not state a specific duration.

Our results show that a TSA duration that is too long or too short has a negative impact on the sale price. Specifically, TSAs with a duration of either 6 to 12 months or longer than 18 months reduced the success of the carve-out. Interestingly, the duration of the TSA does not have an impact on the speed or cost of the carve-out process.

“Purchasers are willing to reflect assured business continuity – supported by a broad range of TSAs and a reasonable transition period of 12 to 18 months – in the purchase price. However, this means sellers would still be heavily involved in the transaction for more than a year after closing, which may impact their ability to implement other strategic initiatives.”

Independent operating structures

Stand-alone IT functions can significantly increase the success of a carve-out

What role do independent operating structures, known as stand-alone structures, play in the success of a carve-out? To answer this question, we asked decision-makers if and at what stage they introduced stand-alone structures for the business unit that they were selling.

46 % of decision-makers said that they did this before Day One, which means before the transfer. 39 % stated that they introduced stand-alone structures after this point. The reasons for implementing these structures were the sale price (32 %), the speed (32 %) and the cost (22 %) of the transaction.

Which functions were independent on Day One? The decision-makers surveyed most often mentioned Marketing and Sales (75.6 %), Supply Chain Management, and Finance and Controlling (both 48.8 %), as well as Purchasing (46.3 %).

Only 43 % of decision-makers mentioned IT. However, the IT function is particularly valuable during a transaction because it can make a significant contribution to reducing complexity during the carve-out. This can make the process simpler or faster.

“Big companies often operate expensive and complex IT infrastructure. Not transferring IT complexity to a target increases the value of that target. This is particularly true for sellers with over a billion euros of revenue and more than 5,000 employees.”

The methodology

PwC conducted this three-part study in cooperation with the leading market research institute, Kantar, and with the Technical University of Darmstadt. In July 2020, the survey was sent to companies from Austria, Germany and Switzerland that have an annual turnover of more than 300 million euros. 157 decision-makers took part, including Board-level executives and employees from M&A and Strategy departments.

Contact us

Claude Fuhrer

Partner, Global Health Industries Transformation Leader, PwC Switzerland

Tel: +41 58 792 14 23