Your expert for questions

Claude Fuhrer

Partner, Deals Strategy & Operations Leader, PwC Switzerland

Tel.: +41 58 792 14 23

E-Mail

There is strong consensus that global markets are experiencing increased volatility, uncertainty, complexity and ambiguity (VUCA). The causes are manifold: They include new regulations, changing consumer preferences, environmental hazards, political tensions, technological innovations and pandemics such as the most recent COVID-19 outbreak, which caused numerous corporate financial forecast revisions, ad-hoc announcements, profit warnings, suspended annual financial forecasts and a sharp decline of most relevant economic indicators. How are corporates and top executives impacted by that market environment? How do they find ways to navigate VUCA waters successfully? Our exclusive PwC study, which has been conducted in cooperation with Kantar and the Technical University of Darmstadt, provides valuable insights to these questions.

“Decision makers seem to hope that coming volatility strikes will hit anyone but their company. A more promising strategy would be to prepare for the inevitable and make the corporate portfolio more flexible, adaptable and crisis-proof.”

"Optimism on uncertain grounds" is the first part of the PwC Deals study and examines how decision makers perceive the current business environment and future prospects and how that impacts their strategy processes. A key insight: Decision makers in Germany, Austria and Switzerland have a remarkably positive perception of the current market situation – both regarding the impact of the unprecedented COVID-19 pandemic and the focus on overall market environment and future prospects.

In November 2020, "Mastering uncertainty and volatility" will be published as the second part of the study series and explore the impact of market VUCA on executive's portfolio and operational footprint management approaches. Finally, in December 2020, "Unlocking value through carve-outs" constitutes part three of the study series and will focus on the role of carve-outs as a strategic tool.

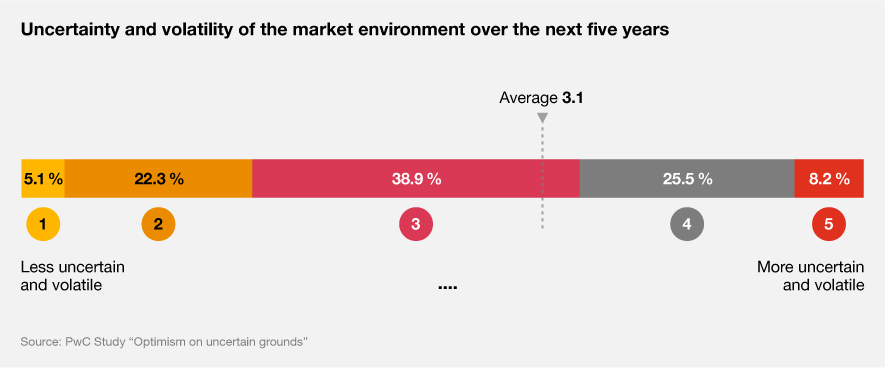

"Optimism on uncertain grounds" as the first part of the study reveals surprising results: Corporate decision makers have a strikingly positive and optimistic view of current market conditions and prospects. Moreover, study participants expect only a modest increase of market volatility and uncertainty over the next five years. Furthermore, optimistic expectations for the five-year market attractiveness and growth opportunities are provided by the study participants.

Marc Schmidli shares his perspective on the optimism of corporate leaders: "Either corporates operate in a stable market niche or underestimate the impact of the pandemic. On the other hand, the fact that the current market recovery is being bolstered considerably by various governmental measures, such as the suspension of the company’s obligation to file for insolvency or the 'Kurzarbeit' (short-time work) regulation might flaw the validity of the current positive market perception."

"Given the huge impact of the pandemic, it remains to be seen whether the remarkable optimism among decision makers will turn out to be naivety, or bold and justifiable confidence in their skills for mastering the challenges ahead."

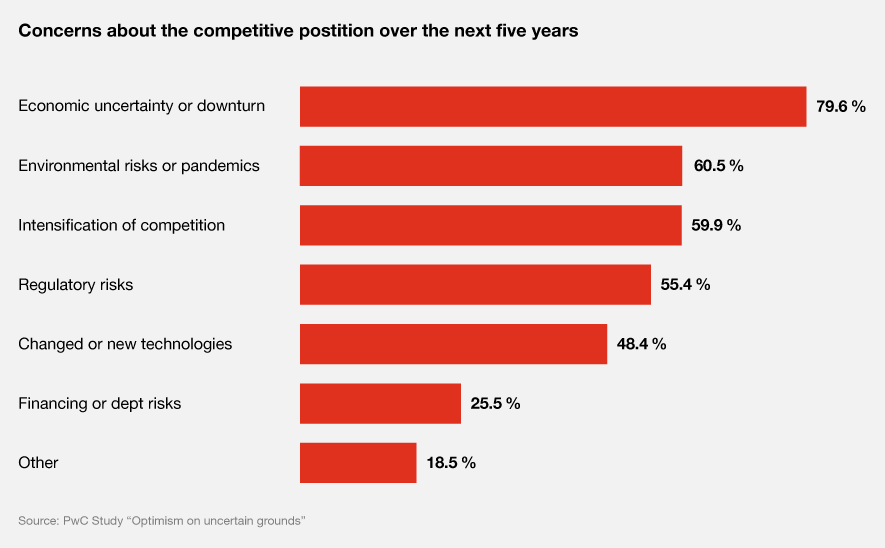

Among the major threats to competitive positioning in the coming years, participants perceive an overall economic downturn (80 percent of respondents), followed by environmental risks (61 percent), intensifying competition (60 percent) and regulatory risks (55 percent) as the most relevant ones. Only every fourth study participant perceives financing or debt risks as a threat. "Surprisingly, decision makers perceive the company-specific risks as less threatening than the risks for the economy as a whole", comments Neil Siri, Deal Analytics & Technology Leader at PwC Germany.

Mastering uncertainty and volatility: The second part of our latest Deals study analyzes how the perception of market structures and market prospects affects the company portfolio and the actions of decision-makers. In focus: Portfolio management and the control of operational corporate structures.

A strategic approach to carve-outs:In an increasingly uncertain and complex market environment, strategic carve-outs are getting more important. The third part of the study examines the role of carve-outs as a strategic instrument – and how decision-makers can significantly increase the success of carve-outs.

In cooperation with Kantar and the Technical University of Darmstadt, PwC conducted a three-part study with focus on companies in the DACH region (Germany, Austria, Switzerland) with an annual turnover of more than €300m. A total of 157 decision makers (board level, M&A/strategy lead or similar position) participated in the study.

Claude Fuhrer

Partner, Deals Strategy & Operations Leader, PwC Switzerland

Tel: +41 58 792 14 23